Factor Trading – March 6th Report

NOTE: All future such Premium Reports will NOT be publicly available. To receive or view any of these Premium Reports in the future, you will need to be signed up on our free email list. Please register using the form at the bottom of this report.

Market Review

Factor Moves are currently ongoing in:

- Gold

- Japanese Yen

- USD/NOK

- Copper

- GBP/CAD

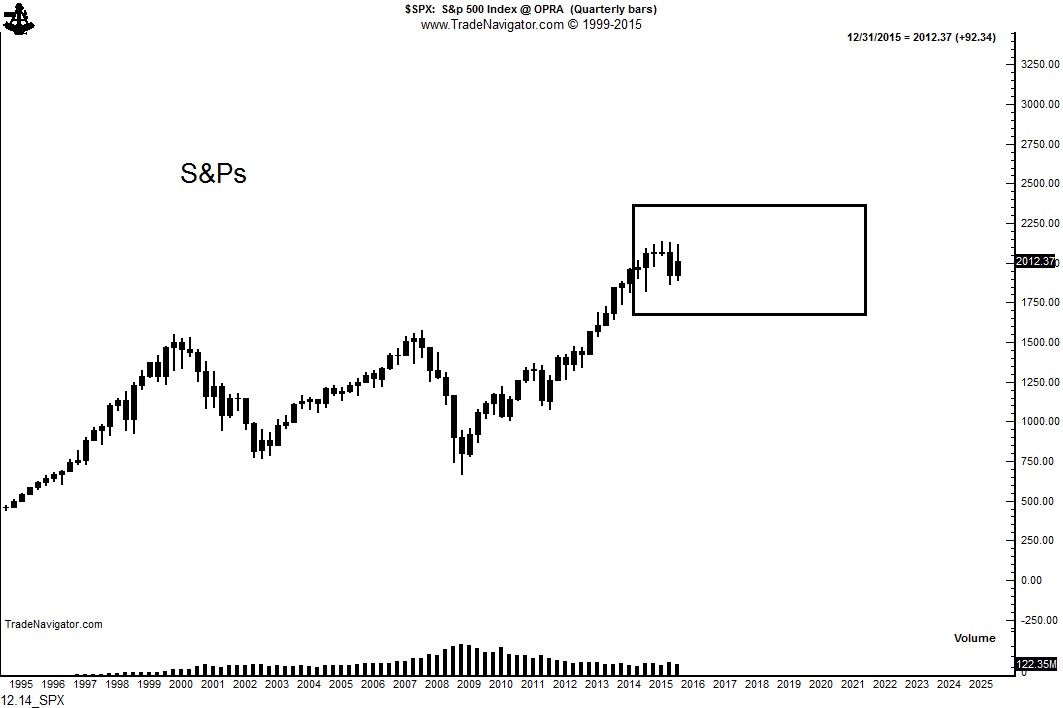

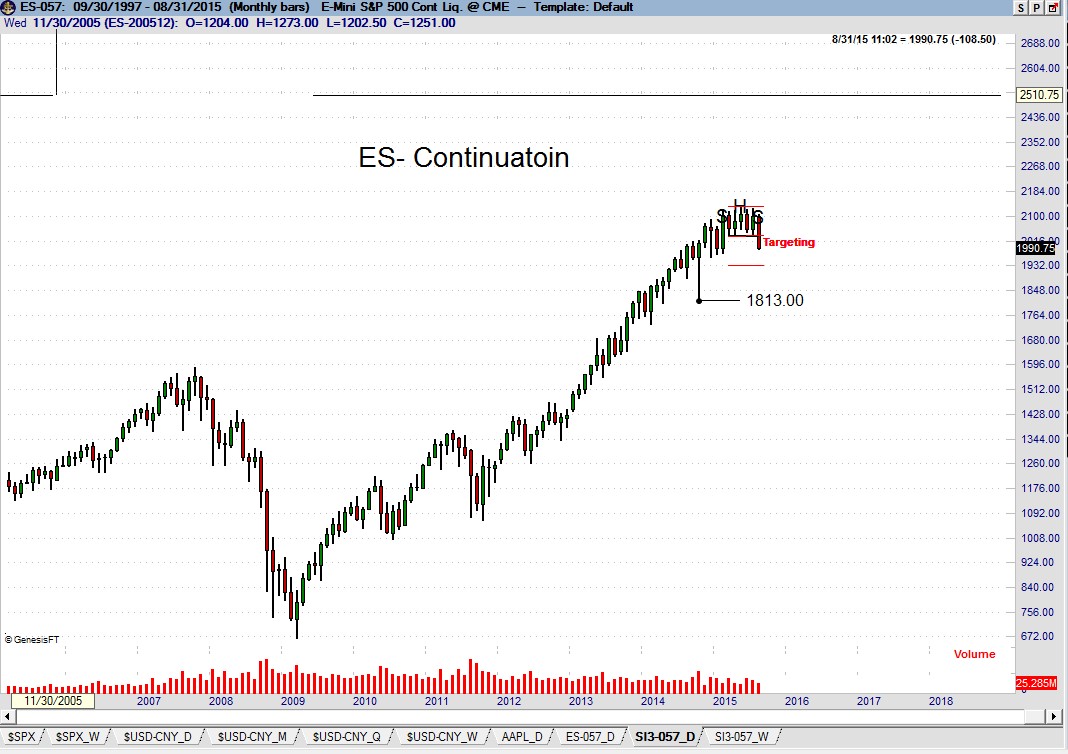

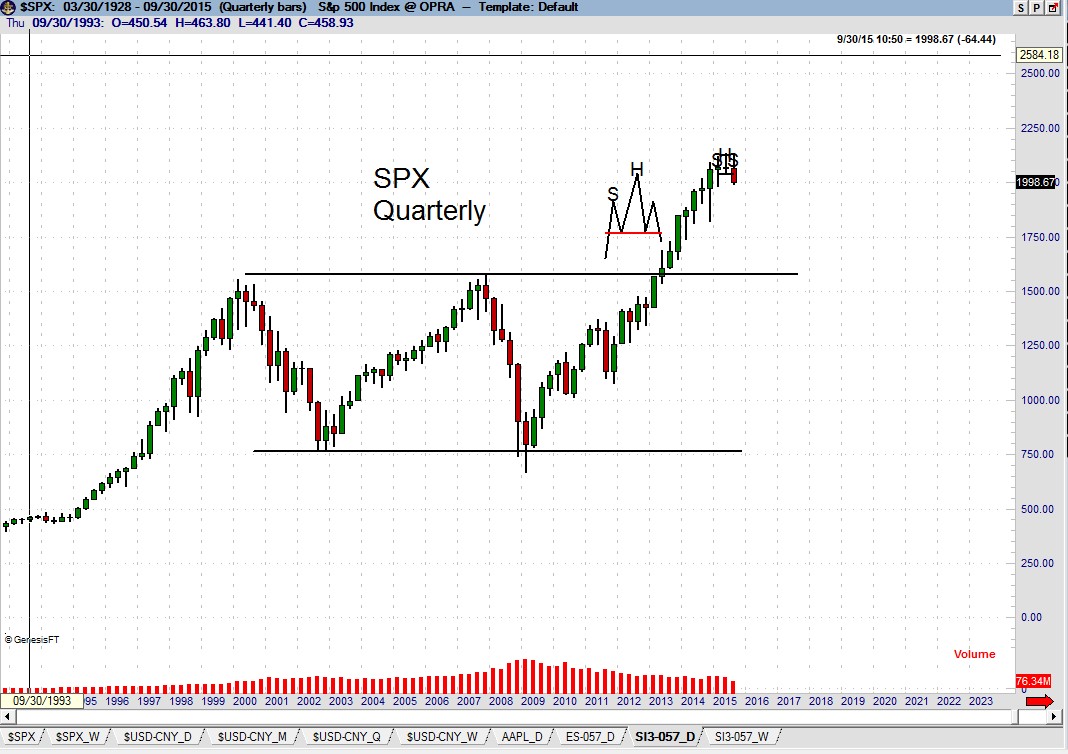

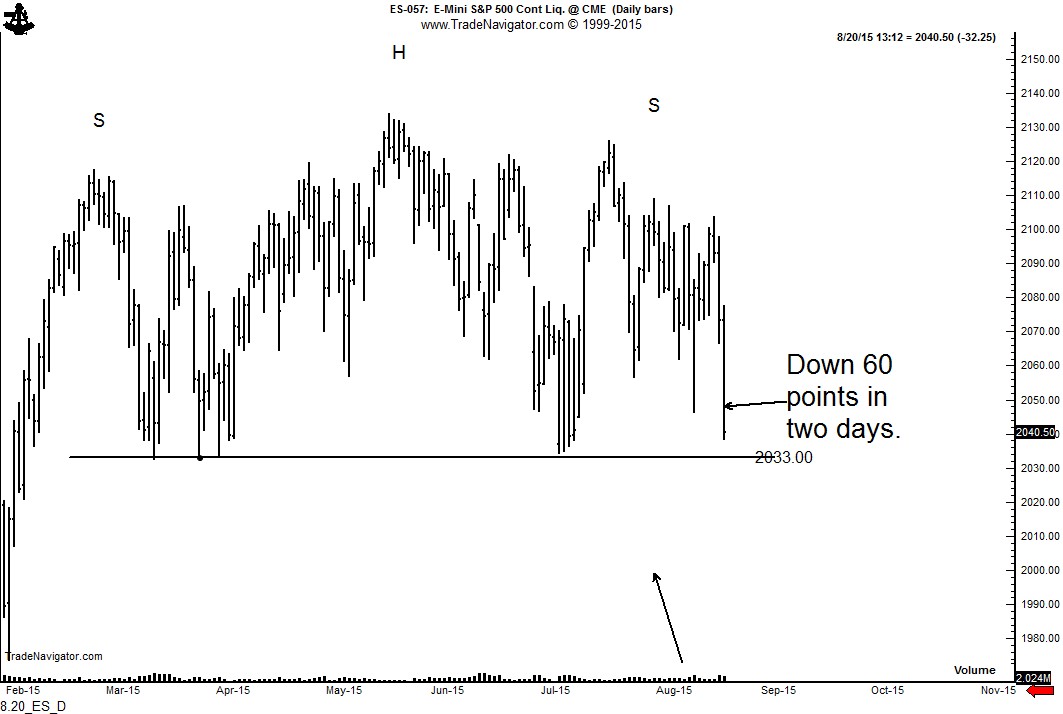

A Factor Move is developing in AUD/NZD. This issue of the Factor also comments on Canadian Dollar, New Zealand Dollar, Australian Dollar and U.S. stock indexes.

Factor Moves in Progress

Copper (daily chart)

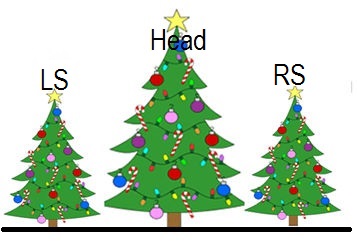

There are several observations worthy of note on the daily Copper chart. First, note the premature breakout on Friday, Feb 26. The market broke out of the H&S bottom, but the rally could not hold. Following a premature breakout traders should be on extra alert and jump on a subsequent closing price breakout. Second, the advance and close on Monday, Feb 29 and especially on Tuesday, Mar 1, confirmed the H&S bottom. Both days served as buying opportunities. Third, for all practical purposes the target was met by Friday’s advance. I typically am conservative on determining “measured moves.” Factor is flat, having taken a crazy ride on the long side this past week.