Draw-downs are a fact of life for a market speculator (Dec 5, 2021 Report)

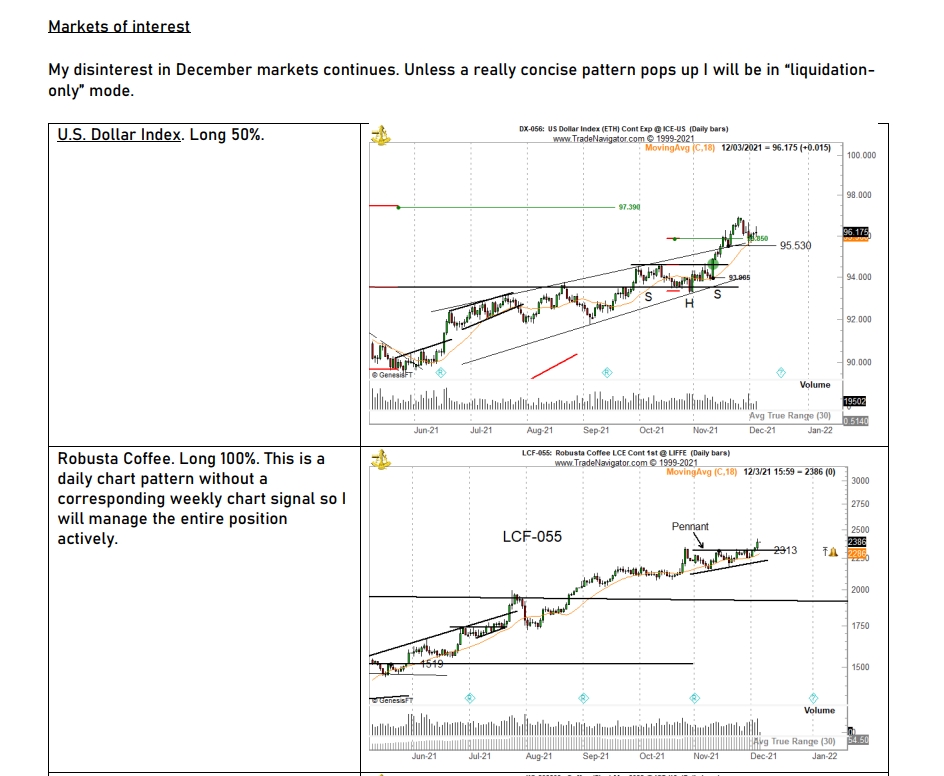

I have posted numerous Tweets on the Members’ Community Twitter stream the past week or so about trading during adversity. Why? Because, as I have stated, December is NOT the month to try to make up for the entire year gone by. Over the years I have known several traders who went bust by doubling or tripling down to catch up during December in order to resurrect a year that was not successful. December is typically a choppy month.

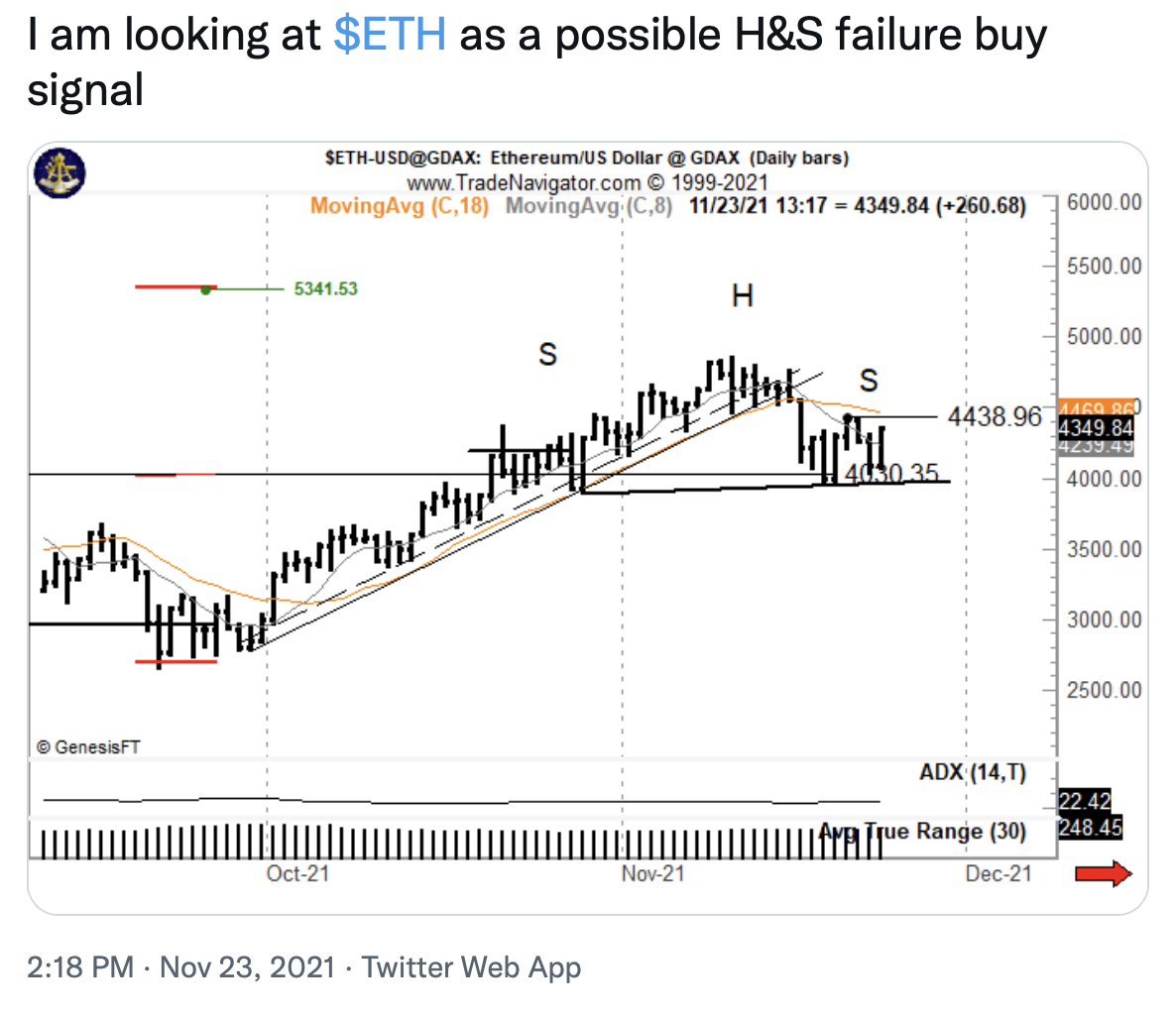

I have been open about my intent to get as flat as possible into December. Obviously, the big news this past week has been the large decline in equities and the cryptos. Where do these markets go from here? I am clueless, but my hunch (unsupported by any positions) is that following a struggling rally we should see equity prices further erode and that BTC and ETH could be in for several months of broad trading ranges. Time will tell.

I am looking past the current volatility in equities and cryptos and thinking about 2022.

Commentary on open trade equity | unrealized profits (November 21, 2021 Report)

Unrealized profits are taken into account when calculating futures and forex trading profits for tax liability. Also, hedge fund managers calculate their performance based on closed trades in addition to changes in open equity (OTE) from one reporting period to the next.

Many traders monitor their asset balances, including unrealized profits/losses. While I report unrealized gains/losses in my annual tax statements, I ignore open trade equity in monitoring my Net Asset Value in real time. Open profits do not belong to me so why would I treat them as belong to me. The only Net Asset Value that I care about is Closed Trade Net Asset Value.

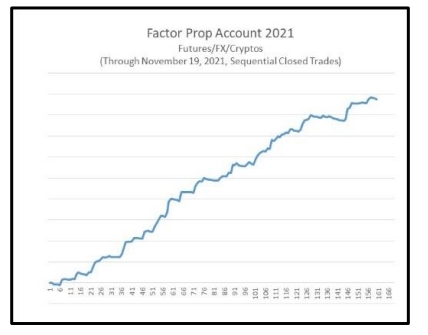

One of the tables/graphs I update regularly is my Closed Trade Net Asset Value – I have this figure going back to 1981 on a monthly basis and back to 2014 on a sequential closed trade basis. In my opinion, how a trader considers open profits can GREATLY impact their emotional state – which can impact their trading disposition. A couple of examples – one hypothetical and one real time – illustrate this.

• Hypothetical: This morning you had a $20,000 open profit in a futures contract but your trailing stop got hit, erasing $10,000 of the profit. In your mind do you think/feel that you lost $10,000 or that you made $10,000?

• Realtime: I would have to figure out the exact amount, but I ended the week with less equity in my Prop Account than I had at the beginning of the week. Yet, closed trades this past week had a composite profit of 80 basis points. So, who cares how much in open profits slipped through the cracks?

My focus (MY GOAL) is to keep advancing my Sequential Closed Trade NAV. The graph shown is for 2021 Futures/Forex/Crypto closed trades. For the purpose of this discussion the numeric values of the “Y” axis are unimportant. Of paramount importance to me is avoiding big losses so that the NAV curve is no more than a few good trades from a new ATH. Even right now I am in trades that based on current stop levels will push the NAV curve into a new ATH. In a nutshell, that’s my goal. I operate on the assumption which has proven itself to me that if I take care of losses, then winners will take care of themselves. Trading is about managing capital and risk. That I need to enter and close trades is simply the plumbing by which that occurs. It is the big losses (for me this is any loss greater than 30 BP per tranche) that screw up the calculus of trading.