A correct understanding of “rate-of-return”

The lack of understanding of trading performance is wider than I imagined

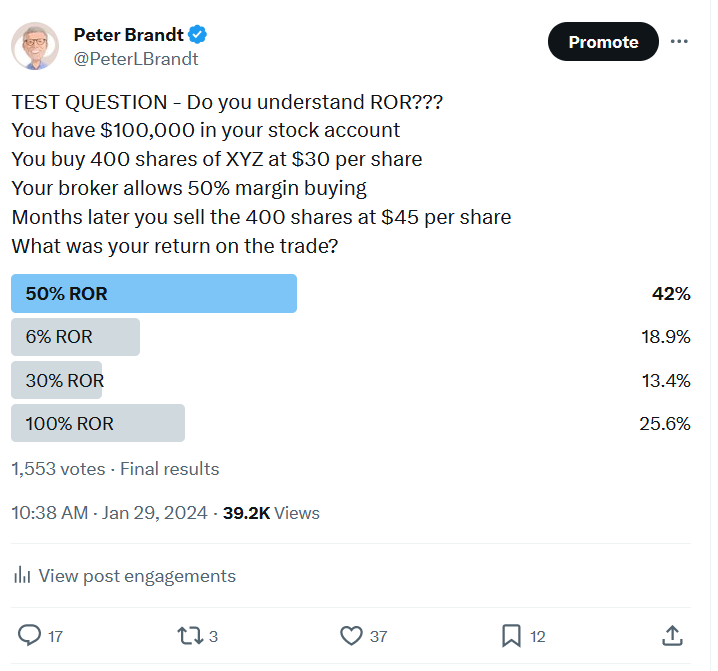

On January 29, 2024 I posted on “X” the polling Tweet shown below.

The wording was intended to reveal the faulty understanding of performance by the majority of social media participants.

Faulty indeed!!

81% of the 1,553 respondents answered wrong.

The trade produced a 6% rate on capital.

Anyone who monitors Twitter is accustomed to such claims as:

-

- “Trade delivered 10x profit”

- “120% return in one-week”

My response to such claims is always: Bull Crap!

The profit/loss and risk of a trade MUST always be expressed as a percent of the composite value of the entire amount of capital from which the trade was made. In the example of the polling question, the two datum points attributable to performance are:

- Investment of $12,000 to purchase 400 shares of XYZ

- A profit of $6,000 or $15 per share

The percent change of the underlying asset does NOT represent the rate of return.

The profit as a percent of the margined position does NOT represent the rate of return.

I repeat — the risk AND profit/loss of a trade must be calculated in relationship to the total actual or nominal value of a trading/investment account.

Let me unpack an actual example from the prop account of my company, Factor Trading. For the sake of this argument, assume that my trading account has a total nominal value of $1 million.

On January 9 I shorted seven contracts of May 2024 Soybeans at 12.85. The underlying value of this trade (35,000 bushels) was $449,750. The margin requirement to carry this trade was $28,910 (keep in mind that the CME sets a minimum margin requirement per contract but each FCM can require more).

I covered the trade today at a price of $12.23, or a profit per bushel of 62 cents. So, the total profit of the trade was $21,700.

Based on the answers to the poll (above), 26% of respondents would have pegged the rate of return of this trade at 75% (21,700/28,910) — and this answer would be wrong.

And 42% of respondents would have pegged the rate of return at 4.8% (.62/12.85) — and this also would be wrong.

Repeating once again — rate of return (and risk) must be expressed as a percent of the total account capitalization, so a profit of $28,910 represented a return of 2.9% (or 290 basis points), derived from dividing the profit of $28,910 by the total nominal capitalization of $1,000,000.

To conclude, rate of return should NOT be calculated based on the profit/loss as a percent of the change of the underlying asset or as a percent of the margin used.

Yet follow Twitter in the days ahead and see how many braggard traders misreport the return of their trades.

One final note — if a Commodity Trading Advisor or investment manager were to report performance in any other way than explained, the NFA/CFTC or SEC would severely judge such reporting as misleading and subject to a monetary fine.

End

Become a Factor Member

Members receive:

- Trading Commodity Futures with Classical Chart Patterns: A free PDF copy of Peter’s classic out-of-print book

- The Weekend: Thoughts on a Sunday (Weekend) Afternoon / Factor Update

- Private Twitter Page: Real-time alerts on interesting charts and observations, member dialog, the process of trading, the human aspect of trading, and risk/trade management

- Webinars: Periodic member-only webinars where Peter speaks about current conditions and fields member questions

- Knowledge Center: Fast and easy access to current and archived content from Peter’s extensive library of trading content

- Automatic notifications: Email and social media notifications are sent out when new content is published

- Factor Report Educational Papers: Periodic educational and instructional documents

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. My goal is to shoot straight on what trading is all about.

I hope you will consider joining the Factor community.