Tag Archive for: Euro

Euro Dollar Forex Pair

/by Peter BrandtEuro Dollar Forex Pair

It is time to take another look at the Euro Dollar Forex Pair from the 30,000 foot level. The quarterly graph displays two prominent features. First, the 6½-year descending triangle top completed in Mar 2015 has an unmet target at .8670. Second, the decline in Mar 2015 found strong support at the 45-year trendline. Read More

Read MoreSignificant Factor Alert – Sep 20th

/by Peter BrandtLong Term Euro Charts Point to Trouble Ahead

/by Peter Brandt

Long Term Euro Charts

For a considerable period of time I have held a very negative opinion on the Euro. The Euro currency has a complicated history. The Maastricht Treaty of 1992 obligated certain Euro nations to adopt a common currency – although it was not until Jan 2002 that currencies such as the D-Mark were officially replaced by the Euro currency mechanism. It is possible to create a proxy EUR that dates back to 1992. In fact, IMM and proxy price data exist back to the early 1970s. Several technical developments on the EUR graphs are worthy of note.

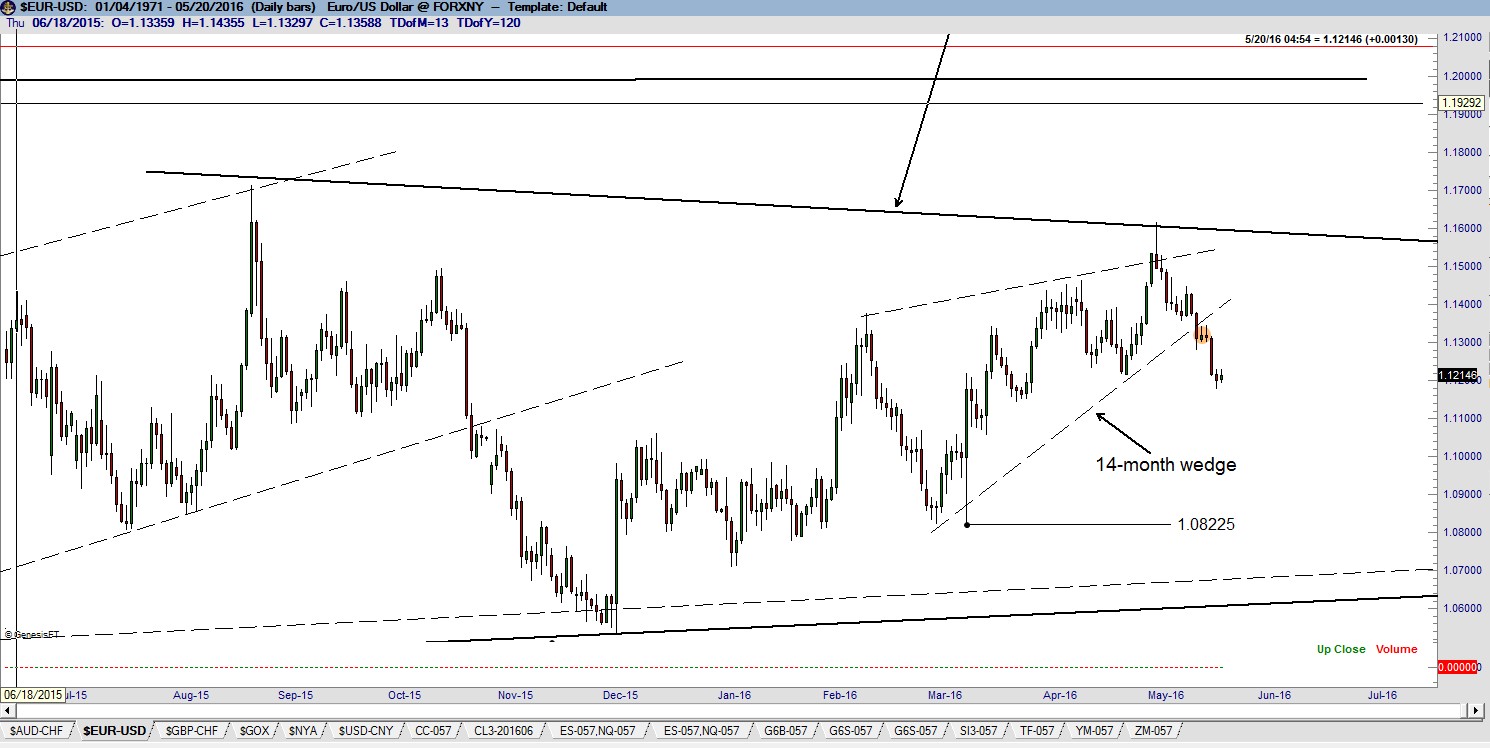

A 6-1/2 year descending triangle on the quarterly graph was completed by the decline in Jan 2015. This pattern has an unmet target of 84 cents, the area of the 2001 low. The monthly graph also displays a dominant multi- decade trend-line connecting back to the 1985 low. The decline in the first quarter of 2015 found support at this trend-line. It is interesting to note that the price range in the first quarter 2015 has contained the market ever since. The weekly graph displays a possible 27-month congestion. It is my contention that this congestion will eventually be resolved to the downside – and that the simultaneous violation of the lower boundary of this congestion zone and the multi-decade trend-line will tie into a crisis in the Euro currency mechanism.

The daily graph displays a completed 14-week rising wedge with a target of 1.0822.

Factor Membership is now available, including a quarterly option. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information, visit the home page here.

I hope you will consider joining the Factor community.

##