U.S. mid cap and small cap stocks have taken over leadership

/by Peter BrandtBuilding a trade to profit from this momentum shift

Note: Members of the Factor Service have already been made aware of the ideas presented herein — many Factor members have already taken action.

It appears that the bull trend in U.S. equities is now spilling over to mid caps and small caps. These stock indexes have substantial room to play catch-up and offer attractive profit potential for futures and ETF traders.

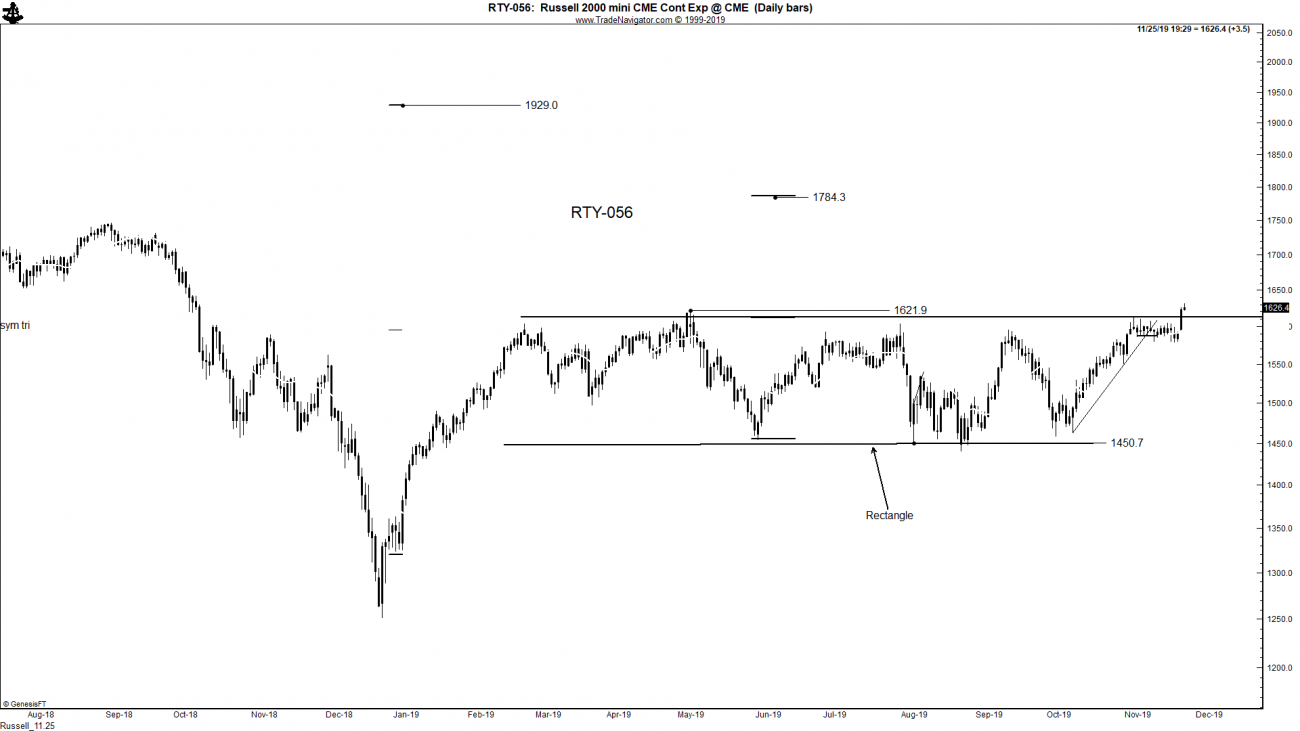

Futures traders

The Russell 2000 is attempting to breakout from a 9-month classical charting rectangle. This rectangle has targets of 1784 and 1929. Traders can choose from the mini Russell (CME) which carries a value of $50 for each point of price change or the micro Russell (CME) which carries a value of $5 for each point of price change. For example, an advance by the mini Russell from the present price of 1626 to the target of 1784 would represent a profit of $7,900 per futures contract. Each futures contract requires a margin deposit of $3,300. This interpretation of the chart will be null and void if the Russell declines below 1579. A decisive close above 1640 is required to confirm the upside breakout.

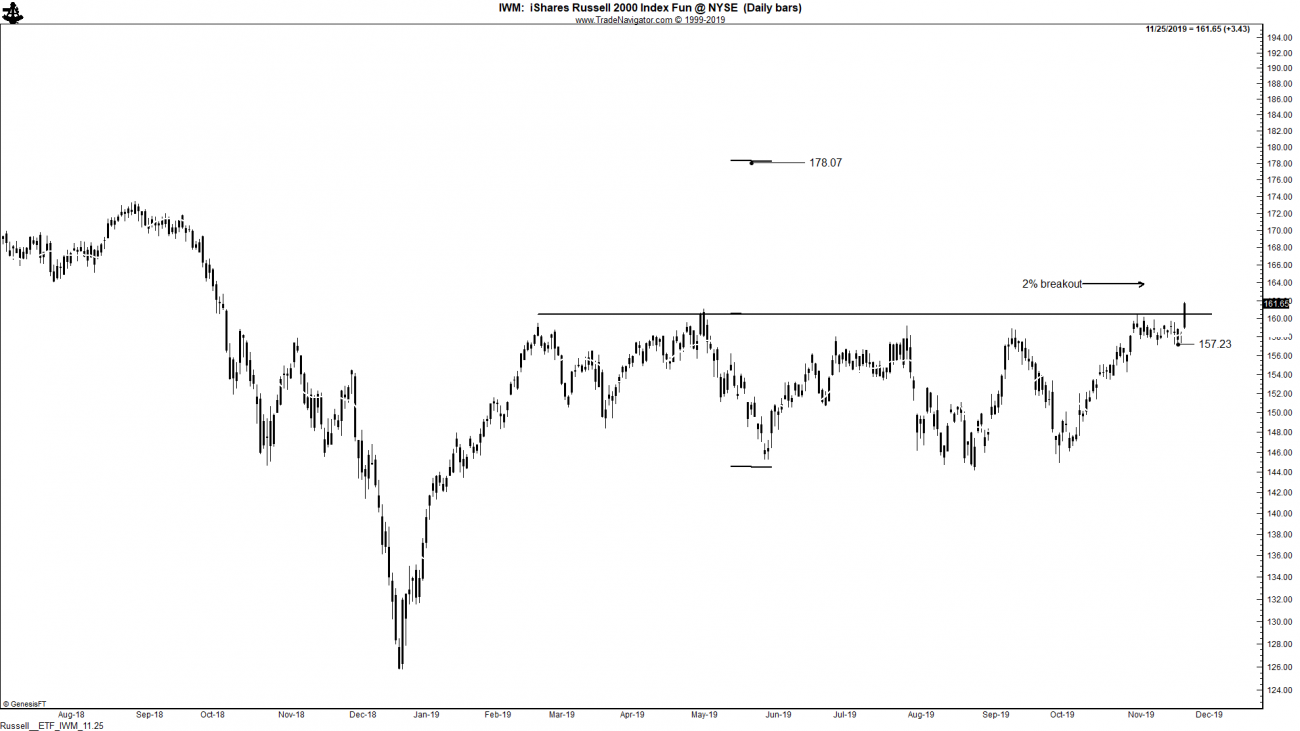

ETFs

Futures contracts offer a much more efficient way to utilize trading capital and maximize profits — but also with commensurate risks. The Russelll ETF (IWM) is also attempting to breakout. I use a 2% breakout rule for ETFs. Thus, a close above 163.84 would constitute a price breakout. A close below 157.23 would negate a bullish breakout. With a profit target of 178.07, a purchase of 100 shares (cost of $16,384 at the breakout level) would offer a profit at the target of $1,423. The risk (using the 157.23 negation level) would be approximately $660 based on a 100-share purchase.

Obviously, futures trading is only for those traders with appropriate risk capital and temperaments. Yet, I hope the above example provides an excellent example of the benefits of trading futures vs. ETFs. While the ETF trade as laid out provides a 9% return of the capital used to buy the ETF, a futures contract offers a profit potential of more than 200% of the capital used to margin the trade.

While the profit potentials listed above are in relationship to the capital used to control the trades presented, the Factor Service believes that risk must always be measured against the total capital held in a trading account.

plb

###

Foreign Exchange Idea’s on Watch

/by Peter BrandtNZD/USD (CME)

The daily closing price chart provides a clearer picture of the possible inverted H&S bottom than does the daily bar or candlestick chart. I am interested in the long side of NZD. Read MoreFactor Special Report, November 24, 2019 – Bitcoin

/by Peter BrandtFactor Update, November 22, 2019

/by Peter BrandtBuilding Performance, One Trade at a Time, November 2019

/by Peter BrandtFactor Update, November 16, 2019

/by Peter BrandtBuilding Performance, One Trade at a Time, November 2019

/by Peter BrandtFactor Update, November 8, 2019

/by Peter BrandtStocks Keep On

/by Peter BrandtS&P 500 (CME)

The S&P Index is attempting to penetrate the neckline of a 22-month continuation inverted H&S pattern. Note that a 15-week ascending triangle has been completed on the daily chart of the Dec contract. Perhaps this triangle will serve as the launching pad to complete the larger H&S configuration. Factor is long. Read More

Read MoreRecent Posts:

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am- The “We-Fund-You” Prop Trading Industry should be immediately shut downJuly 17, 2024 - 5:54 am

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm

Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm