September 30, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 30, 2023

September 29, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 29, 2023

Steps to access the Factor Member Private Twitter

/by Peter BrandtSeptember 28, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 28, 2023

September 27, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 27, 2023Factor Featured Trade DAX

/by Peter BrandtIssued to Factor Members on September 24, 2023

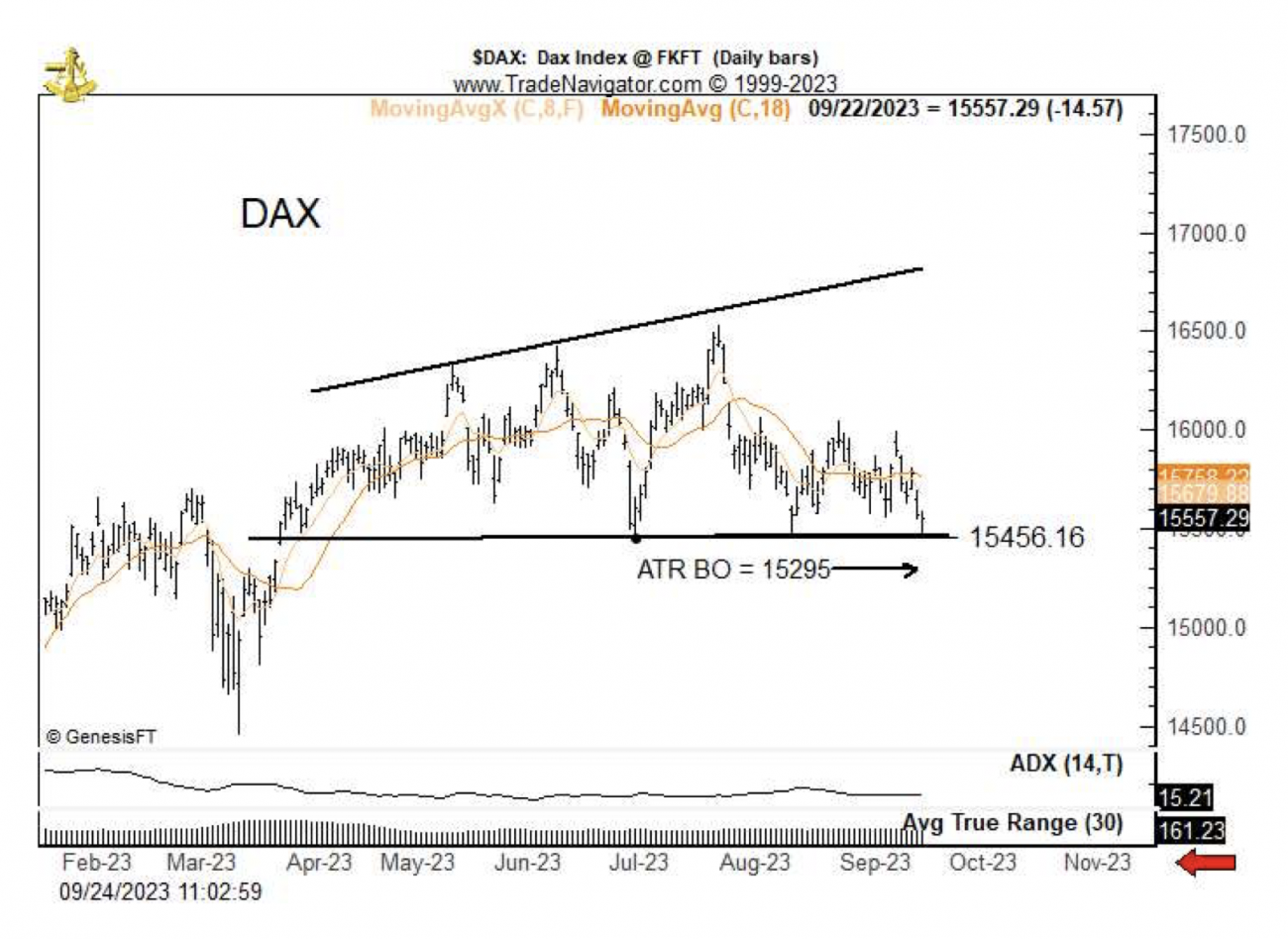

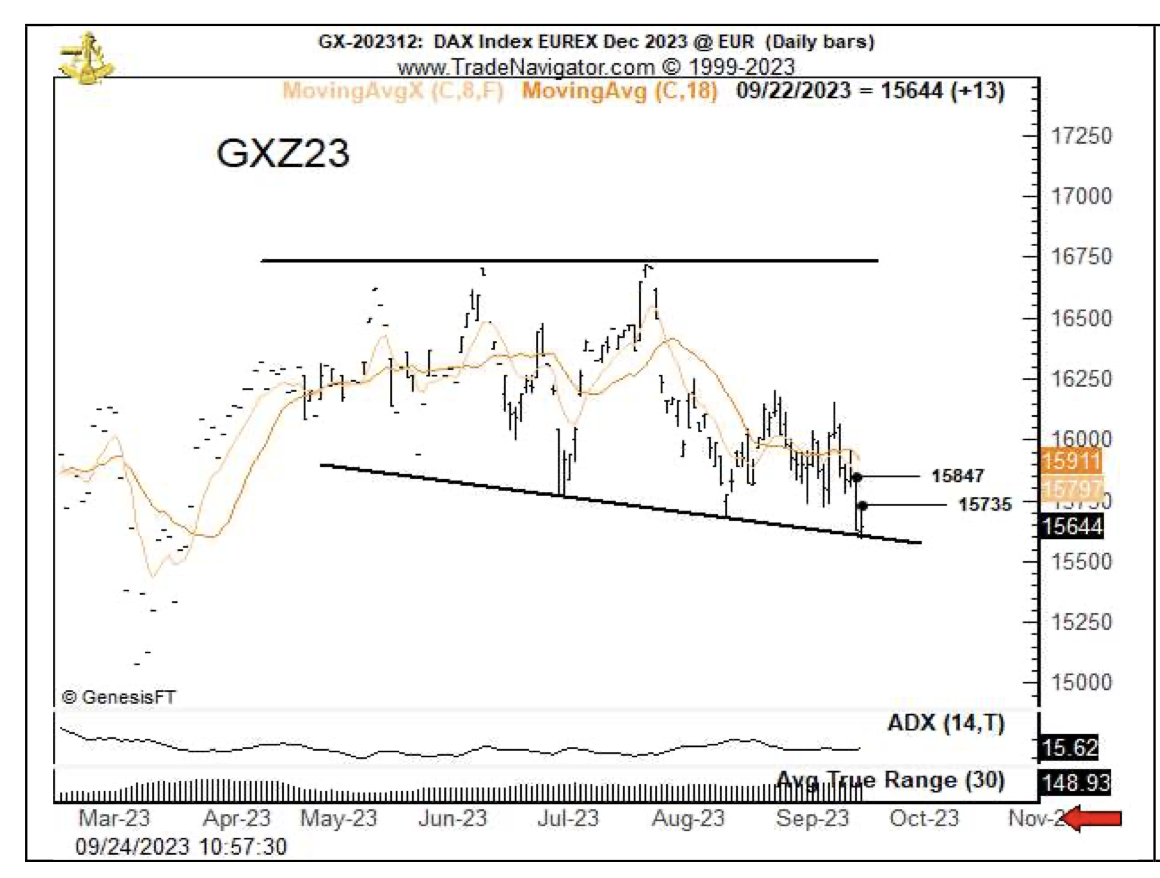

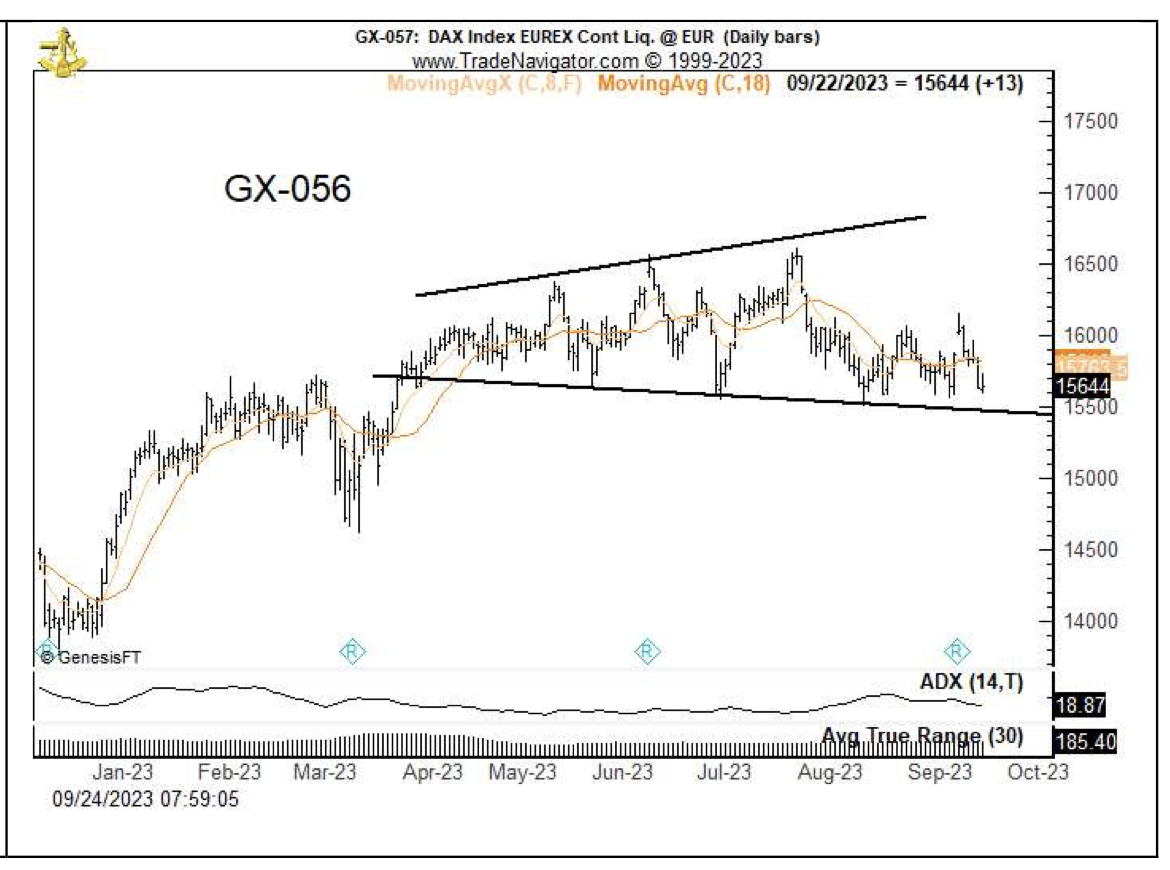

Trade Spotlight – Short DAX Index

The spot DAX displays a right angled broadening triangle with a horizontal lower boundary at 15450 and with a 30-day ATR of 161 points. The continuation chart (056) appears as a broadening triangle. The Dec futures contract shows a right angled broadening triangle with a slanted lower boundary. The large futures contract has a point value of €5, the mini-contract has a value of €1 per point. I will use an alert from the spot chart as my trigger.

Constructing the initial trade

There are two possible risk point levels on a short trade in the Dec contract:

- Above the Sep 22 high at 15735

- Above the Sep 21 high at 15847

Spot DAX closed 252 points above its ATR BO at 15295. But the spot DAX closed several hours prior to the close of the DAX futures, which weakened by approximately 50 points after the spot close. Making the appropriate adjustments, I believe the ATR breakout for the Dec contract is sub 15500 (call it 15489).

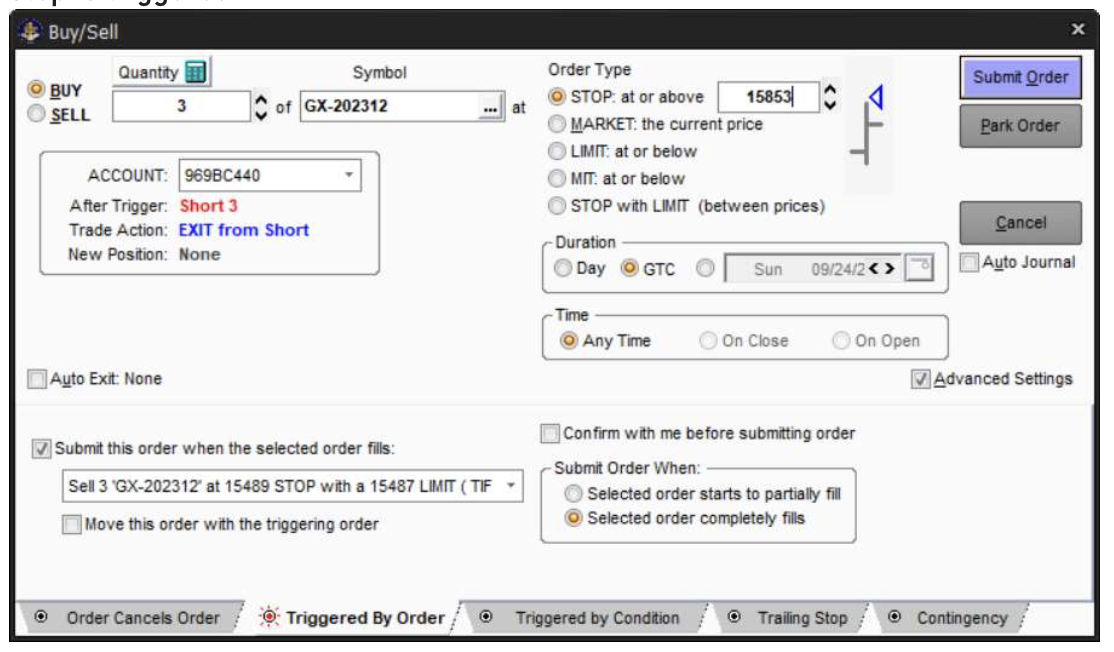

A risk from a short trade entry at 15489 to 15853 (above Sep 21 high) would be 364 points, or €1820 (around $1,940 or so). Thus, a three large contract (or 15 mini contract) trade would create a risk of just under 60 basis points (6/10th of 1% of total nominal capital).

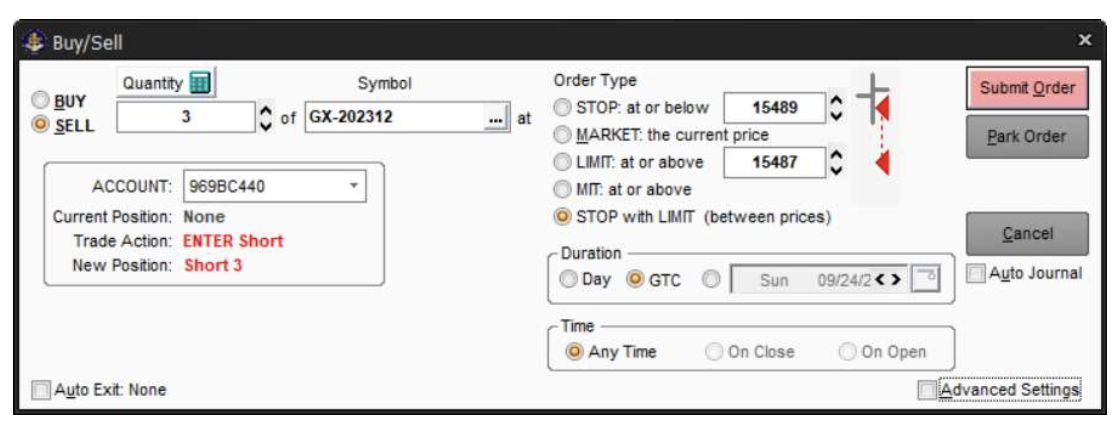

The orders below reflect the trade. The first order is the entry stop (with a limit).

The attached order is also entered, reflecting a buy stop which becomes active if/when the entry sell stop is triggered.

Become a Factor Member

Members receive:

- Trading Commodity Futures with Classical Chart Patterns: A free PDF copy of Peter’s classic out-of-print book

- The Weekend: Thoughts on a Sunday (Weekend) Afternoon

- Private Twitter Page: Real-time alerts on interesting charts and observations, member dialog, the process of trading, the human aspect of trading, and risk/trade management

- Webinars: Periodic member-only webinars where Peter speaks about current conditions and fields member questions

- Knowledge Center: Fast and easy access to current and archived content from Peter’s extensive library of trading content

- Automatic notifications: Email and social media notifications are sent out when new content is published

- Factor Report Educational Papers: Periodic educational and instructional documents

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. My goal is to shoot straight on what trading is all about.

I hope you will consider joining the Factor community.

Factor Trade Spotlight Corn September 26 2023

/by Peter BrandtSeptember 26, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 26, 2023September 25, 2023

/by Peter BrandtWant to see Tweets live and engage with Factor Members? Join our Private Twitter page HERE

Factor Members Private Twitter Feed - September 25, 2023Recent Posts:

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am- The “We-Fund-You” Prop Trading Industry should be immediately shut downJuly 17, 2024 - 5:54 am

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm

Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm