Does the current CFTC COT Report forecast a decline in Gold prices?

CFTC COT (Commitment of Traders) Report Forecast a Gold Decline?

In recent past, I have cited the CFTC COT (Commitment of Traders) report’s record open interest by large specs and record short open interest by commercials as a possible negative for Gold prices. Never one to trust myself, I decided to dig deeper to find out if my claim held water.

In fact, there is no recent evidence that such extremes in commercial shorts and large spec longs are negative factors on subsequent price action.

The chart below shows (vertical red lines) those instances since 2009 when the CFTC COT (Commitment of Traders) report commercial short positions exceeded 30 million oz. of Gold and large spec long positions exceeded 25 million oz. of Gold.

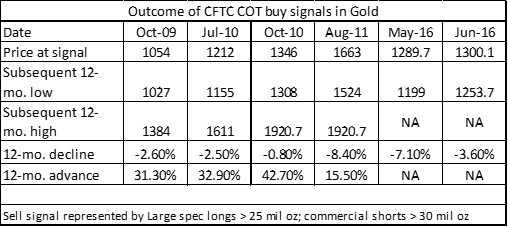

There were four instances during the major bull trend in Gold ending in Sep 2011 when the above cited position extremes were exceeded. Each instance the subsequent 12-month high far exceeded the subsequent 12-month low, as shown in the table below. As this table shows, the declines following these position extremes in May and June 2016 have been generally larger than the corrections during the 2009-2011 bull move. But the point is this — there is no evidence from recent history that extreme long positions by large specs and short positions by commercials produce sizable corrections.

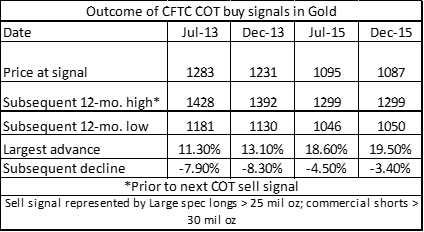

I also took a look at those instance with extreme long positions by commercials and extreme short positions by large specs. The chart above shows those instances with green vertical lines. In this case, extreme positions are considered to be commercial short positions smaller than 2.5 million oz (commercials have never long Gold) and large spec long positions smaller than 2.5 million oz (long specs have never been short Gold). COT buy signals have not been as pronounced (relative to the 12-month downside risk) as is the case with COT sell signals.

In summary, I can no longer retain the argument that excessive commercial short positions and large spec long positions automatically represent an negative price influence.

More information on the Factor Service could be found here: Webinar Video. I hope you will consider joining the Factor community.

##