Currency Review

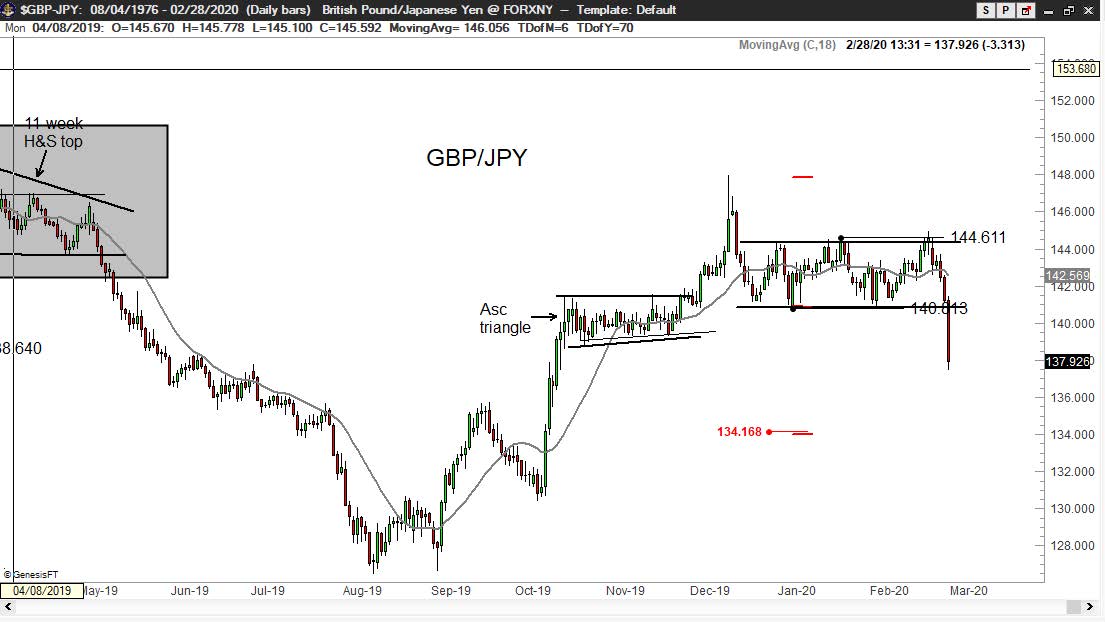

GBP/JPY (spot)

A continuation rectangle was completed on Friday. I missed this trade. I did not get the order in. Read More

Read More Read More

Read MoreThis Forex pair once again completed an 11-month falling wedge (a diagonal pattern). Factor established a long position on Friday. I have low expectations for this trade – that could be a good sign. There is the potential for a significant bull trend based on the long-term chart.

This discussion will bring Factor members back to Jun 2017. The advance in Mar 2016 violated a multi-year parabola. Following the initial rally from the violated parabola, the market corrected in the form of a 13-month channel. The completion of this channel in Jun 2016 produced a 785 BP trading profit for the Factor Tracking Account.

Another channel is forming in the C$. This is a diagonal pattern, so I am cautious. Keep in mind that long CAD futures (the value of the CAD expressed in USD) is the same trade as short spot USD/CAD (the number of CAD that can be purchased by one USD). See the daily chart of futures and spot.

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work.

Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

SaveSave

Here are just a couple of sample Forex possibilities from the past weekend member report.

GBP/NOK

This forex cross continues to display a possible 28-month ascending triangle. I really like this pattern – but I do not like the volatility that Brexit is likely to create with any trade involving the British Pound. I am willing to go with an upside breakout of this pattern, but sized small (perhaps as small as 20,000 GPB/NOK per $200k of trading capital).

This cross is forming a possible rounding or complex H&S top. I am watching this cross carefully for a trading opportunity. This cross should be immune from the craziness of Brexit.

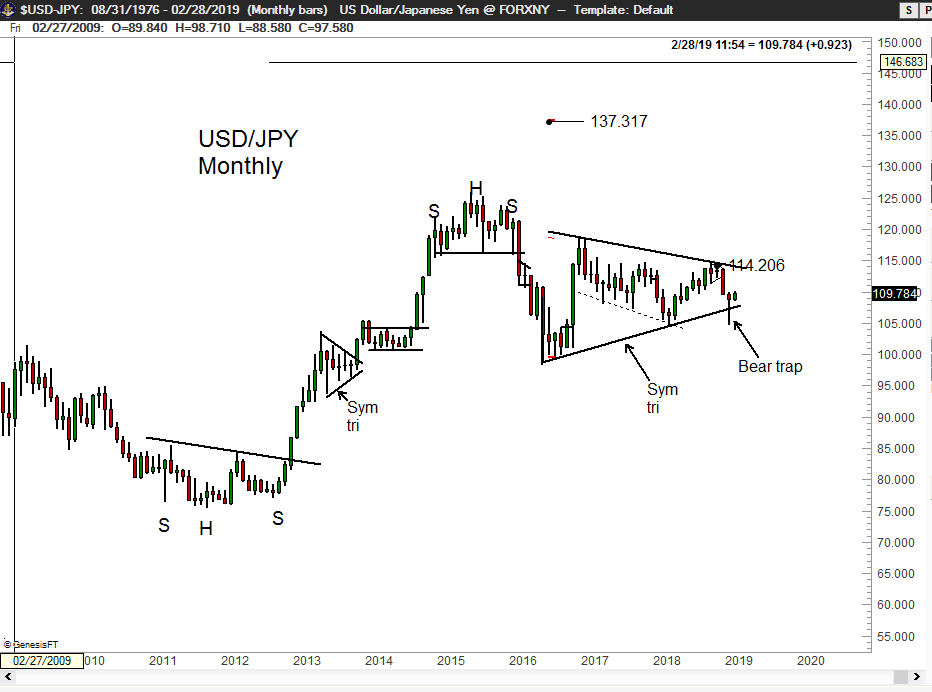

USD/JPY

I am displaying a chart of USD/JPY as a reference point for JPY because of my interest in CHF/JPY. If there is a pattern, I like less than a prolonged symmetrical triangle on a daily chart it is a prolonged symmetrical triangle on a weekly or monthly graph. Nevertheless, USD/JPY is coiling. Factor is flat – I have no trading interest in the Yen.

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work.

Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

SaveSave