Why trade an ETF when the underlying Futures or Forex contract can be traded.

Trading an ETF tied to an underlying Futures or Forex market requires far more capital with less profit potential at the exact same level of risk as directly trading the underlying futures or forex contract. Five examples are provided to make my point.

- S&P futures vs. SPY

- S&P futures vs. SH (inverted SPY)

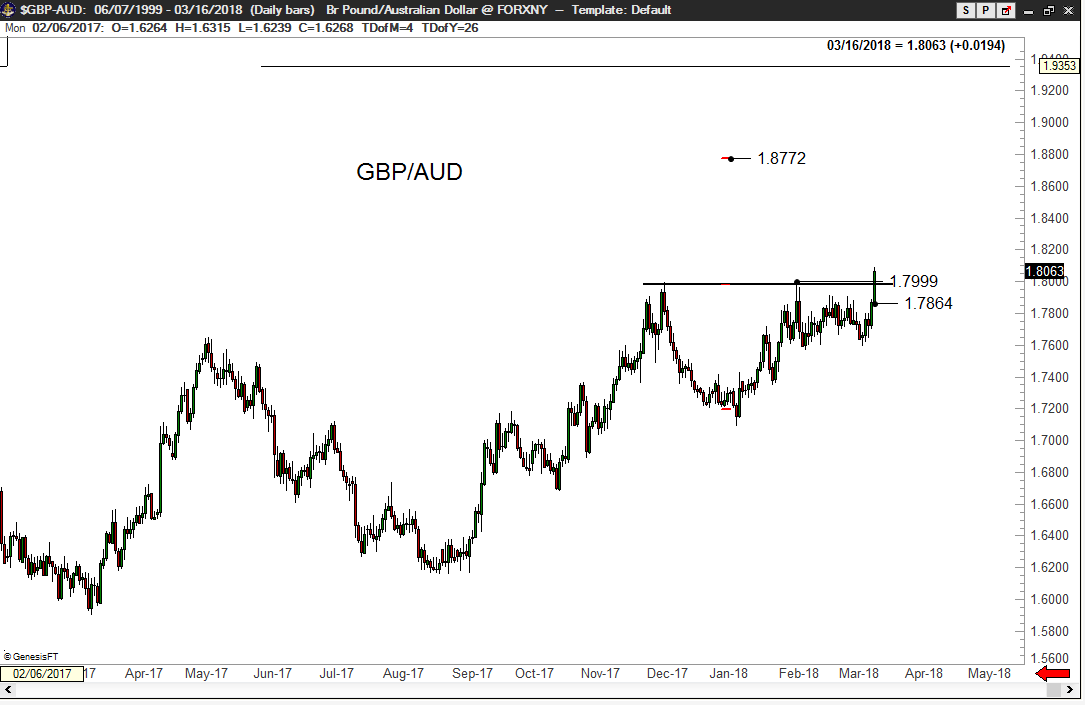

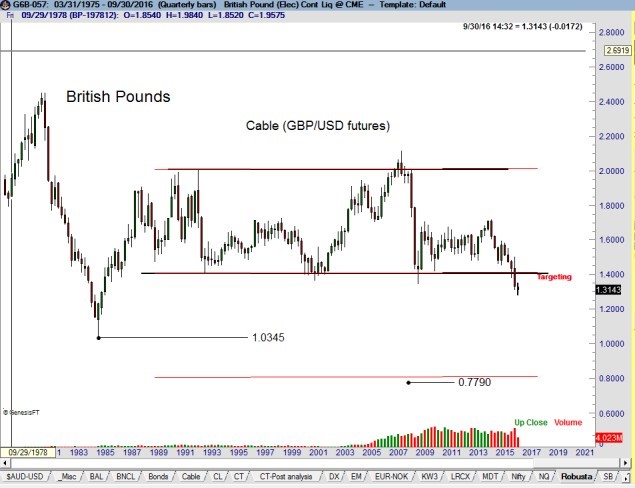

- British Pounds futures vs. FXB

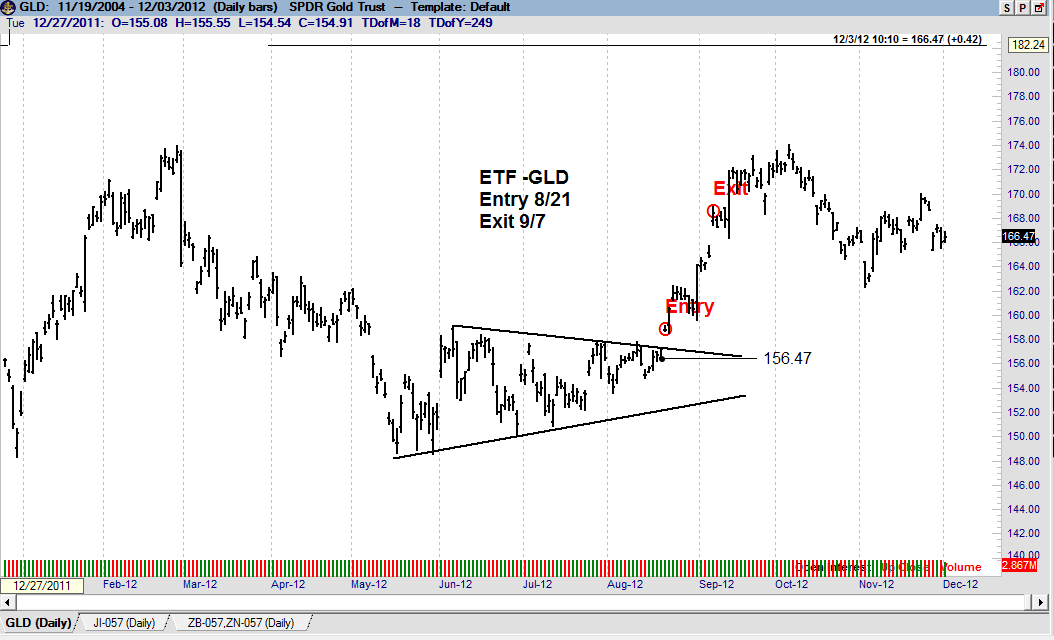

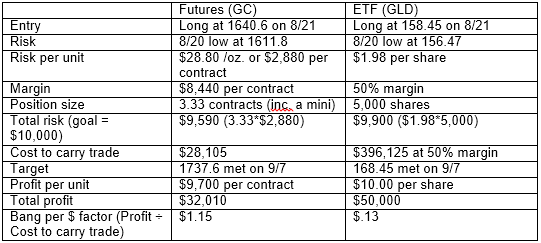

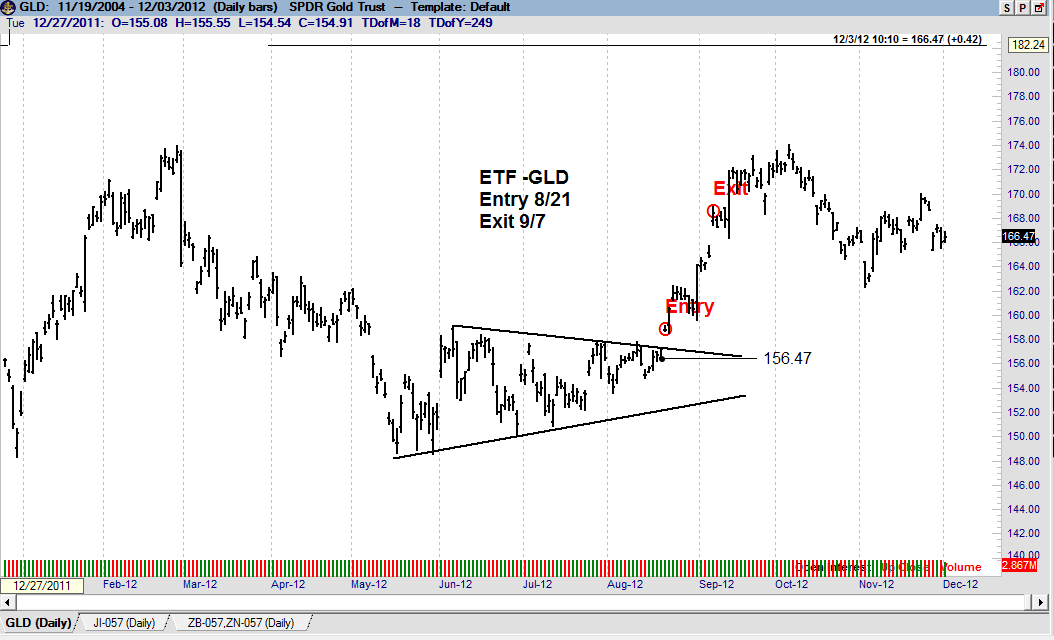

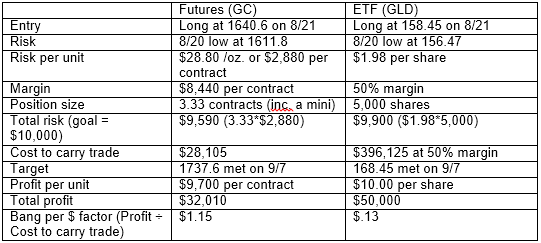

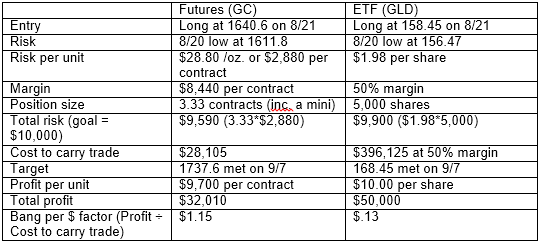

- Gold futures vs. GLD

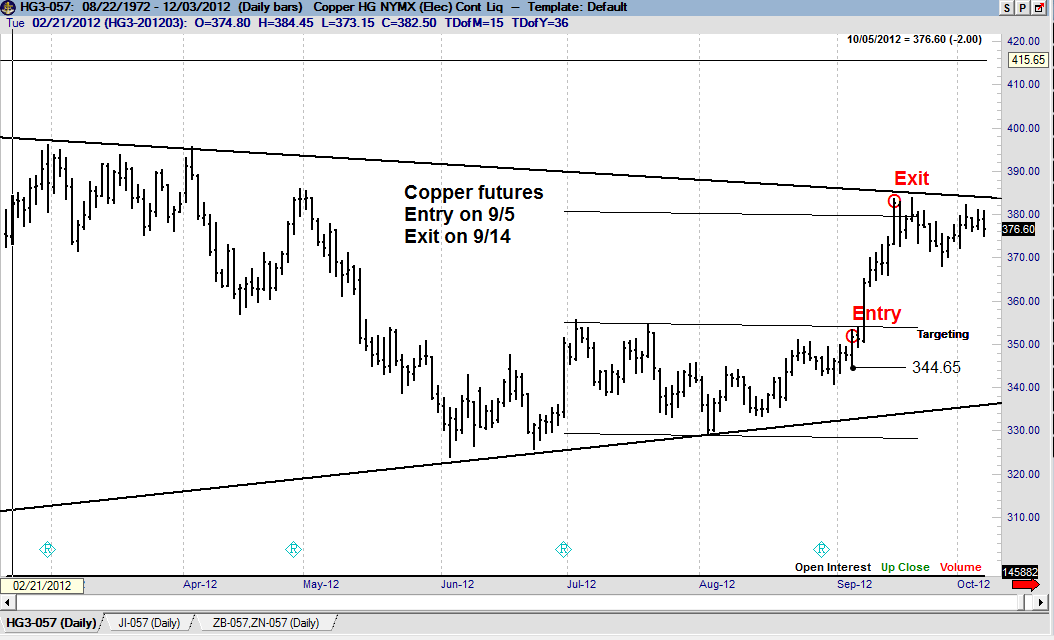

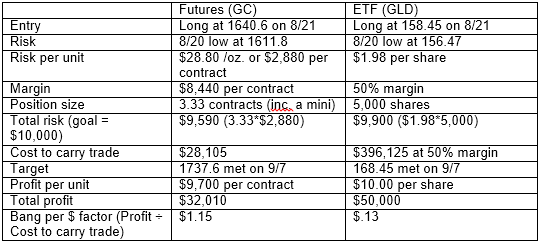

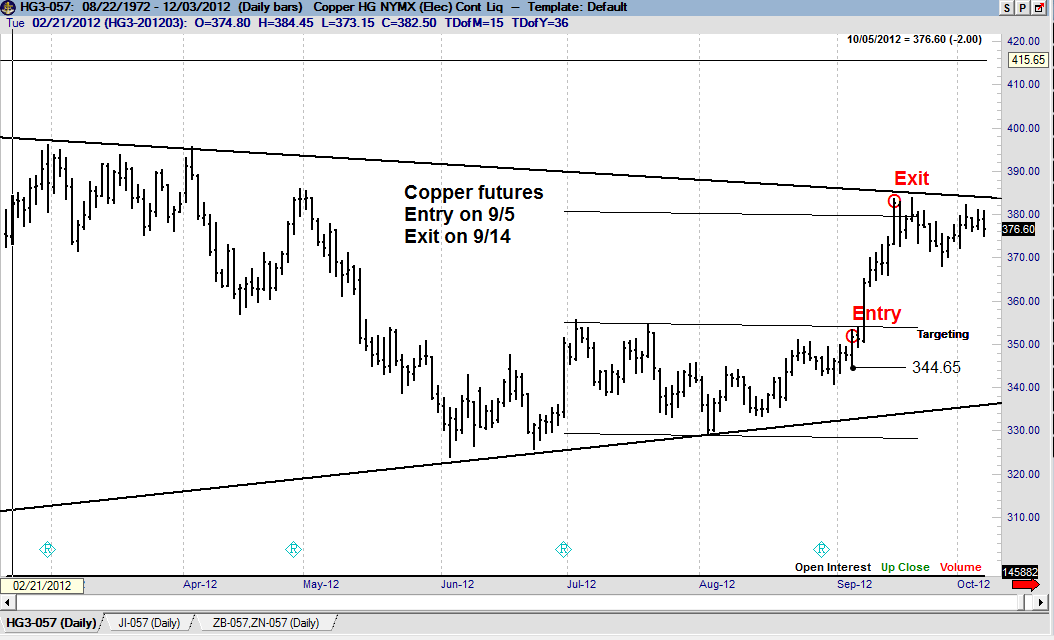

- Copper futures vs. JJC

Assumptions:

- An ETF represents a specific futures or forex market

- A loss of $10,000 is risked per trade – in both the futures/forex and ETF expressions of a trade. A risk of $1,000 would simply require dividing the key numbers by 10

- The entry and exit for each trade (futures/forex vs. the ETF) are made simultaneously – same date and time

- The corresponding charts for each trade set up are shown

Note: This post will no doubt create some level of controversy and disagreement. This is my intent. I will stand by my position that trading an ETF tied to an underlying futures or forex market is a very foolish way to manage trading capital. I have no idea why a trader would ever trade a futures or forex-related ETF if he or she can handle the risk of the futures and forex markets. Let the facts of this document speak for themselves.

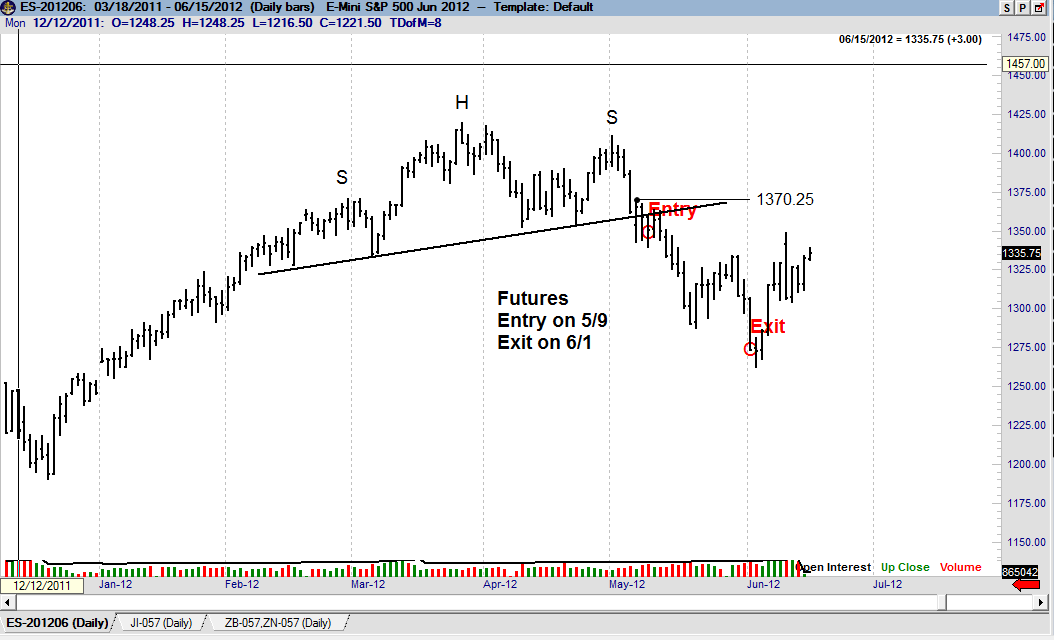

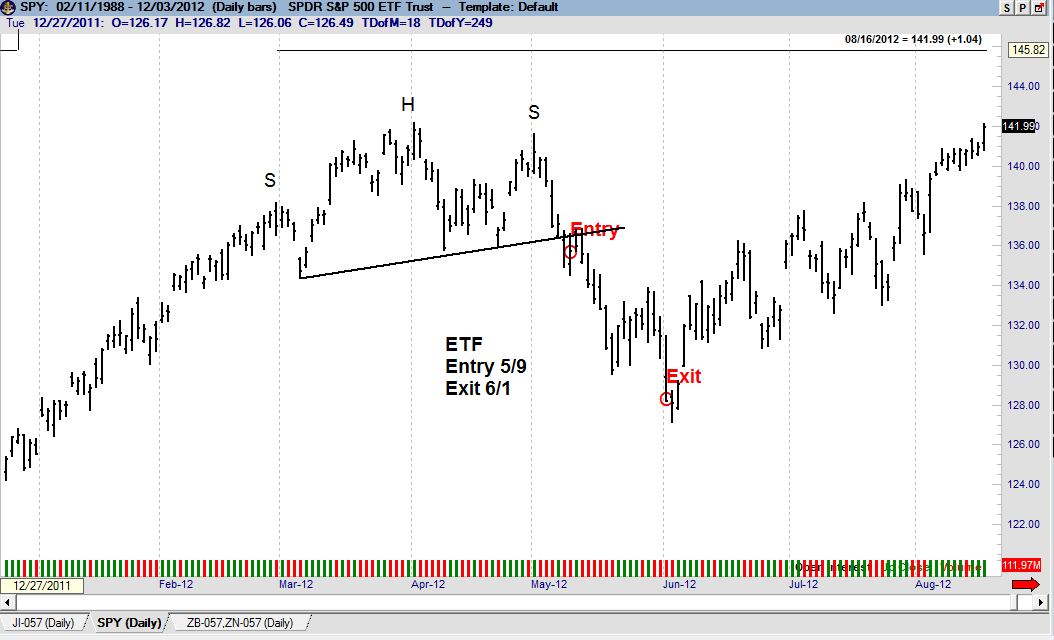

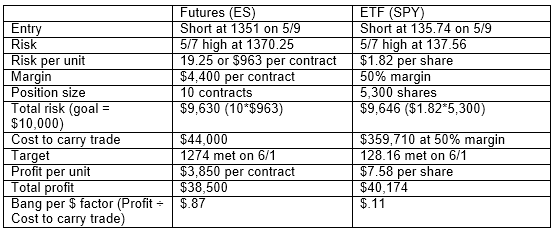

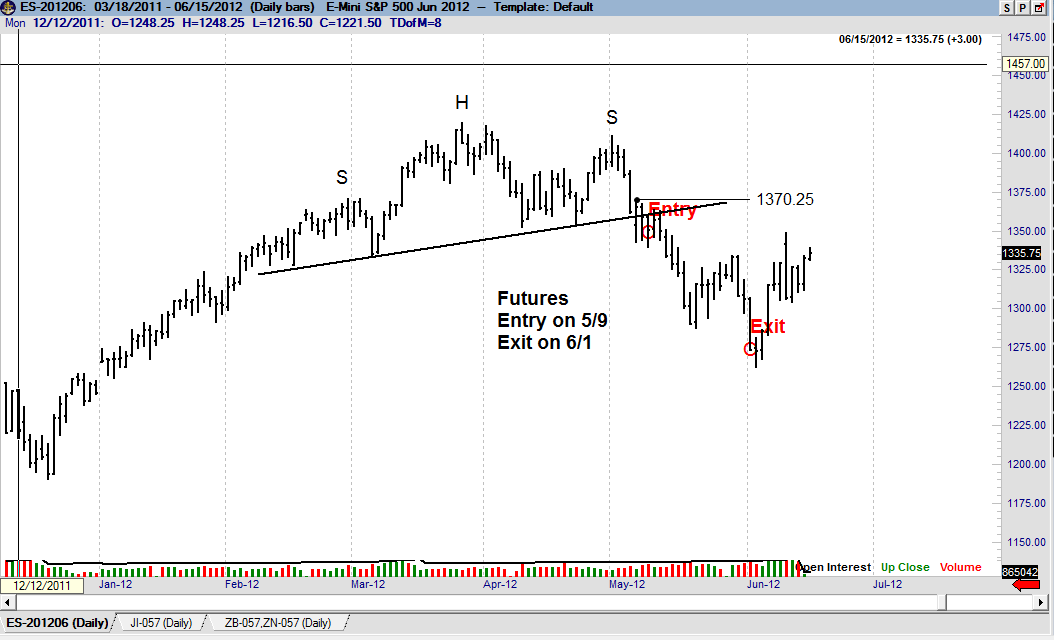

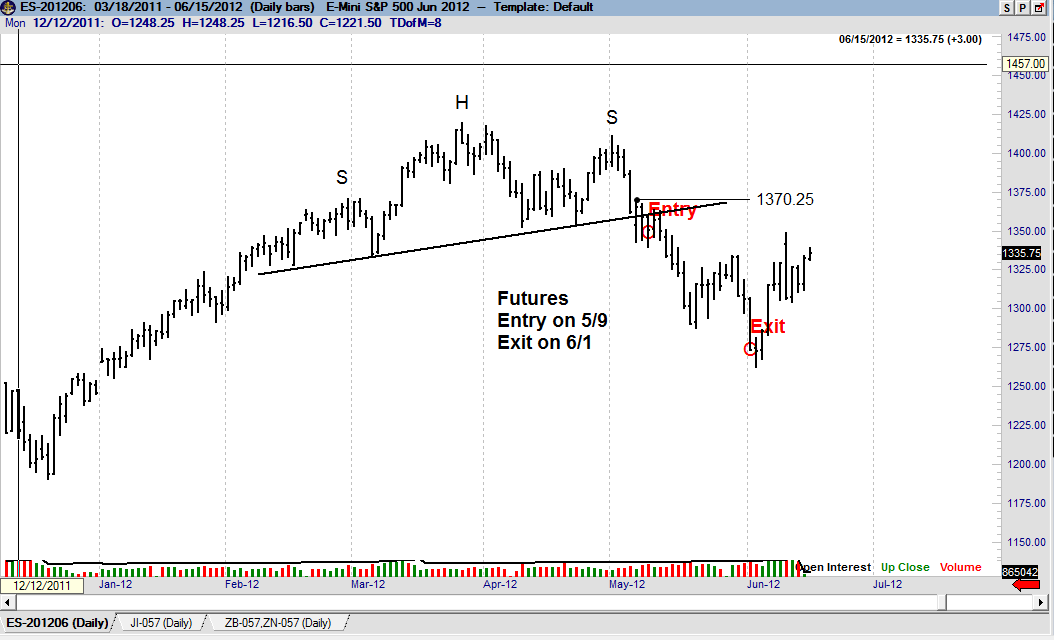

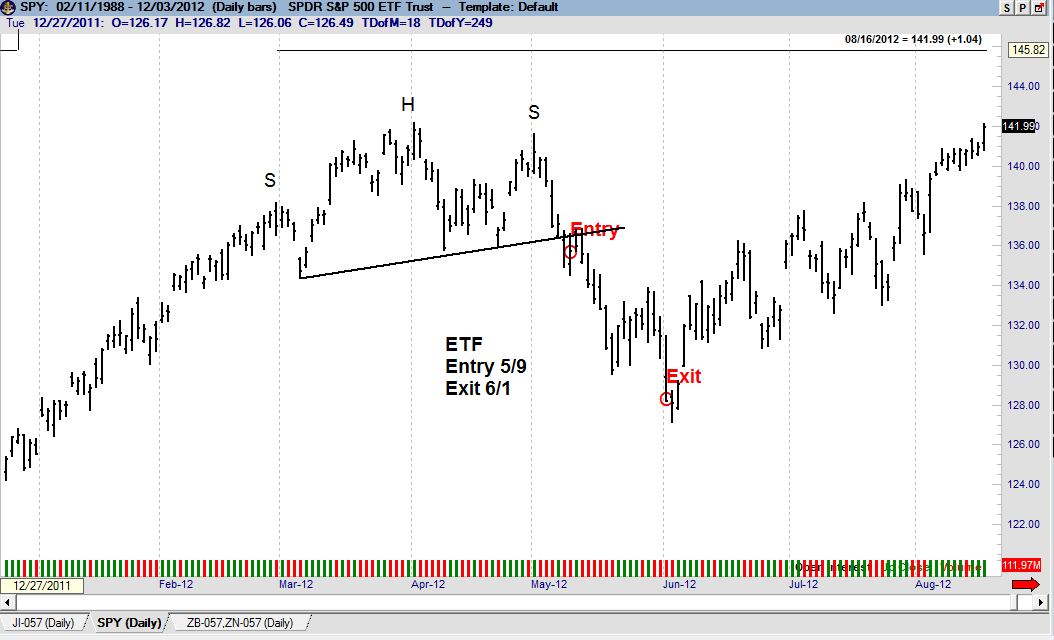

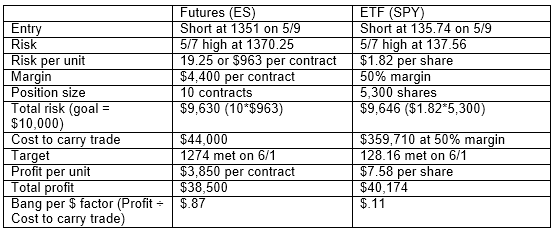

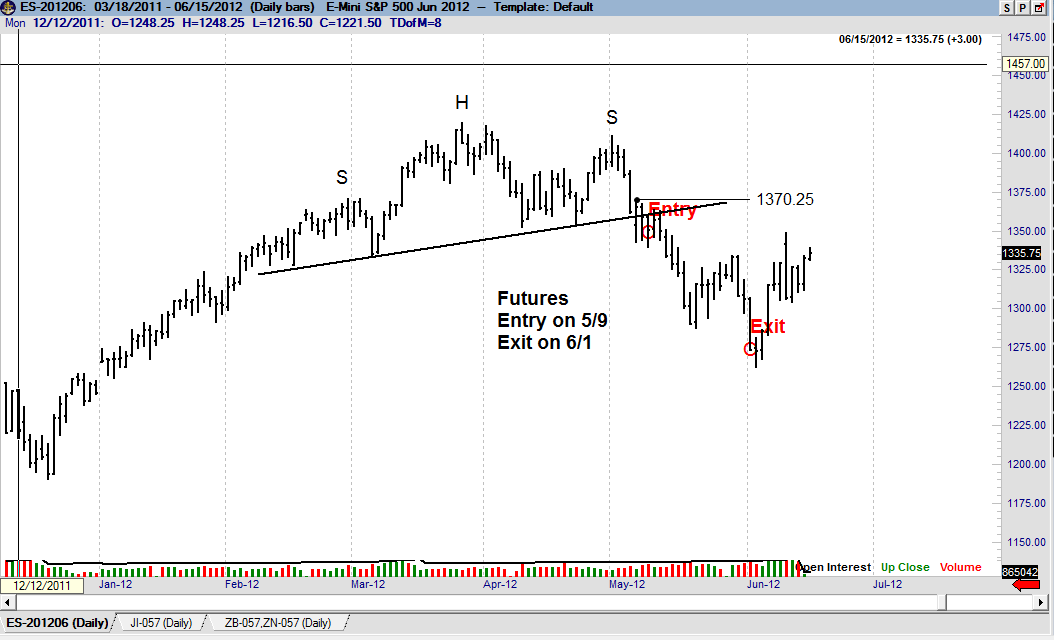

S&P 500 – Shorting the H&S top in May 2012

Summary: Trading SPY ties up eight times more capital in a trade with a near-identical risk to reward profile. FOOLISH!

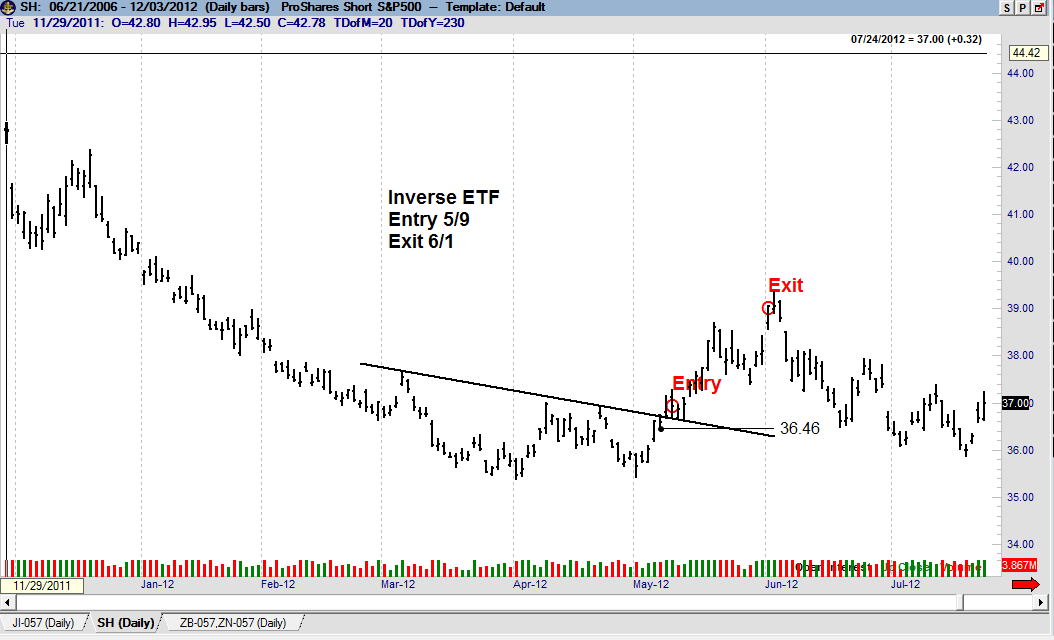

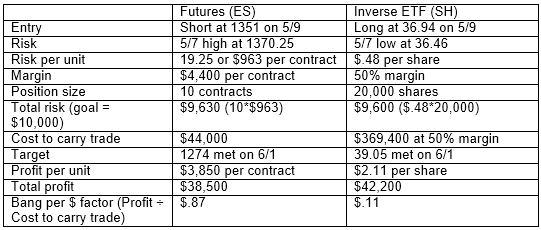

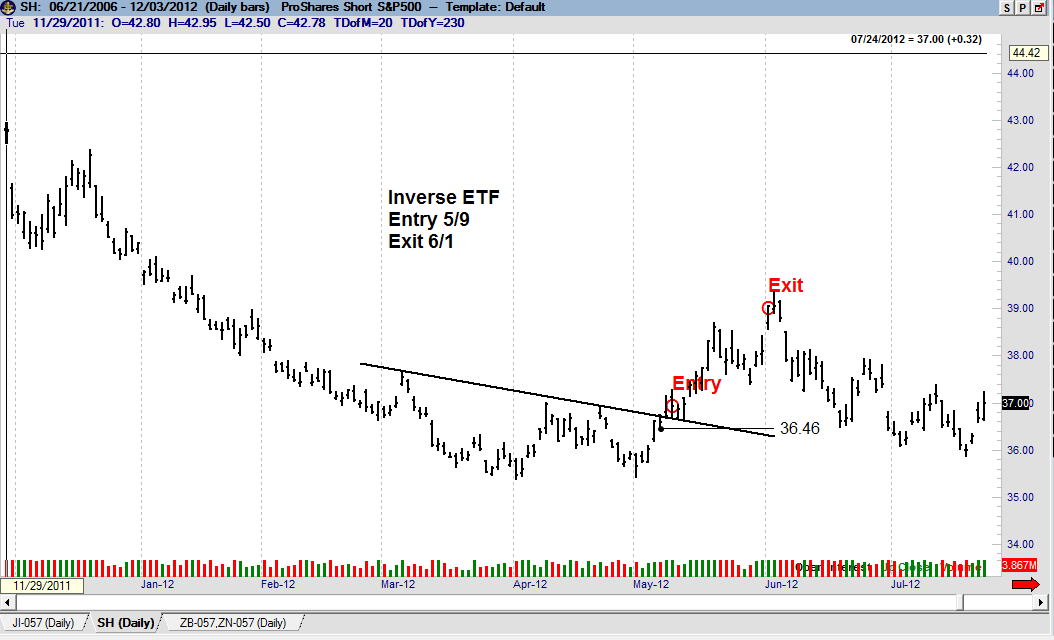

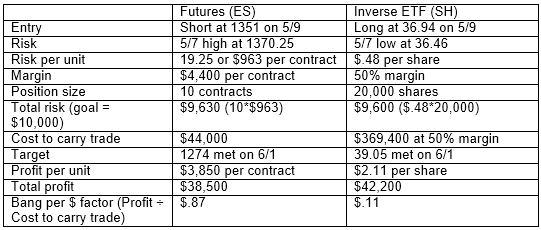

S&P 500 – Shorting the S&P top in May 2012 with an inverse ETF

Summary: Trading an inverse S&P ETF (SH) ties up eight times more capital in a trade with a near-identical risk to reward profile. FOOLISH!

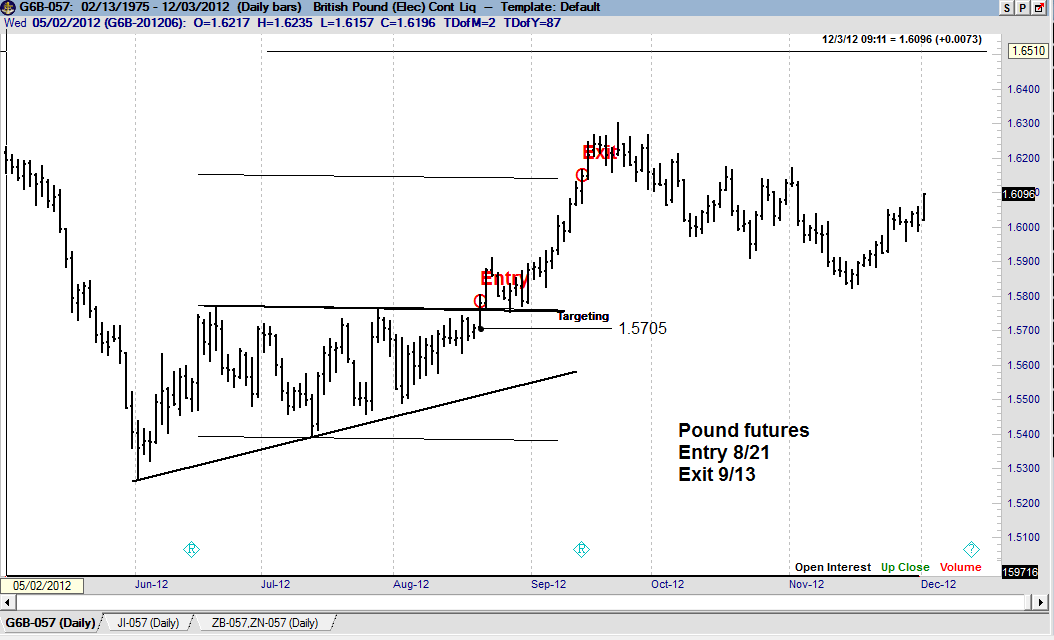

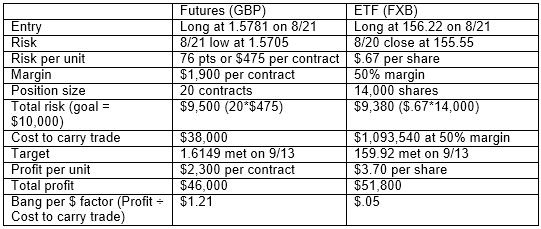

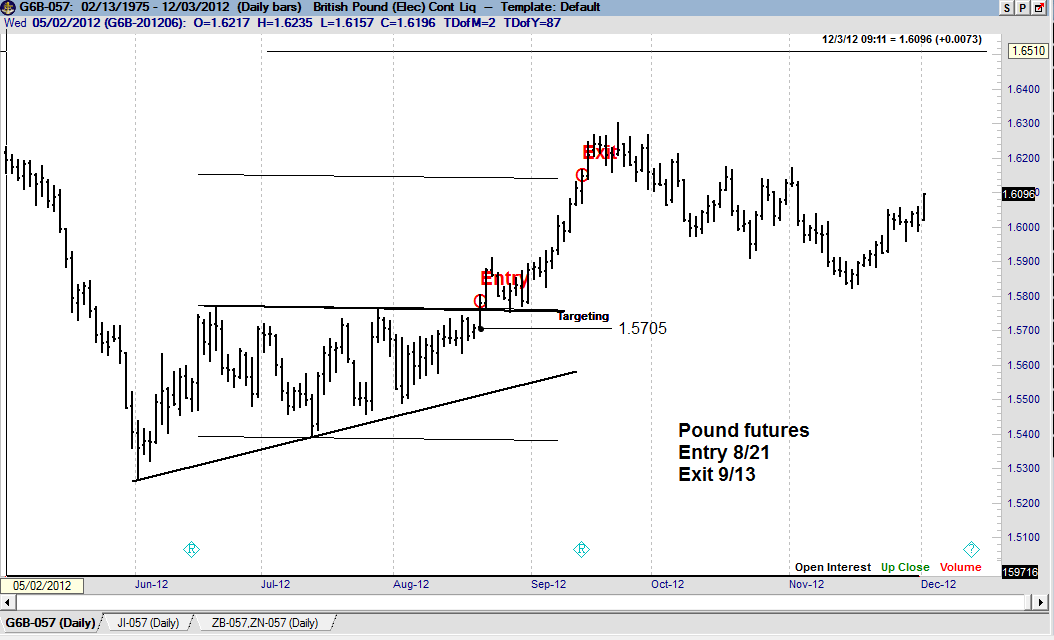

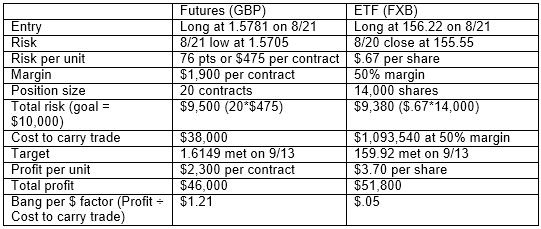

British Pound – Buying the descending triangle bottom in August

Summary: Trading a long British Pound ETF (FXB) ties up 24-times more capital in a trade with a near-identical risk to reward profile. FOOLISH! REALLY FOOLISH! JUST PLAIN STUPID!

Gold – Buying the symmetrical triangle in August 2012

Summary: Trading a long Gold ETF (GLD) ties up nine times more capital in a trade with a near-identical risk to reward profile. FOOLISH!

Copper – Buying the 3-month -compound fulcrum bottom in September 2012

Summary: Trading a long Copper ETF (JJC) offered 25% more profit potential, but tied up eight times more capital in a trade with a near-identical risk profile. FOOLISH!

Summary

I could go on and on with these examples — to interest rate markets, grains, energy, food and fiber, every conceivable forex pair.

No matter how you stack it, using ETFs when underlying futures or forex contracts are available is an absolutely foolish utilization of trading capital.

With the sole of exceptions of having an account with too little capital to trade futures or an IRA or Roth account unable to use futures, why a person would trade GLD or SLV or SPY or any number of futures/forex-related ETFs in beyond my comprehension?

For the same risk per trade (expressed in dollars or as a percent of a trading account), futures/forex provide the following advantages:

- More liquidity

- Fewer overnight gaps

- 24-hour trading access (in most cases)

- Ability to hold far more different trades at the same time

- Great punch per dollar employed to hold a trade – in fact, capital in futures is about eight to 10 times more efficient at an equal-risk level

- Shorts in futures cannot be called back (as is the case with a short ETF position)

If you are a properly capitalized trader (I would saying anything north of $100,000 of non-IRA trading assets) you need to seriously challenge your use of ETFs instead of the underlying futures contract or forex cross.

PLB

###