Silver is a way to play the US$ — NOT!!!!!

If you are bearish on the US$, there are better bets to make.

In recent days many a Silver bull has attempted to convince me that Silver is a play against the US$. I don’t buy it for a minute. Silver is a raw material commodity. End of story. That Silver is considered a semi-precious metal is irrelevant.

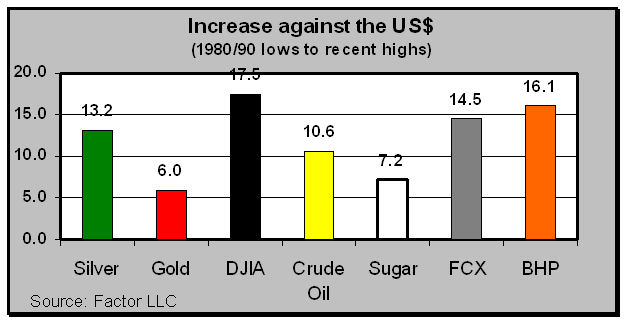

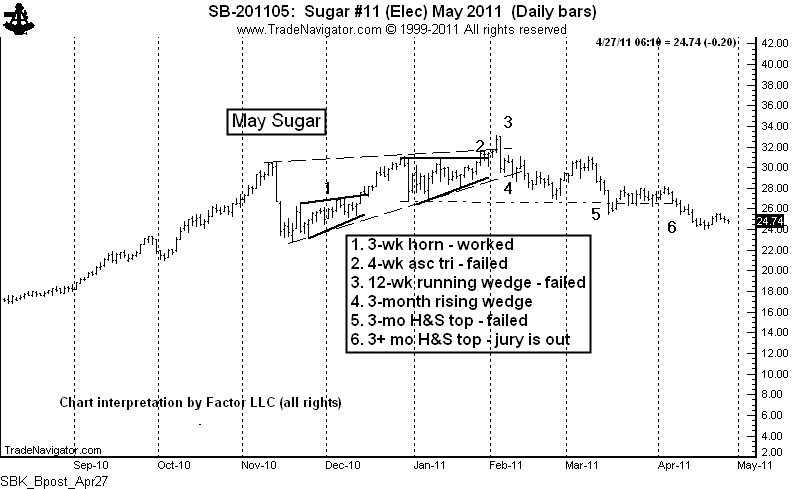

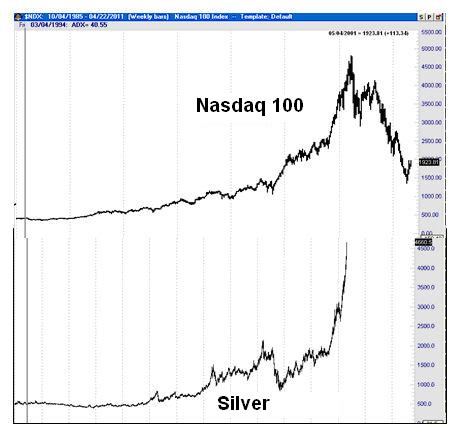

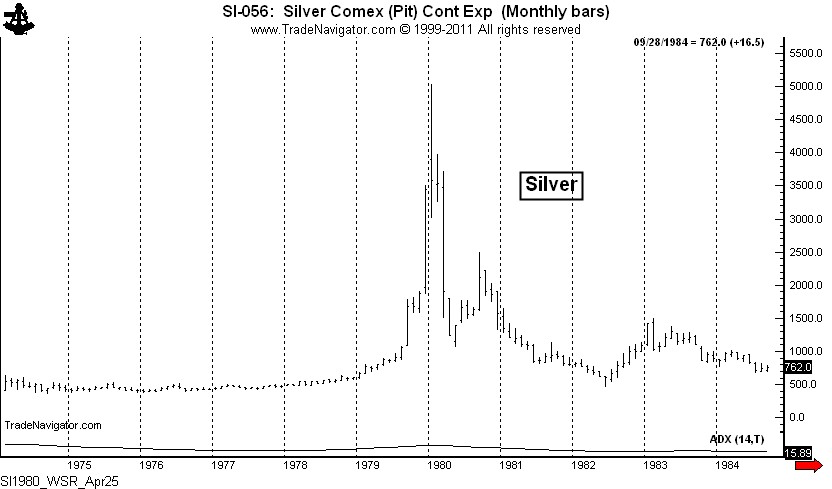

In fact, I will maintain that there are far better ways to make a bet against the US$ than by owning Silver. A picture is worth a thousand words. So I will let the graph below do most of the talking for me.

From the price lows of the 1980s/1990s, Silver has increased 13.2 fold against the US$. In contrast, Gold has only increased by a factor of 6.0 – in other words, Silver has been twice as good of a bet. On a pure price appreciation basis, Sugar was a better hedge against the US$ than was Gold. Perhaps we should all be carrying Sugar cubes to protect us against the incompetence of the Geithner/Bernanke cabal.

So what has been the best bet in US$-denominated terms – stocks – all stocks. In fact, the DJIA has outperformed shares in the largest precious metal producers, BHP Billiton and Freeport-McMoran (both of which have outperformed Silver). In fact, the DJIA has outperformed Silver by 33 percent, even after one of the worst performing decades for stocks in history. This does not even factor in dividends – and the last time I checked, the only dividend Silver pays is oxidization stains in the pocket.

If you want to make a play against the US$, Silver is a second-class citizen with the last name of “Bubble.”

This bull market may carry Silver prices to $60 or $70 or — as proof of the market’s absolute insanity — even $100. But I stand by my prediction that within five years Silver prices will be in the teens.

###