Factor Weekly Chart Scroll, Futures and Forex Markets – January 27, 2022

/by Peter Brandt- Chart scroll with Peter (1 hr 13 mins)

- Live member Q&A

- The Ultra T Notes contracts - Tell us why you trade the "Ultra" T Note contracts vs. the alternative T Note Contract - Symbol /TN on my TD Platform. 1:13:29

- I am working on taking quicker losses and reducing the number of trades that hit my full stop loss. Do you have any suggestions or methods to exit a trade early when you think it is not going in your favor? 1:14:52

- I find the short side is more volatile than the long. Can you please share your thoughts on how you adjust sizing? Also, what do you look for in setups that are different from the long side? 1:16:33

- I started preparing my buy list on the weekend, and I keep watching those lists throughout the week. However, I missed out on so many setups that emerged on the day which didn't exist during weekend preparation. How do you deal with that? 1:17:30

- I see you enter trades on support - breakout retest, moving average test, etc. Can you please elaborate on how you manage the risk on these? Any different from breakout trades? 1:21:09

- I am a new subscriber and relatively new to trading. I just wanted to ask if Peter would cover precious metals and his thinking behind Silver and the chart itself. 1:23:35

- Any advice for new members regarding navigating the markets/general advice for novice futures traders? 1:25:43

- Do you ever use support and resistance levels without a chart pattern to enter or exit a trade. If you do, when? 1:27:37

- Do you have any advice for someone nearing retirement age and contemplating entering the financial markets for the first time? 1:29:46

- How likely do you see Bitcoin dropping to 12,900 --target from the double top -- as you posted on the Factor Member twitter? 1:31:22

- FAQ - Do you ever see yourself hanging it up? Is trading what you’re going to do the rest of your life? 1:36:30

Thoughts on a Weekend Afternoon, January 21/22, 2022

/by Peter BrandtBullish signs in precious metals, January 19, 2022

/by Peter BrandtThoughts on a Weekend Afternoon, January 15/16, 2022

/by Peter BrandtThe Monthly | Blog Edition | December 2021

/by Peter BrandtA glimpse inside the Factor Member Portal

From the just-completed month

December Numbers

- Tweets posted on our Private Member Twitter: 149

- Updates and Special Reports posted on the Member site: 9

- Videos/interviews posted on the member site: 1

Snippets from Thoughts on a Weekend Afternoon

Peter’s thoughts on the finished week and the week ahead | Issued most weekends

January 1, 2022

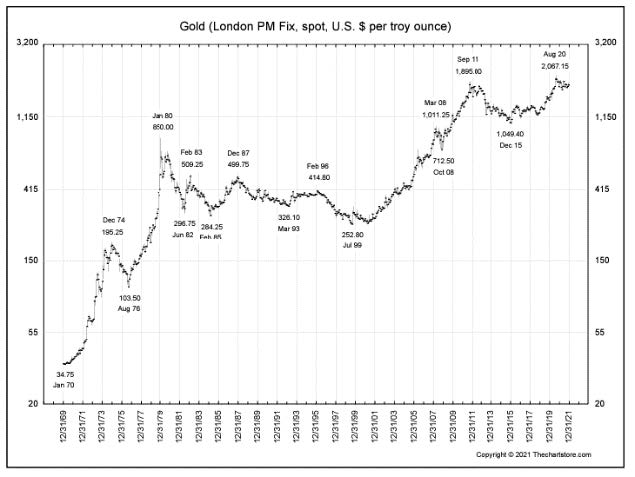

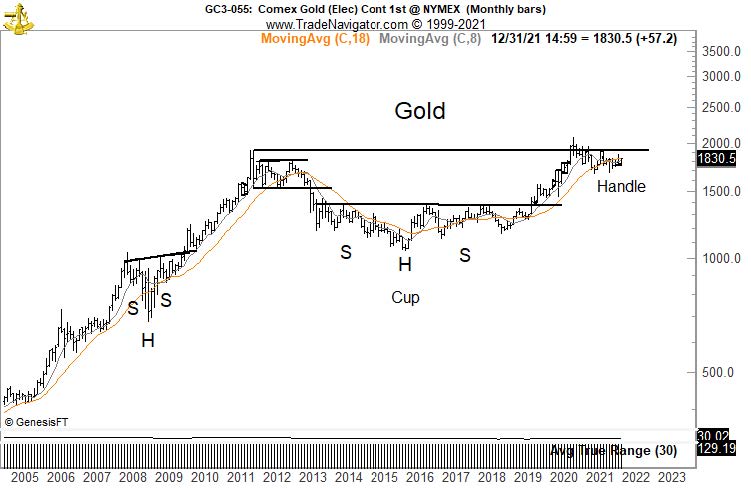

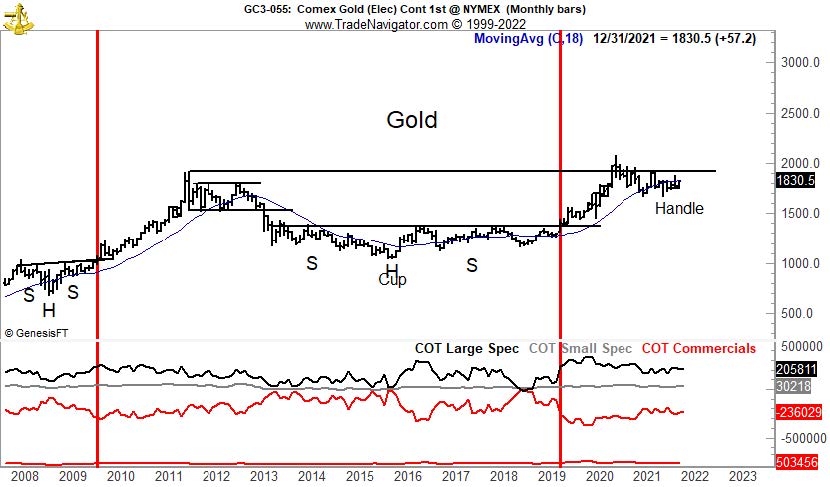

A Big Picture Look at Gold

A number of Factor Members have asked if the monthly Gold chart can be interpreted as a possible Cup and Handle pattern dating back to 2011 high. In fact, I completely accept this interpretation. My only question is whether the Handle might extend longer and to lower levels or if the current shallow and brief Handle will be all the market experiences. In the case of a shallow Handle we should be alert for a buy signal on weekly and daily charts.

The market has chopped since making a high at 2,063 (nearby futures) on Aug 7, 2020. The high in spot Gold on that date was 2,075. One thing is for sure IMO – a 17-month trading range of 20% (of the underlying value) starting at an all-time high is seldom bearish price behavior.

The current daily and weekly charts seem premature for a massive blast off at this time unless we label the period since the Mar 2021 low as a 5-point reversal symmetrical triangle. This is not an

ideal interpretation because the symmetrical triangle is not the most reliable chart pattern. While his pattern is not likely to launch the completion of the 10-year Cup and Handle it could propel

prices to retest the 2020 high. That, in itself, would be a really good trade.

Among other traders, I have cast doubt on the possibilities of a $200-plus Gold rally to retest the 2020 high based on the profile of COT data – that Commercials hold an extreme short position while Specs hold an extreme short position. I am revising my thinking on this. Historically – across all commodities – extreme short positions by Commercials is a head-wind against a sustained advance. Yet, the last two “super” bull trends in Gold began with extreme short positioning by Commercials (see vertical red lines).

(REPORT CONTINUED WITH PREMIUM MEMBERS SECTION)

___________________

January 2022

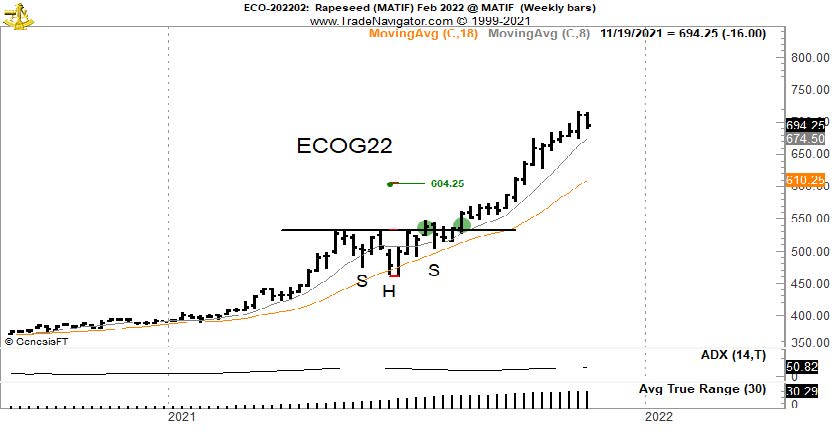

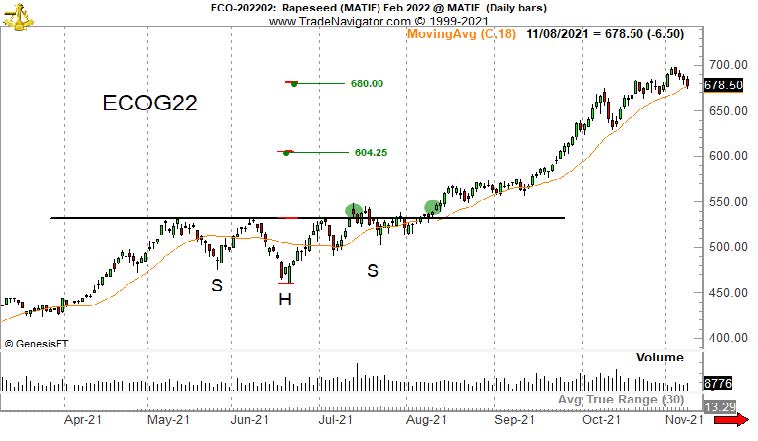

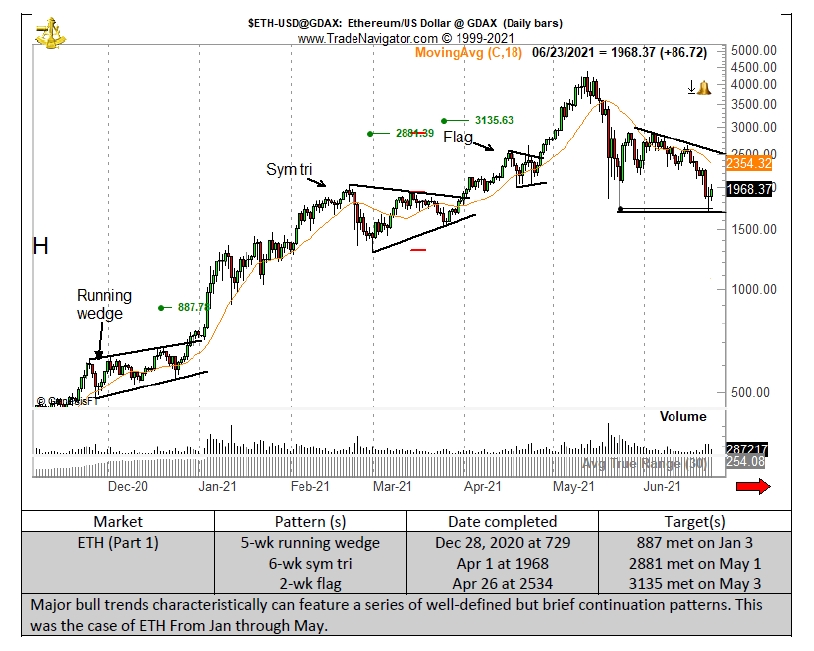

Each year at about this time, I publish the “Factor Best Dressed List,” showcasing outstanding examples of classical charting principles from the just-completed year.

The Best Dressed List (BDL) illustrates the types of swing trading situations Factor LLC ideally seeks in its proprietary account. These types of trading situations are a primary focus of Factor LLC’s trading. Here are just a few examples from the premium report.

Factor Member Private Twitter

Top Five Tweets

Recommended Reading

Contains an affiliate link to our Amazon Store

Become a Factor Member

Members receive:

- Trading Commodity Futures with Classical Chart Patterns: A free PDF copy of Peter’s classic out-of-print book

- The Weekend: Thoughts on a Sunday (Weekend) Afternoon

- The Monthly: Issued monthly, will provide an overview of the completed month and highlighted member content

- Private Twitter Page: Real-time alerts on interesting charts and observations, member dialog, the process of trading, the human aspect of trading, and risk/trade management (streamed on the member site as well)

- Webinars: Periodic member-only webinars where Peter speaks about current conditions and fields member questions

- Knowledge Center: Fast and easy access to current and archived content from Peter’s extensive library of trading content

- Automatic notifications: Email and social media notifications are sent out when new content is published

- Factor Report Educational Papers: Periodic educational and instructional documents

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. My goal is to shoot straight on what trading is all about.

I hope you will consider joining the Factor community.

Thoughts on a Weekend Afternoon, January 9, 2022 (issued January 7)

/by Peter BrandtThe Monthly – December 2021

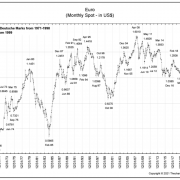

/by Peter BrandtReal Vision interview – The January Effect: Trading the EUR/USD

/by Peter BrandtThe January EUR/USD Effect

/by Peter BrandtPreface: For a number of years, Factor LLC has issued an annual update of “The January EUR/USD Effect” (previously titled The January FX Effect)

Recent Posts:

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am

Join The Exclusive Macro Trading Community With Factor’s Own Jonathon KingJuly 25, 2024 - 11:07 am- The “We-Fund-You” Prop Trading Industry should be immediately shut downJuly 17, 2024 - 5:54 am

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm

The beautiful symmetry of past Bitcoin bull market cyclesJune 2, 2024 - 12:10 pm Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm

Bitcoin — a once in a lifetime trade, never to be equaledMay 3, 2024 - 3:10 pm