🔹 What I’m Watching, Reading & Listening To 🔹

- Surviving Black Hawk Down (documentary) on Netflix

- Not just another war documentary— this is a raw, unfiltered, deeply human examination of one of the most infamous battles in US military history. What makes this series groundbreaking is its commitment to telling both sides of the story. For the first time in a major documentary, we hear from both the American Delta Force operators and Rangers who fought for survival and also from the Somali fighters and civilians who lived through the chaos.

- Principles for Dealing with the Changing World Order by Ray Dalio

-

Dalio again showcases his ability to break down complex ideas into clear, digestible insights. In this 40-minute summary of his latest book, he explains how studying history provides a framework for understanding the future, recounts being on the stock market floor the day after President Nixon took the U.S. off the gold standard, and discusses how growing gaps in incomes and values is reshaping society in today's world resembling the period from 1930 - 1945.

https://www.youtube.com/watch?v=xguam0TKMw8

Dalio's Bridgewater Fund (+$200 Billion AUM) just partnered with StateStreet Advisors to

launch the AllWeather ETF ($ALLW) to replicate the strategies and positions of the famous hedge fund. AllWeather is arguably the most well-known example of risk parity, an investment approach that allocates to different assets based on their levels of volatility. Rather than pile predominantly into a riskier asset class like stocks to get big returns, the idea is to achieve similar results with a more diversified, safer portfolio, often combined with leverage.

- Disclosures in early March 2025 showed a bet against Australian stocks and bonds.

🔹 Geopolitics, Tariffs & Market Volatility 🔹

Russian President Vladimir Putin, wearing military fatigues, stated that Russia needs more clarifications before agreeing to a

30-day ceasefire with Ukraine, which was endorsed by the

U.S. and Ukraine earlier this week. Putin took a less hard-line approach than his foreign policy adviser, Yuri Ushakov, who dismissed the terms of the ceasefire as a mere "breather" for Ukrainian troops to regather strength.

Ushakov reiterated these demands: Ukraine must recognize Russia's annexation of Crimea and four southeastern regions, withdraw troops from lands claimed by Russia and pledge never to join NATO. He said he "hopes [the United States] knows our position and wants to believe that they will take it into account as we work together going forward."

The U.S. restored military aid to Ukraine after ceasefire talks this week in Saudi Arabia.

What’s Next? Negotiations in Moscow happening now between Putin and U.S. envoy Steve Witkoff could determine whether Russia agrees to a ceasefire or requires further concessions before halting hostilities (I think we already know the answer to that).

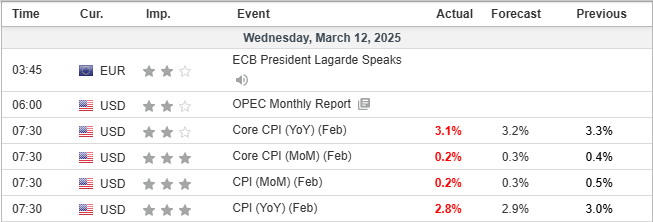

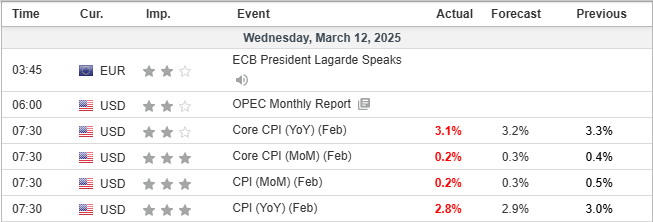

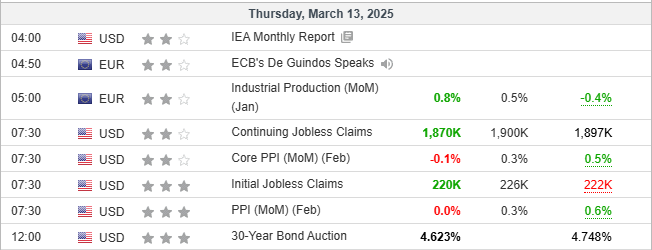

🔹 Inflation, Labor Market & Fed Outlook 🔹

This week we got inflation and labor market data. Next week we get an FOMC meeting with a press conference and interest rate decision (NO CHANGE EXPECTED).

“February’s CPI report flags weakening consumer demand for discretionary items, echoing the pullback in spending evident in other data. But disinflation in certain goods that are highly exposed to tariffs – cars, home furnishings, apparels – has stalled." - Bloomberg Economics

“February’s CPI report flags weakening consumer demand for discretionary items, echoing the pullback in spending evident in other data. But disinflation in certain goods that are highly exposed to tariffs – cars, home furnishings, apparels – has stalled." - Bloomberg Economics

- The Truflation U.S. Inflation Index dropped to 1.35%, marking a continued decline from February’s 2%+ level (see below)

- Bloomberg reports Walmart asked Chinese suppliers to lower prices, aiming to absorb the new tariff burden at the supplier level rather than passing it on to consumers. Good luck.

Truflation

Interest rates

US Federal Reserve chairman, Jerome Powell, signaled that the Fed will take a

wait and see approach regarding the impact of the Trump admin tariffs before making definitive decisions on monetary policy. The Fed is now expected to cut interest rates three times in 2025, beginning in June 2025.

- Barclay's expects just two rate cuts, specifically in June and September on labor market weakness.

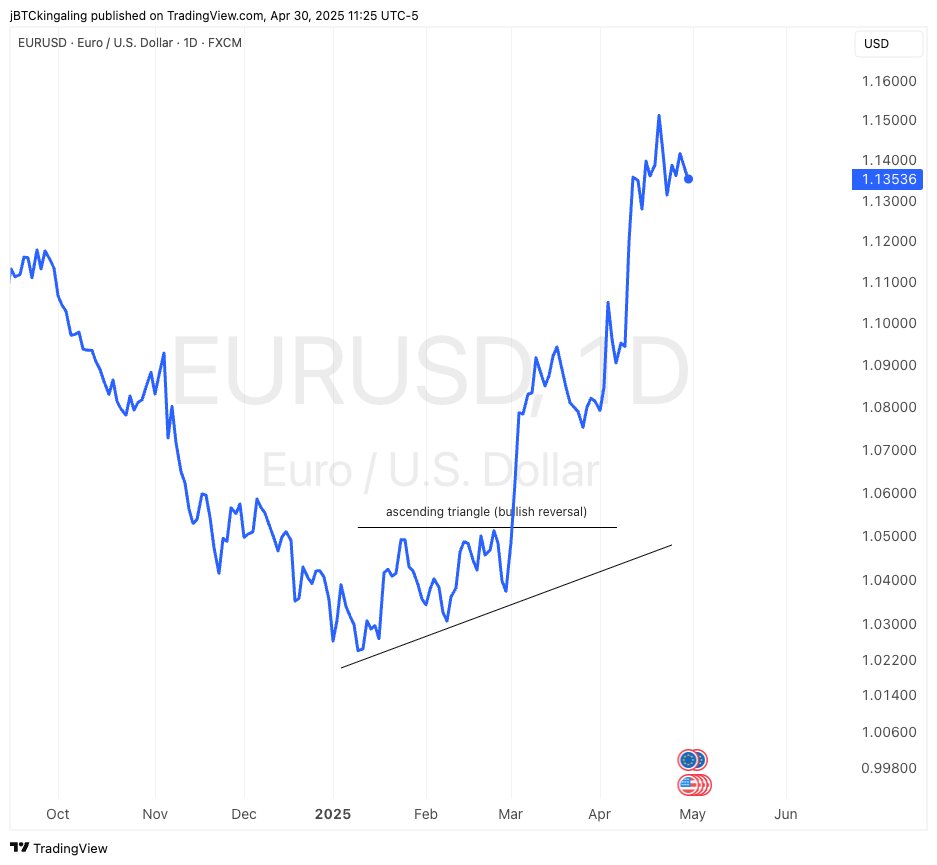

The European Central Bank did not disappoint, cutting rates for the 6th time in a row

. Monetary policy is becoming meaningfully less restrictive, as the interest rate cuts are making new borrowing less expensive for firms and households and loan growth is picking up.

The Euro/USD fx cross quickly reached the minimum target implied by the Ascending Triangle bottom pattern (reversal).

Days before, taken from Chart Wizards Report #62 and X post.

🔹 Commodities: Trends & Trade Setups 🔹

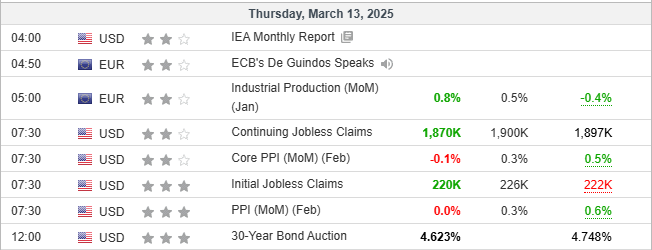

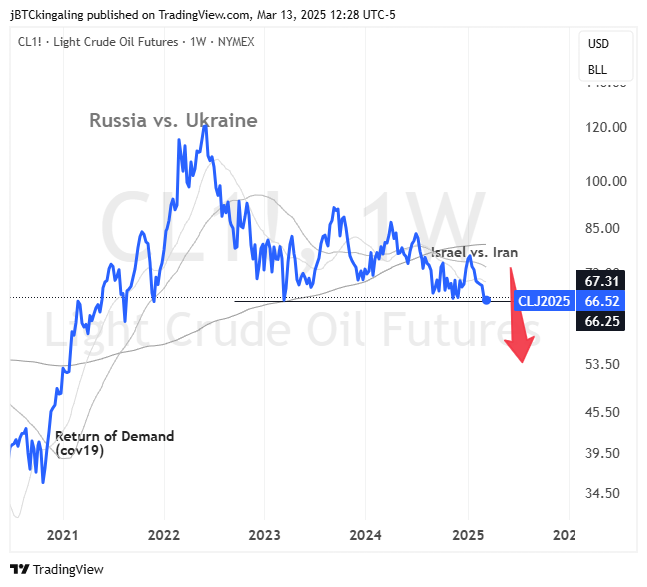

Oil Market Update: Optimism vs. Reality

Houston’s annual oil and gas conference was buzzing with optimism under a pro-fossil fuel Trump administration, but major oil traders, including Vitol and Gunvor, are beginning to turn cautious on crude prices. Welcome to the dark side.

Vitol and Gunvor don't expect an oil price crash, but instead a slow grind lower as supply outpaces demand. OPEC+ is ramping up production, U.S. output remains steady (though slower than before), and South American supply is growing—all adding downward pressure on prices.

crude oil futures (continuous) $/bbl

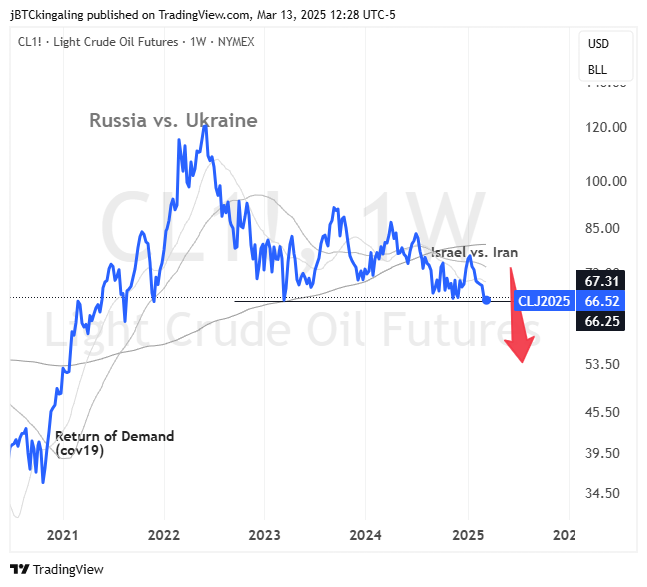

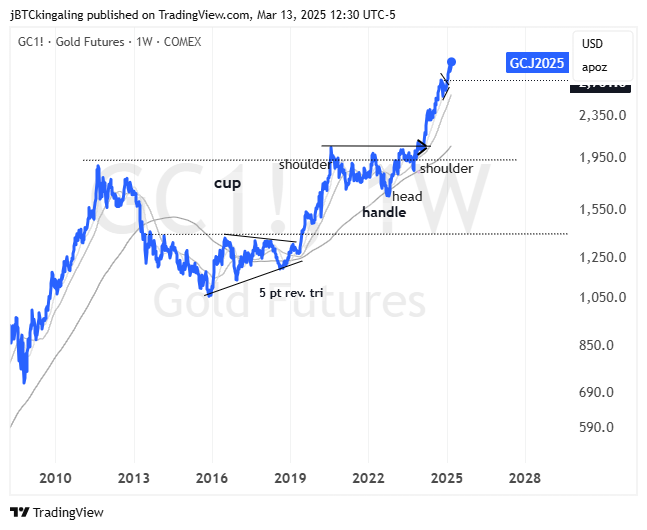

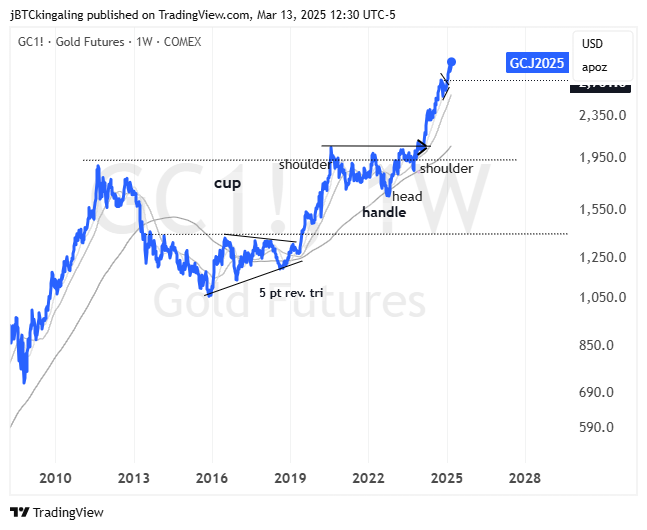

🪙StoneX broker talks physical gold shortage 🪙

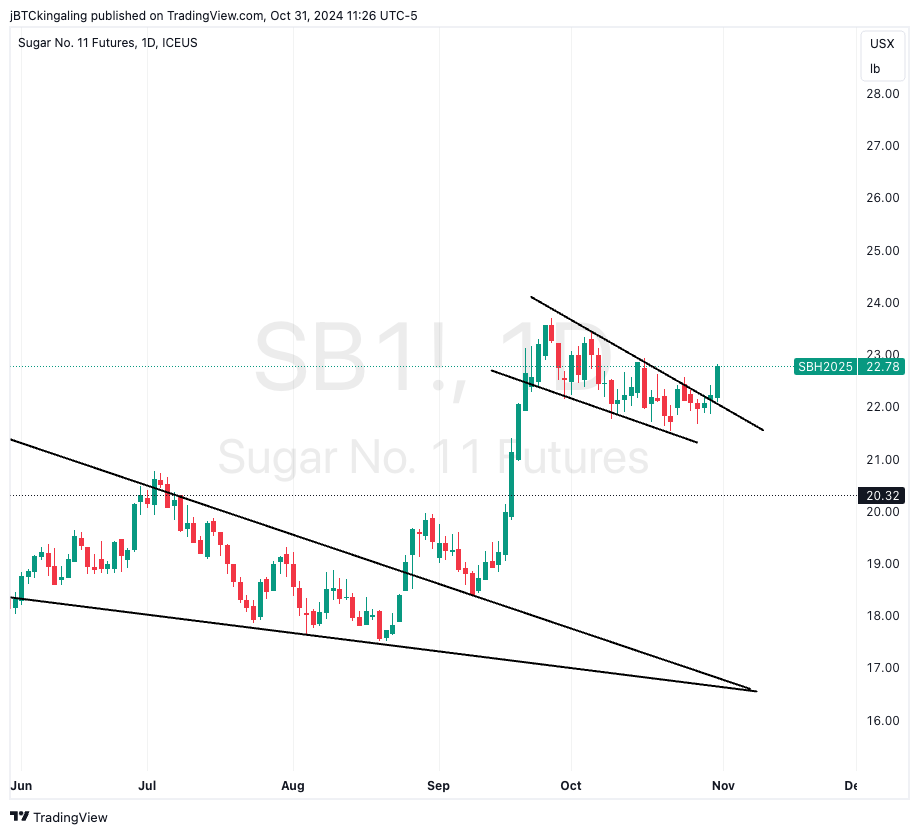

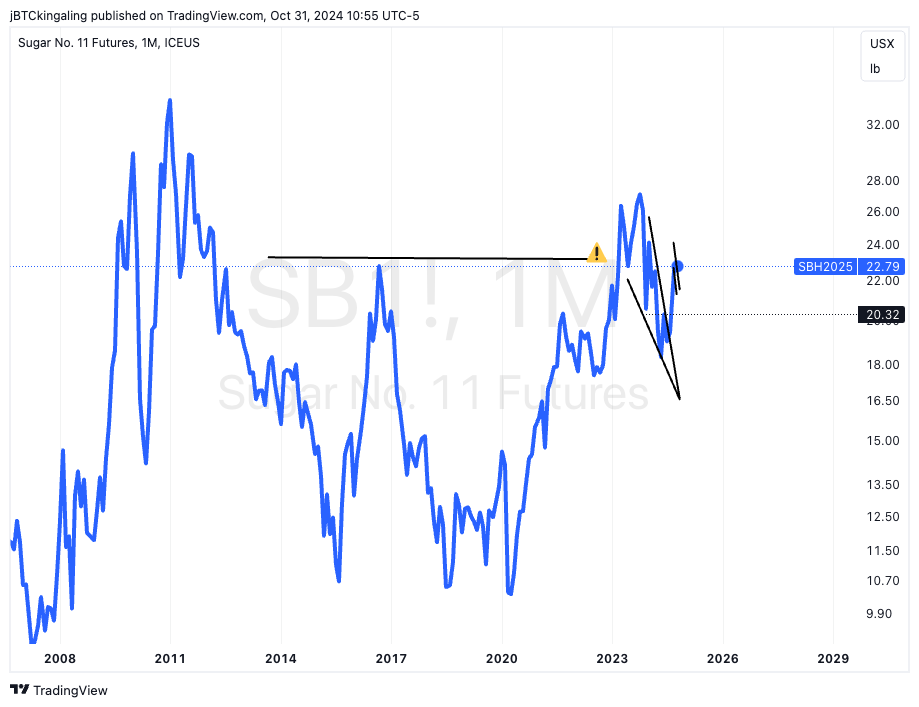

One of the best multi-chart pattern breakouts and trend continuations I've ever seen.

Gold futures $/oz

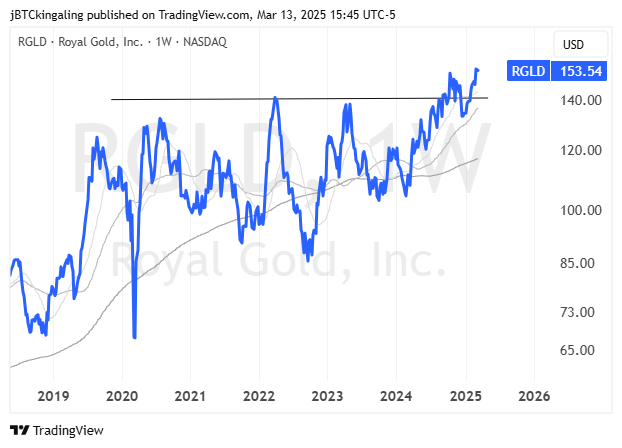

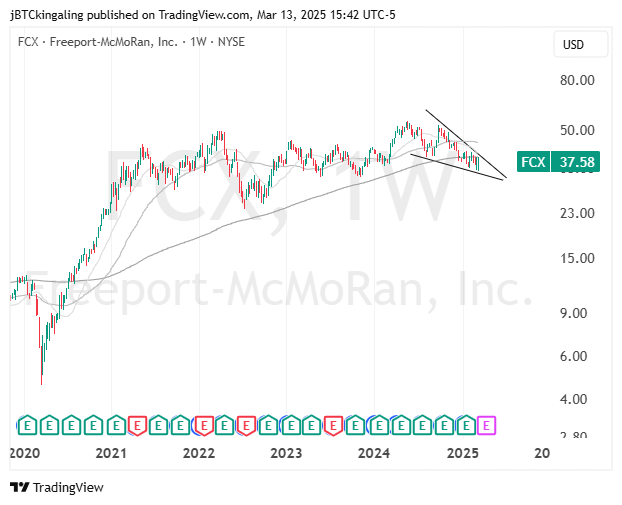

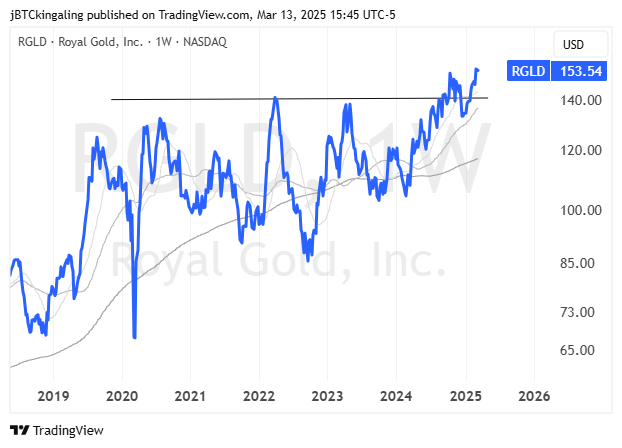

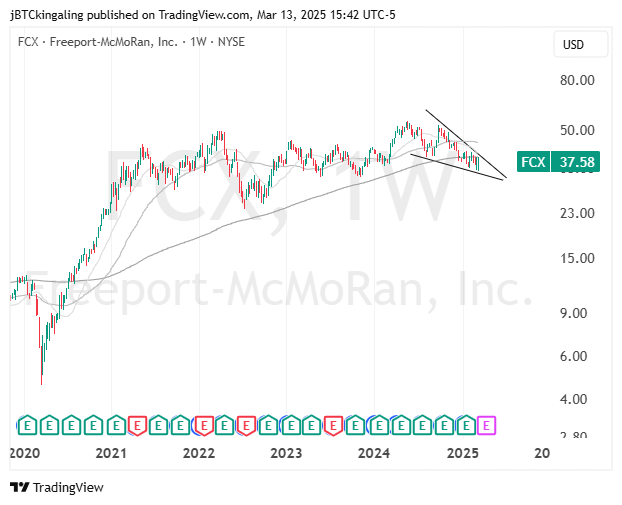

Royal Gold (RGLD) confirmed a breakout of a multi-year continuation pattern. Freeport-McMoRan (FCX) may soon complete a falling wedge continuation pattern. The former is much stronger.

https://www.youtube.com/watch?v=jvxQJBQidy4&t=1s

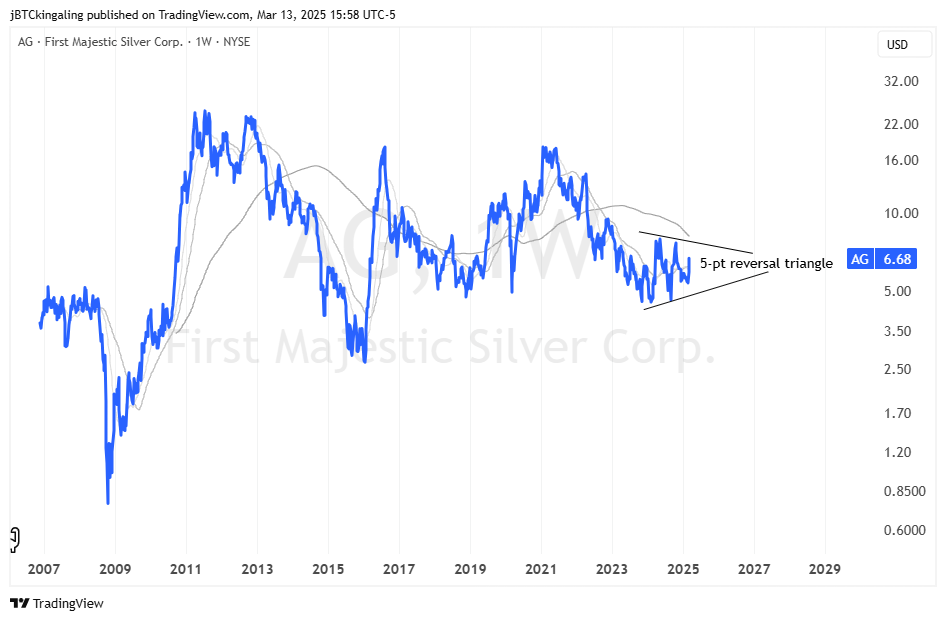

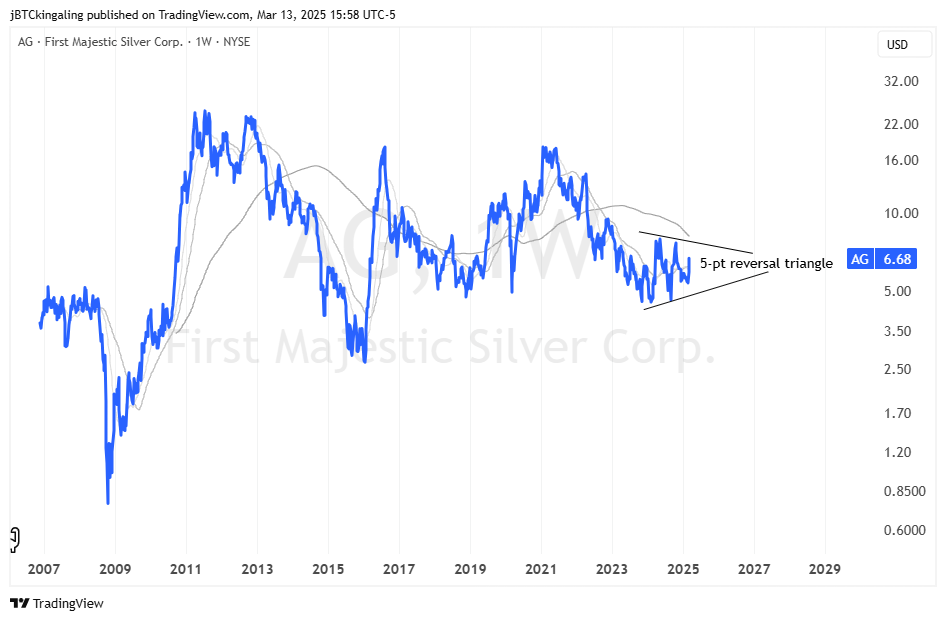

Silver Related Stocks Show Promise

First Majestic Silver Corp - $AG (NYSE) - Five point reversal triangle potential that breaks out above $8.00. I've had my eyes on this chart for a few weeks now and will buy the breakout - if and when.

Check out this symmetrical triangle in $DBB - Invesco Base Metals ETF. Diagonal boundaries are

not ideal.

See previous Peter Brandt posts on horizontal vs. diagonal boundaries.

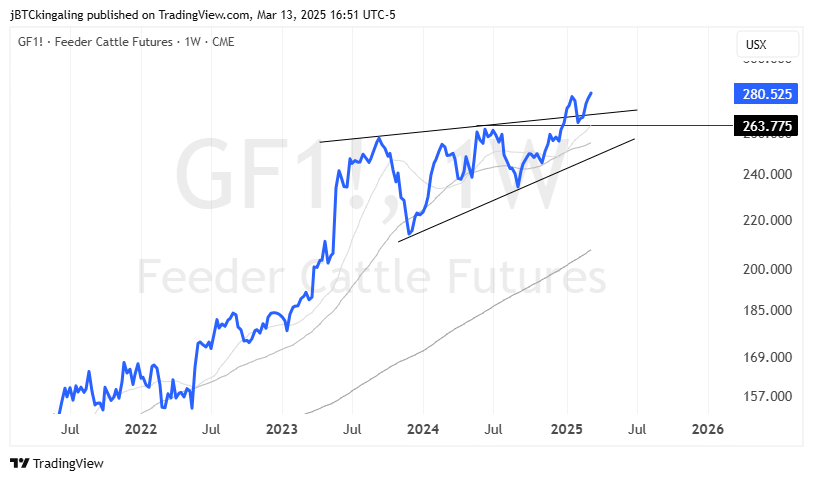

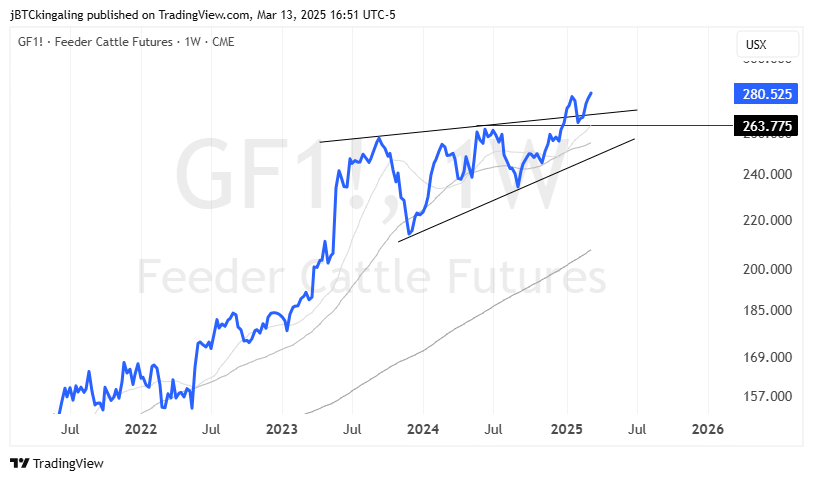

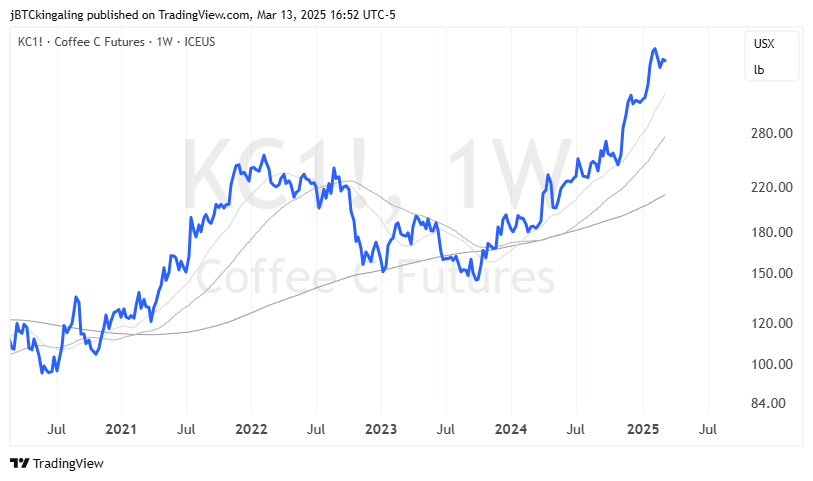

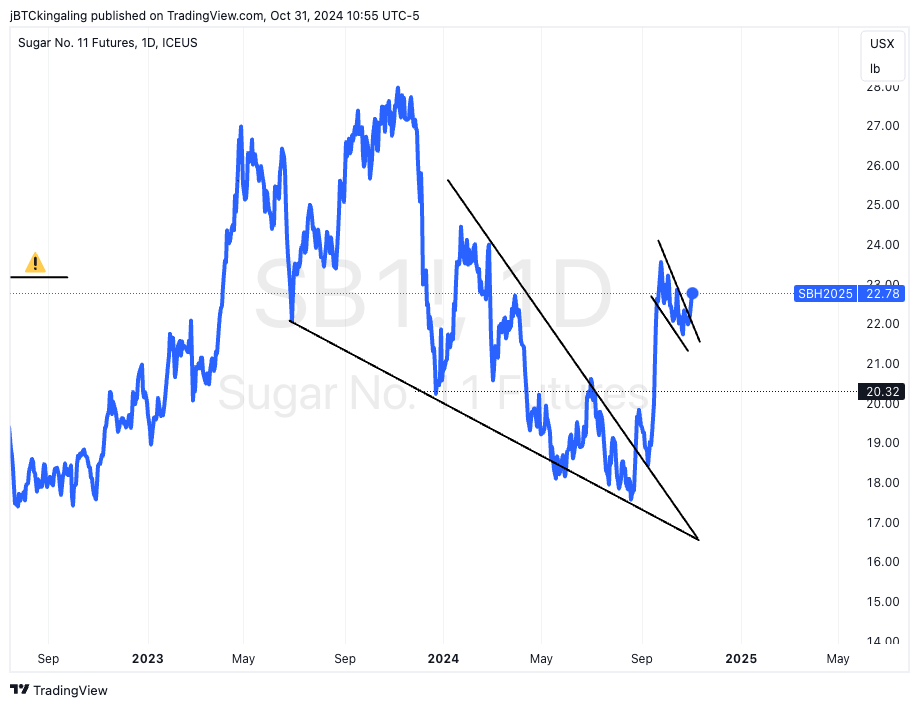

🔹 Other Strong Commodities Trends 🔹

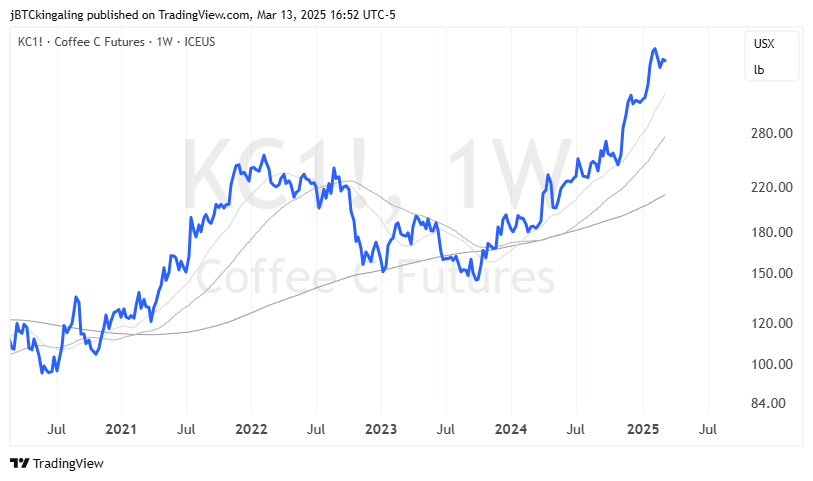

Cattle & Coffee - new all-time highs for both in recent weeks, and both look to continue the upward momentum on rising costs and worsening supply.

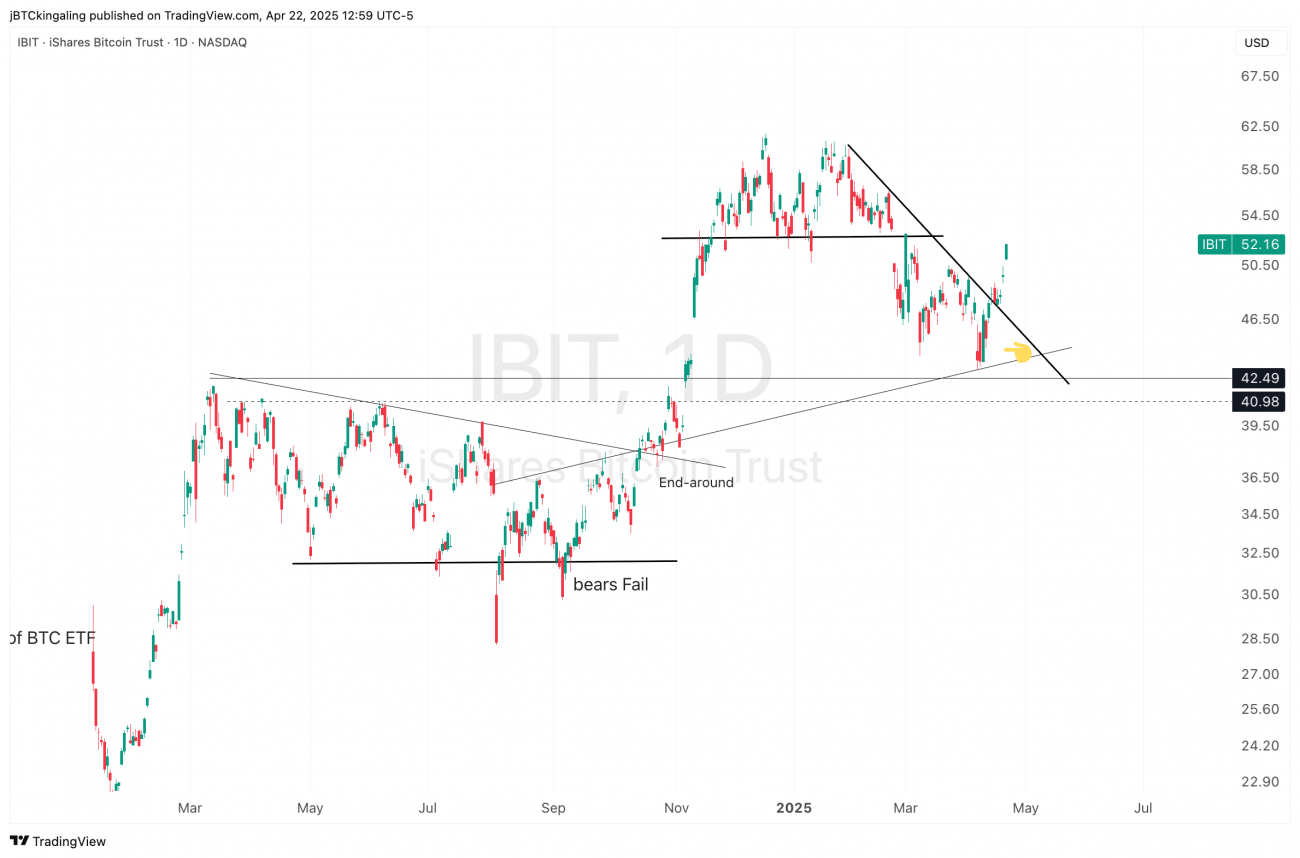

🔹 Stocks & Crypto: Market Movers & Setups 🔹

The S&P500 is down more than 10% from its all-time high seen just last month.

- Costco is down 15% from its 2025 high.

- SOFI is down 40% (we took profits at target).

- Tesla is down 50%. (we took profits at target).

- Apple is down 18% (stopped out).

- Amazon is down 21%.

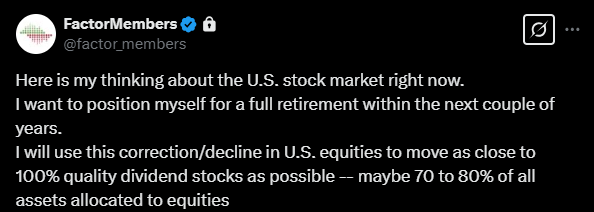

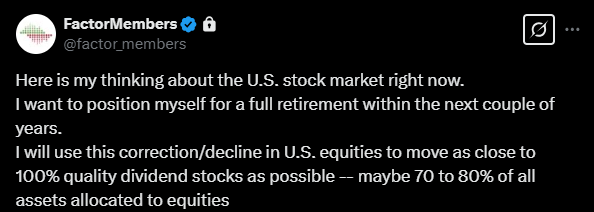

For astute investors, long-term investors, and students of history, we're in the midst of what is likely a generational buying opportunity. In times like this, I look to my friend Peter for wisdom. Peter has traded actively through FIVE DECADES🐐 .

I have a simple approach when it comes to my long-term portfolio:

And on that note, let's get back to the charts.

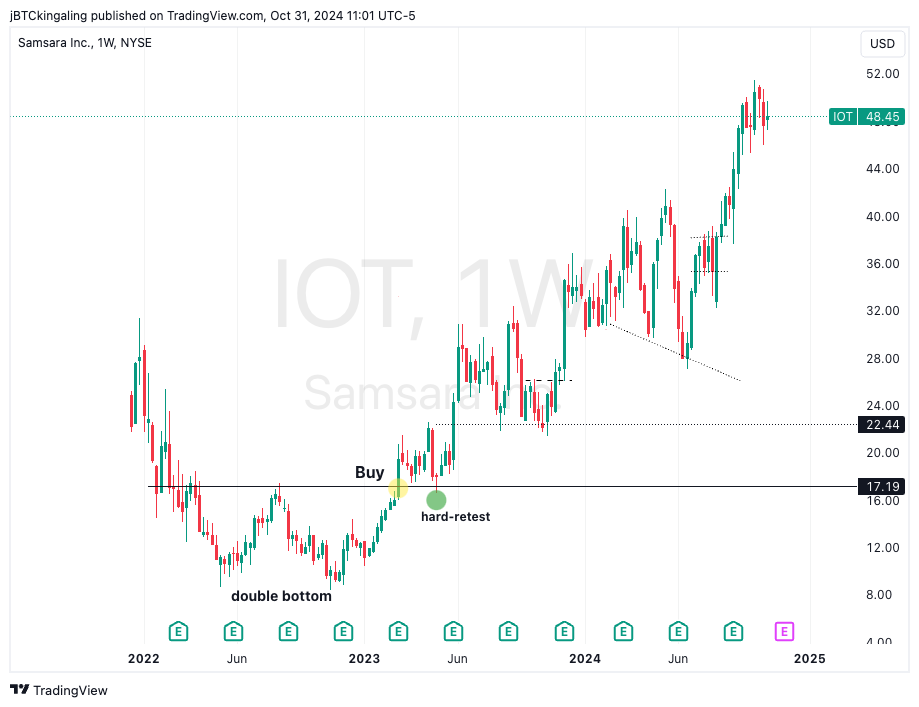

Relative strength is a great way to discover alpha during broad market corrections, and I'm looking at several stock charts for new positions. I am flat most of these today but have alerts and orders resting in the system.

... To be continued for Chart Wizards subscribers...

Read More

Ushakov reiterated these demands: Ukraine must recognize Russia's annexation of Crimea and four southeastern regions, withdraw troops from lands claimed by Russia and pledge never to join NATO. He said he "hopes [the United States] knows our position and wants to believe that they will take it into account as we work together going forward."

The U.S. restored military aid to Ukraine after ceasefire talks this week in Saudi Arabia.

Ushakov reiterated these demands: Ukraine must recognize Russia's annexation of Crimea and four southeastern regions, withdraw troops from lands claimed by Russia and pledge never to join NATO. He said he "hopes [the United States] knows our position and wants to believe that they will take it into account as we work together going forward."

The U.S. restored military aid to Ukraine after ceasefire talks this week in Saudi Arabia.

https://www.youtube.com/watch?v=jvxQJBQidy4&t=1s

https://www.youtube.com/watch?v=jvxQJBQidy4&t=1s

Check out this symmetrical triangle in $DBB - Invesco Base Metals ETF. Diagonal boundaries are

Check out this symmetrical triangle in $DBB - Invesco Base Metals ETF. Diagonal boundaries are  🔹 Other Strong Commodities Trends 🔹

Cattle & Coffee - new all-time highs for both in recent weeks, and both look to continue the upward momentum on rising costs and worsening supply.

🔹 Other Strong Commodities Trends 🔹

Cattle & Coffee - new all-time highs for both in recent weeks, and both look to continue the upward momentum on rising costs and worsening supply.

I have a simple approach when it comes to my long-term portfolio:

I have a simple approach when it comes to my long-term portfolio:

And on that note, let's get back to the charts.

Relative strength is a great way to discover alpha during broad market corrections, and I'm looking at several stock charts for new positions. I am flat most of these today but have alerts and orders resting in the system.

And on that note, let's get back to the charts.

Relative strength is a great way to discover alpha during broad market corrections, and I'm looking at several stock charts for new positions. I am flat most of these today but have alerts and orders resting in the system.

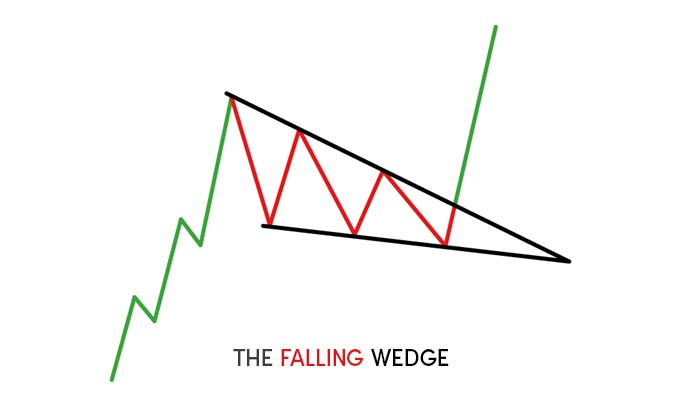

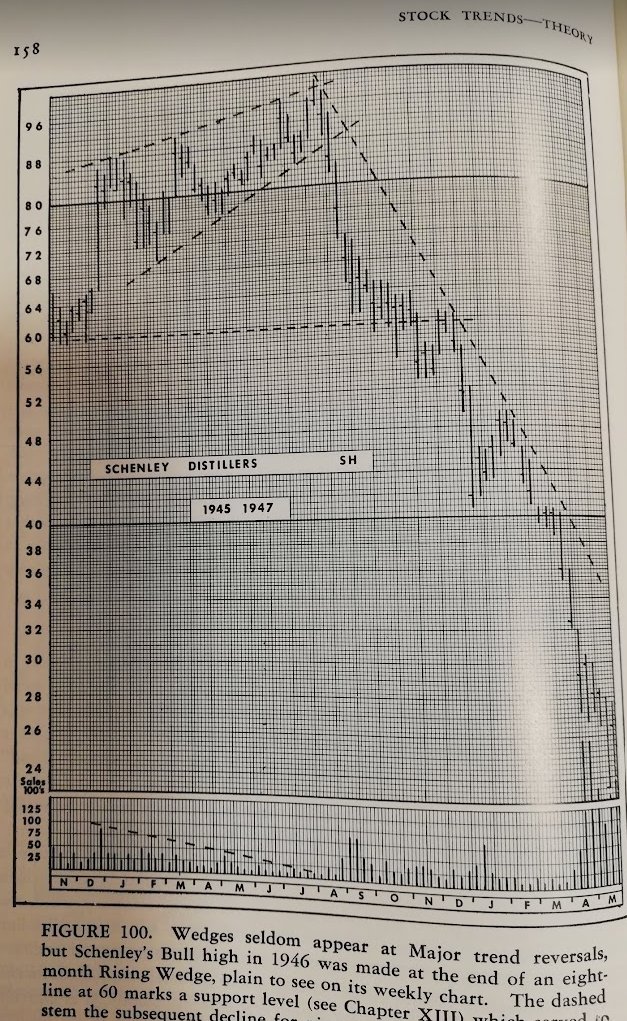

Falling Wedge: This pattern usually forms after a strong rally, but bulls are temporarily pushed back by bears, creating a waning series of

Falling Wedge: This pattern usually forms after a strong rally, but bulls are temporarily pushed back by bears, creating a waning series of