Tag Archive for: $GC_F $GLD #GOLD

October 2025 ChartWizards Report 69 by JK

/by Jonathon KingChartWizards Monthly Report #66 July 2025

/by Jonathon KingFREE – Chart Wizards Report #65 (May 2025)

/by Jonathon KingFriends of Factor, Chart Wizards, and Aspiring Chart Wizards,

In anticipation of releasing the June 2025 Chart Wizards report in the next few days, I present to you this gift: ChartWizardsNFT™ Report #65 (below) is my most complete, candid, and chart-packed breakdown yet. It covers everything from gold’s moonshot to Palantir’s political premium, plus the impact of Trump’s “Big Beautiful Bill.”

If you trade with conviction, manage risk like a pro (or hope to), and want raw alpha instead of recycled headlines, this report is for you.

Get next month’s setups, breakdowns, and battle tested frameworks before the free crowd.

Factor members get a special discount.

Trade Safe,

jk

Report #65 (May 2025)

CWNFT 65 by JK

ChartWizards Report 65 – June 3, 2025

/by Jonathon KingFREE: CHARTWIZARDS REPORT #64 (SAMPLE)

/by Jonathon KingGreetings, fellow Chart Wizards, future pros, wanna-be’s, and the chart curious,

I’m thankful to call Peter Brandt my friend, but seeing as he’s one of the greatest market tacticians of all time, I’m still humbled and honored when he gives me a compliment like this one:

Markets are changing fast, and I wanted to share some FREE alpha with Peter’s readers and Factor members:

What You’ll Find in My Reports

My reports aim to distill the most important market-moving news and highlight both new and existing trade setups in a simple, quick, and easy-to-digest format. Most importantly, everything is framed through the lens of risk management, with a focus on practical, tactical trading.

In short, this is my monthly trading journal. It’s never financial advice (I’m wrong a lot). Do your own research (DYOR) before investing capital.

Enjoy this FREE SAMPLE of Chart WizardsNFT Report #64.

Note: some full pages and select charts have been removed due to their proprietary nature.

ChartWizardsNFT Report #64 – May 5, 2025

What I’m Watching:

Here is a compelling conversation from Dr. Eric Schmidt, former Google CEO, on the intersection of artificial intelligence, biotechnology, and national security.

According to Schmidt AI is “underhyped“. He says it is no longer just advancing computer science and automation, but also reshaping fields like biophysics and materials science. This remark jumped out at me: “The computers are now doing self-improvement… They don’t have to listen to us anymore.”

🔹 Geopolitics, Interest Rates & AI Money 🔹

As markets digest the first U.S. GDP contraction since 2022, a shifting global order is becoming undeniable. A joint U.S.-Ukraine minerals fund, record-breaking container cancellations from China, and rising tariff-driven inflation suggest structural decoupling is no longer just a tail risk – it’s base case.

Fed Chair Powell acknowledged stagflationary pressures and trimmed balance sheet runoff, while Bitcoin dominance and gold prices surged as investors brace for a liquidity pivot.

Meanwhile, OpenAI secured $40B, led by SoftBank, with Trump administration support—marking the largest private tech raise in history. What happens next depends on the Fed, tariffs, and investor resilience.

FactSet: In aggregate, companies are reporting earnings that are 10.0% above estimates, which is above the 5-year average of 8.8% and above the 10-year average of 6.9%.

Torsten Slok at Apollo poured cold water on hopes of getting trade deals done in a timely manner.

🔹 FX 🔹

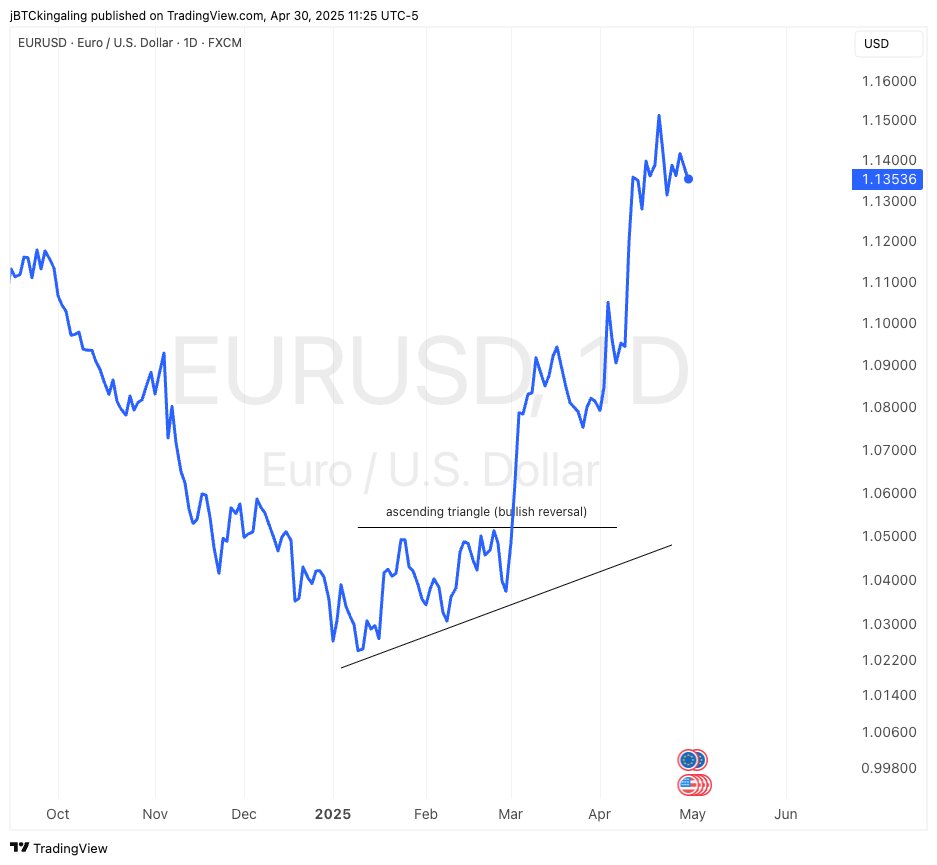

The U.S. dollar’s global share of global FX reserves has dropped from 72% in 2000 to 58% today. The USD is still dominant, contributing to about 50% of global transactions; however, investors are diversifying away from USD exposure amid rising tariffs and political volatility. In contrast, EURUSD broke out of its multi-month base as Eurozone GDP surprised to the upside while U.S. growth turned negative. The dollar’s relative strength narrative is cracking under the weight of structural trade shifts, fiscal imbalances, and softer Fed guidance. Expect continued capital flows into alternatives as BRICS currencies and gold gain reserve share.

see original eur/usd trade post here

🔹 Crypto Update🔹

Bitcoin Now Positive YTD, Reclaims Key Level as Institutional Demand Surges

Bitcoin jumped to $94.7k following optimism around tariff de-escalation between the U.S. and China, reclaiming the Short-Term Holder (STH) Average Cost Basis of $92.9k – a critical on-chain pivot historically separating bearish corrections from bullish recoveries.

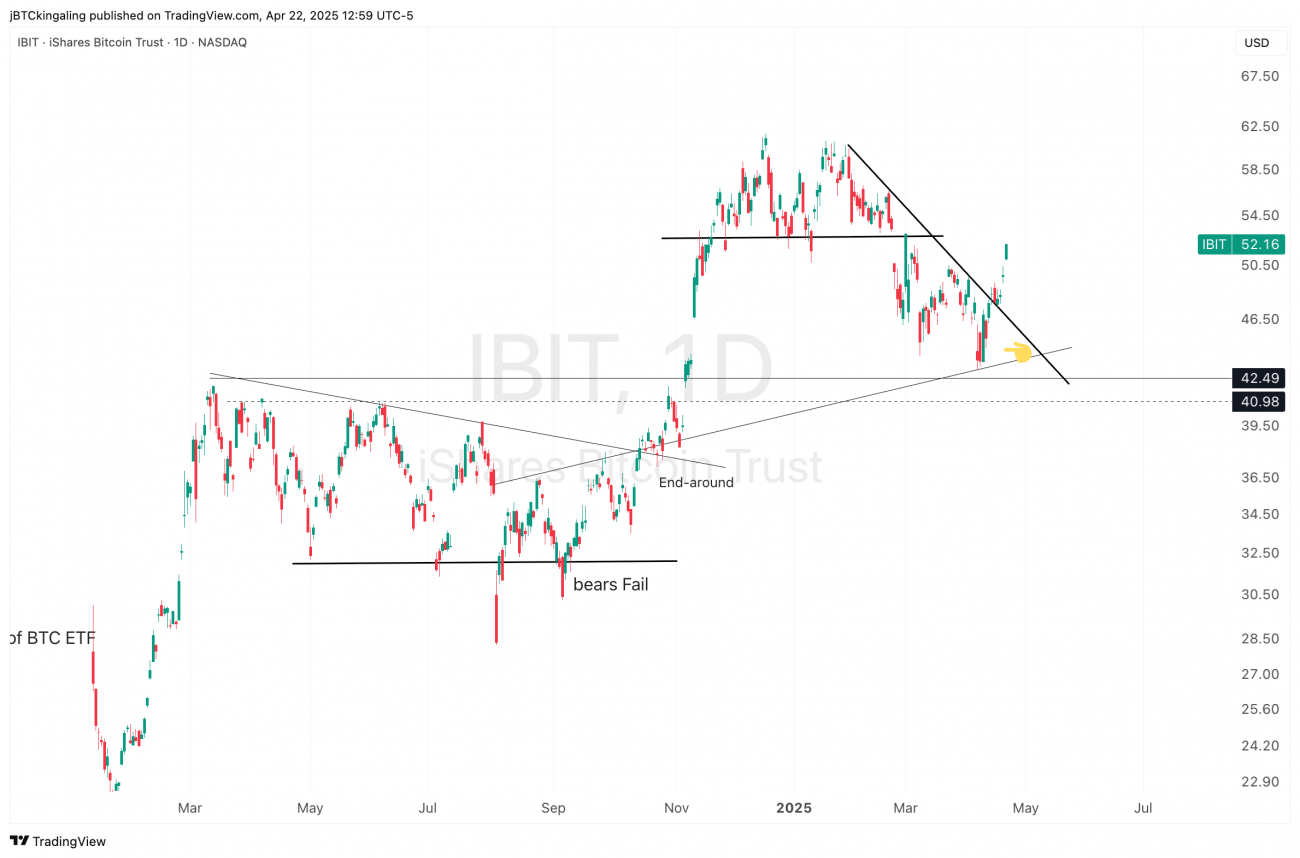

Institutions Choose Bitcoin Over Ethereum

U.S. spot Bitcoin ETFs saw a record $1.54B in net inflows on April 22, dwarfing Ethereum ETF flows, which remain below 1% of spot volume. This reflects a widening institutional preference for BTC, reinforced by macro uncertainty and clear digital gold narratives. For Bitcoin, reclaiming and holding the STH-Cost Basis is pivotal. If this level holds, it could mark the transition to a sustained bullish regime. If not, recent gains risk being another dead cat bounce in a still-fragile macro backdrop.

- $IBIT is a good proxy for charting BTC too (I remain long).

full report below

-JK

SAMPLE_May 5 2025 CWNFT 64_JKChartWizards Report #64 was released earlier this week for subscribers. If you’re interested in receiving at least one report straight to your inbox for less than $20/month, sign up here: https://www.peterlbrandt.com/chart-wizards/

Chart Wizards Report #64 May 5, 2025

/by Jonathon KingApril 3, 2025 – ChartWizardsNFT Actual Alpha Report 63

/by Jonathon King[FREE PREVIEW] ChartWizards Report #62

/by Jonathon King🚀 Free Preview: Q1 2025 Review & Outlook Report (#62) 🚀

Exclusive insights from ChartWizardsNFT, released March 3, 2025, for Peter Brandt’s subscribers.

📉 Markets are shifting fast. Are you prepared? 📈

💡 Subscribe today for less than $20/month and gain full access to monthly macro & tactical trading reports.

🔗 Join now → HERE.

PREVIEW_CW62_Q12025_JK

ChartWizardsNFT Actual Alpha #60 (December 2024)

/by Jonathon KingRecent Posts:

The January Effect 2026 EditionMarch 10, 2026 - 3:22 pm

The January Effect 2026 EditionMarch 10, 2026 - 3:22 pm Free ChartWizards ReportJanuary 5, 2026 - 1:17 pm

Free ChartWizards ReportJanuary 5, 2026 - 1:17 pm Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm

Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm