Do continuation head and shoulders patterns really exist?

A number of readers have questioned the legitimacy of the continuation pattern. They claim that such a pattern does not exist.

Well, it is time to set the record straight!

Schabacker, Edwards and Magee are the authoritative sources on classical charting principles. The three men never claimed to be the final word on Gann or Elliott or moving averages or candlesticks. But, they are the final word on classical chart patterns.

Here is what Edwards and Magee had to say about the continuation H&S pattern (Technical Analysis of Stock Trends, 5th Edition, pages 181-182):

“Head-and-Shoulders Consolidations.

“All our references to the Head-and-Shoulders formations up to this point…have considered that pattern as typifying reversal of trend, and in its normal and common manifestation that is most definitely the Head-and-Shoulders function. But occasionally prices will go through a series of fluctuations which construct a sort of inverted Head-and-Shoulders picture which in turn leads to continuation of the previous trend.”

“There is no danger of confusing such continuation or consolidation formations with regular Head-and-Shoulders Reversals because, as we have said, they are inverted or abnormal with respect to the direction of price prior to their appearance. In other words, one of these patterns which develops in a rising market will take the form of a Head-and-Shoulders Bottom. Those that appear in declines, assume the appearance of a Head-and-Shoulders Top.”

Now, some folks opposed to the concept of the continuation H&S have parsed Edwards and Magee’s description — pointing out that the exact wording used included “sort of” and “will take the form of.”

I think that such parsing is equal to hair splitting. So did Richard W. Schabacker. In his manuscript, Technical Analysis and Stock Market Profits, written in 1937, Schabacker alluded to the fact that the continuation H&S serves a different purpose than the reversal H&S, but concluded with the following:

“This formation is not a true Head and Shoulders for a number of important reasons but we must admit that it is difficult to find a better name for it….we shall accept the suggested name and call it the Continuation Head and Shoulders.”

So, when I define a pattern as a continuation H&S formation, I am in some pretty good company. For those of you who still take exception to the labeling, take it up with Schabacker, Edwards and Magee.

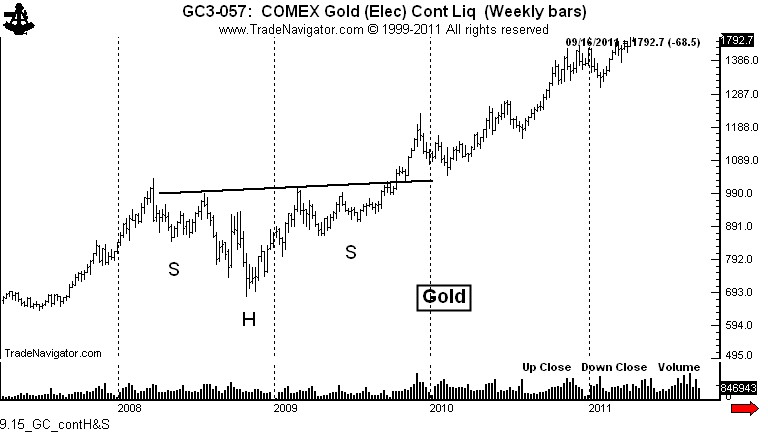

By the way, the chart below displays one of the most classic continuation H&S patterns of all time.

I believe Schabacker, Edwards and Magee would have accepted this labeling, and that is good enough for me. Of course, I could start referring to the pattern as the “a reputed, appearing as, but conditionally qualified, sort of continuation H&S pretender.” Nah, I think I will just refer to it as a continuation H&S pattern, same as I have been doing all along.

###

Trackbacks & Pingbacks

[…] chart pattern was a head and shoulder continuation (here is a perfect discussion on head and shoulder continuation) (@PeterLBrandt) that took almost a decade to form. Breakout from the head and shoulder […]

Leave a Reply

Want to join the discussion?Feel free to contribute!