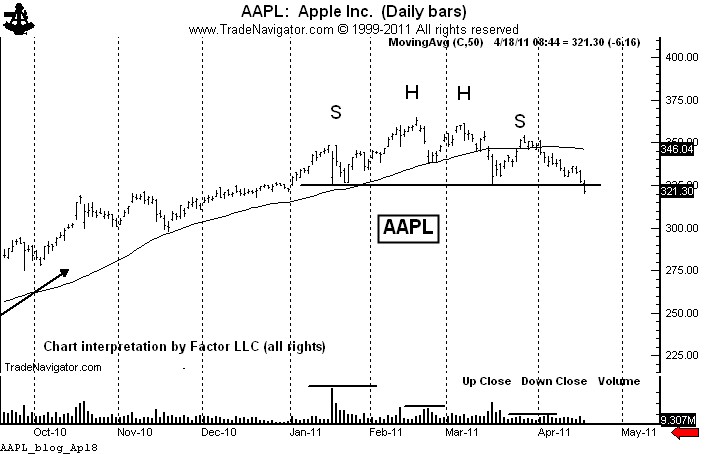

The Apple has fallen (AAPL Part 6): 04.18.2011

The Apple has fallen…look out below!

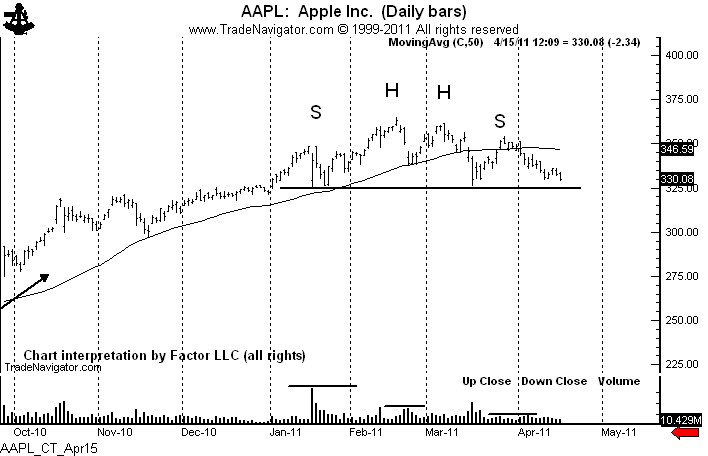

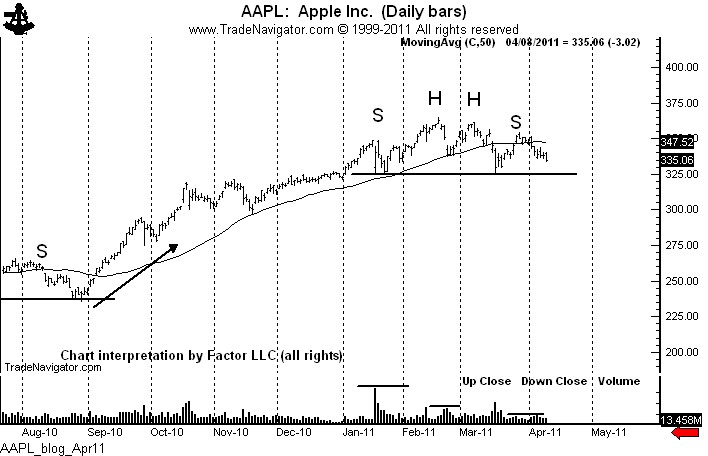

The decline by Apple today has completed a major reversal head and shoulders pattern. In the process I have now sold the final 1/3 (another 100 shares per $100,000 of capital) of my short campaign.

A close above today’s high at 328.14 and especially above the Apr. 13 high at 336.14 are required to negate the bearish interpretation of this daily chart. A close below 322 would confirm the top and establish an objective of 280. Retests of the neckline at 325 to 326 are probable, but the neckline should offer significant resistance.

As detailed by earlier blog postings and communications on StockTwits, my position is now short 300 shares per $100,000 of capital (100 at 338, 100 at 332.41 and 100 at 322.88). I am risking 100 shares to 328.32 and 200 shares to 333.41. So, my risk on the entire short position is 20 to 25 basis points. My potential gain is 1500+ basis points. This trade now has a reward/risk ratio in excess of 70 to 1.

###