Tag Archive for: #SILVER

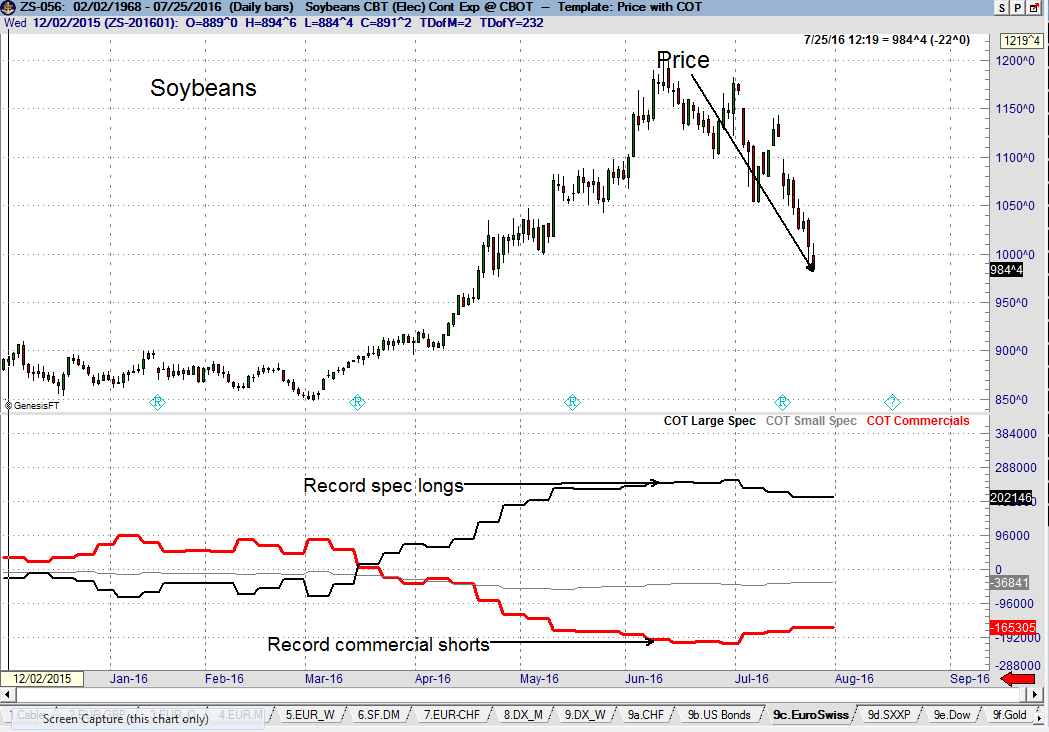

Is rain predicted for the Silver bull market parade?

/by Peter Brandt Read More

Read MoreFactor Update – July 24, 2016

/by Peter BrandtFactor Update – July 17, 2016

/by Peter BrandtFactor Update – July 10, 2016

/by Peter BrandtSilver and Gold Confirm Bull Market

/by Peter BrandtSilver and Gold Confirm Bull Market

Silver and Gold have made some decisive moves of late. It must be emphasized that the long-term trend in Silver and Gold is up. I believe we are now witnessing a Silver Bull Market and a Gold Bull Market. Despite the fact I have preferred the long side of Silver over the long side of Gold, I have grossly underestimated the power of this Silver trend. Thus, a reappraisal of the Silver chart is in order.

The advance on Jun 29 met the target of 18.52 established by the Apr 12 completion of an 8-month H&S bottom. As a result, Factor is now flat in Silver. This trade ended up as a 554 BP profit, thus establishing Silver as a qualified member of the 2016 Best Dressed List and a Bottom-Line trade for Factor.

Silver Bull Market

It is possible to interpret the strength in Silver this past week as the completion of a possible 33-month H&S bottom with an extremely abbreviated right shoulder. The target of this pattern is 22.40, although a retest of the 2011 and 2012 lows just above 26.00 is very possible. I am most interested in buying a meaning correction in Silver, although I doubt that a hard retest of 18.00 (right shoulder high) will occur. Traders who focus on Fibonacci corrections should remain alert.

Gold Bull Market

Factor Membership is now available and the Silver Bull Market and Gold Bull Market will be of prominent focus. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.