AUD/CAD – Chart Developing

Read More

Read More Read More

Read More

and

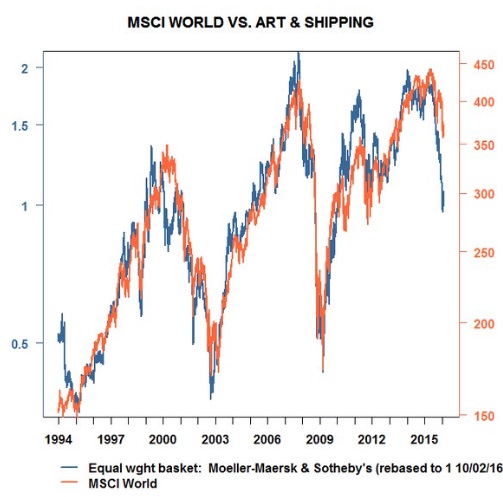

This week two companies had some very interesting things to say about their respective markets that have implications far beyond their individual niches.

First, AP Moller-Maersk, owner of the largest container shipping company in the world, said it saw, “massive deterioration,” in its business last quarter, even, “worse than in 2008.”

Next, Sotheby’s most recent London art auction was held on Tuesday where the company saw sales fall by nearly 50% from the very same auction last year. Furthermore, the famed auction house is now seeing former buyers turn into forced sellers.

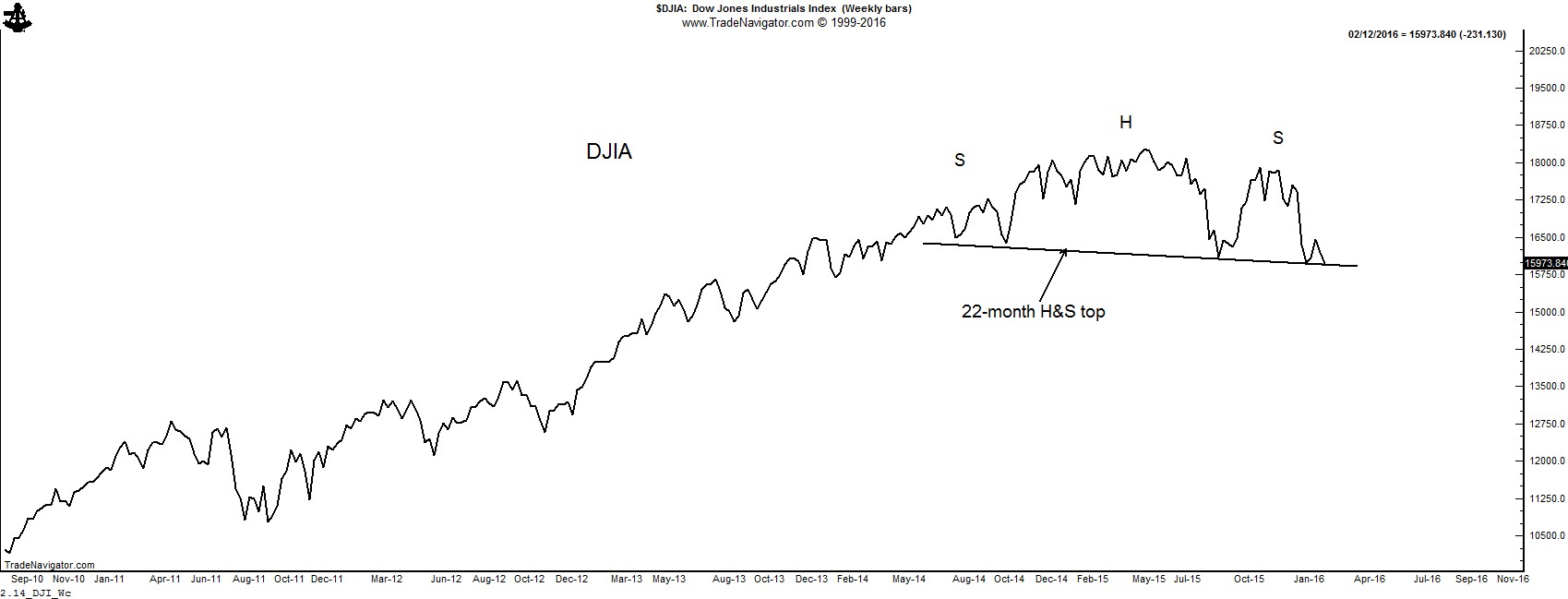

The following picture is worth a 1,000 words.

Many thanks to Factor friend and community member @DanChesler for bringing this chart to my attention.

$BID, $MaerskB:DC

plb

###

Read More

Read More Read More

Read More Read More

Read More Read More

Read More