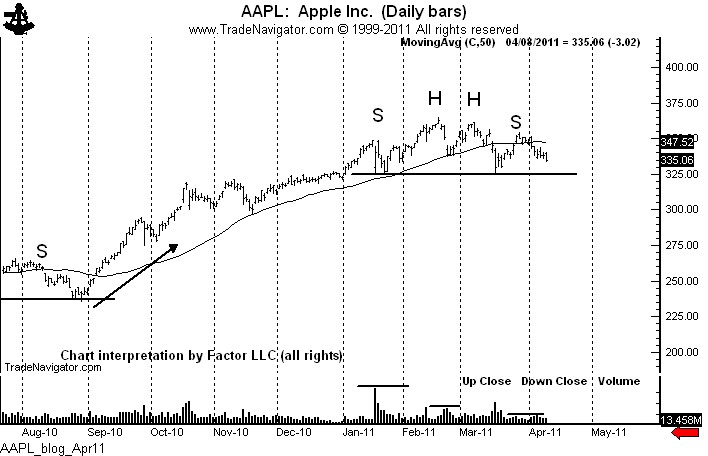

AAPL Part 3, It’s All About Risk: 04.11.2011

It has nothing to do with Apple as a company!

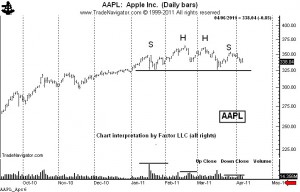

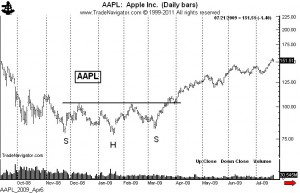

This is my third blog posting about Apple Computer in the past week. The first post suggested strongly a possible top in AAPL. The second post detailed a three-part shorting strategy for AAPL. I executed the first two parts of that shorting strategy last week.

I have received hate email for even suggesting that Apple’s stock is subject to a sizable correction. It has been as if I touched the third rail. People have pointed out to me that no bearish analysis should even be considered. I have heard all about the pending changes in accounting procedures for the iPhone…about low forward P/E ratios…about the sales potential in China and Asia…etc.

To my critics I would just say this: “Get a life…I mean no personal insult…I could care less if AAPL goes up or down in price.”

When I see a great signal set up on a chart, I could care less what company it is or what its fundamentals are. In fact, I could care less if I will be right or wrong in the trade — in truth, I assume I will be wrong (I am wrong about 65% of the time). The only important thing to me is the risk/reward profile of the trade.

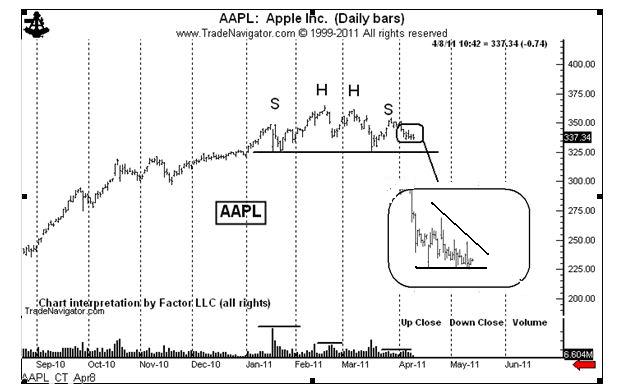

I shorted 100 shares last week at 338, anticipating a 3-month H&S top. I shorted another 100 shares at 334.38 when a small flag was completed. If the H&S top is completed I will short more AAPL. My protective stops are at 336.19 and 340.51. I am risking 61 basis points on the trade currently. That is 6/10th of 1%, or $600 of each $100,000. I have the potential to make 1400 basis points on the trade, that is a 14% gain on a single trade.

Successful market operations have little to do with correctly picking the direction of a stock — and everything to do with managing the relationship between risk and reward. I will take trades with a 20 to 1 risk/reward relationship any day of the week. I could care less if the trade is in AAPL, or Gold or tapioca futures.

###