What do the two have in common?

An opinion is NOT a position. A position is NOT an opinion. In the final analysis, the two have nothing in common. Yet, be aware that in this blog I sometimes present opinions and market perspectives (and misc. things I find interesting at the moment) and other times venture into the world of positions.

I have supported myself and my family by trading commodity futures and forex since 1980. Along the way I have made every mistake possible – many more than once. I have had really great years, and I have had losing years. I have had spectacular trades, and I have regularly had drawdowns (in fact, I am in a drawdown right now, so ignore any specific trading idea I might present).

Over the years I have formed principles that guide my trading. One of those principles is that an opinion is not a trade. I may have an opinion – even a strong one – about a particular market, but that does not mean I will have a position. Similarly, whenever I have a position I try not to form an opinion, because opinions lead to biases, and biases can lead to bad trading decisions. Frankly, I think that market opinions are dangerous when they are mixed with trading strategy. All too often I mix this fatal brew.

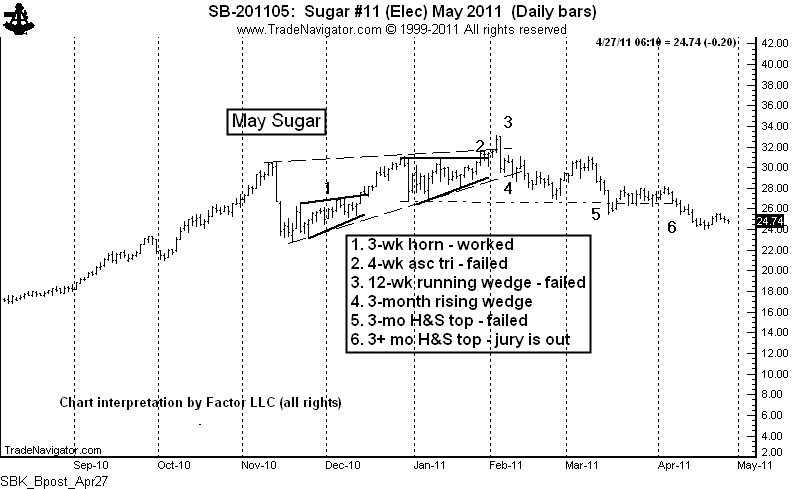

So, if market opinions do not guide my trading, what does? The charts…and specifically, classical chart patterns that are usually eight or more weeks in duration (preferably 14 weeks or longer) and offer specific risk control set-ups for entry. Because I always risk much less than my profit target, my ratio of losers to winners is quite high and always has been. Historically I am unprofitable on 65% of trading events, although over short periods of time that figure can range from 50% to 80%. Personally, I think the idea of chasing trading approaches that are right 80% of the time is a joke. I believe that the payoff in trading comes from risk control protocols, not from trade selection.

I have made my net-bottom line profit from fewer than 10 percent of my trades. The other 90 percent of trades have been wash-outs. Wouldn’t it be wonderful if I knew in advance which 10 percent of the trades would deliver the goods? Although even if I did know this in advance, my human emotions would probably push me into some of the other trades.

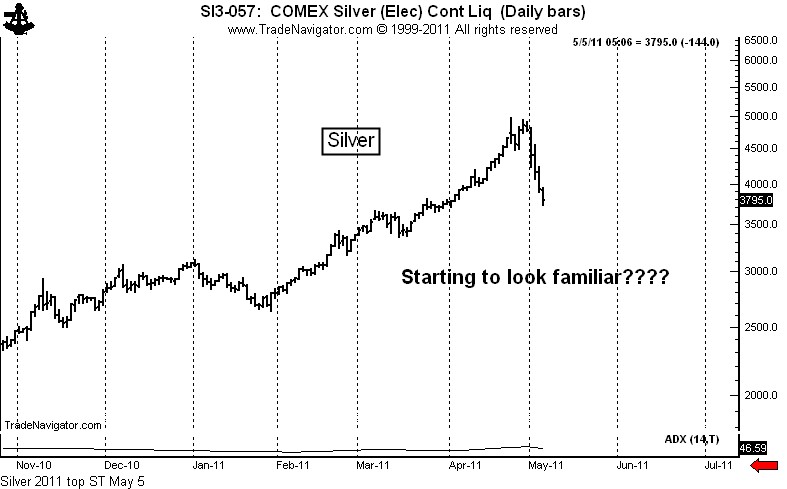

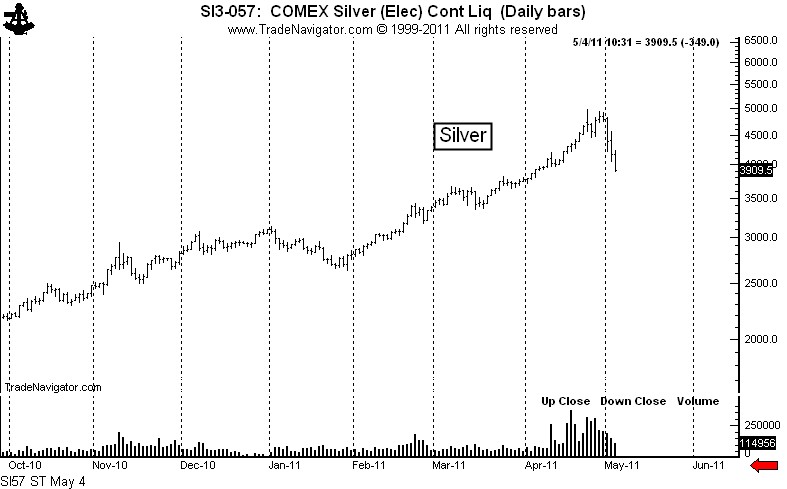

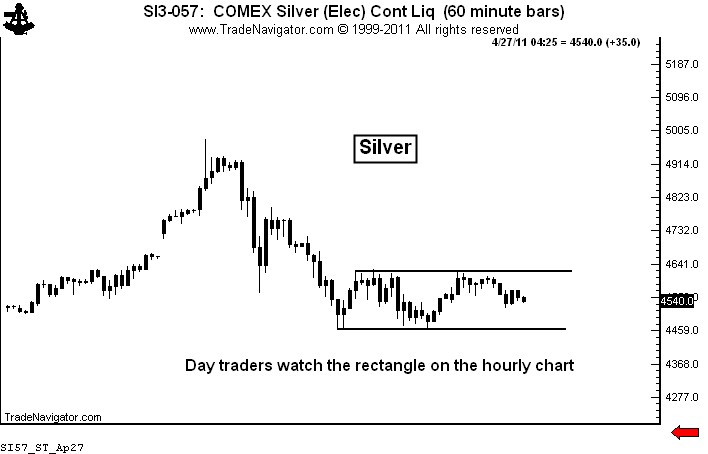

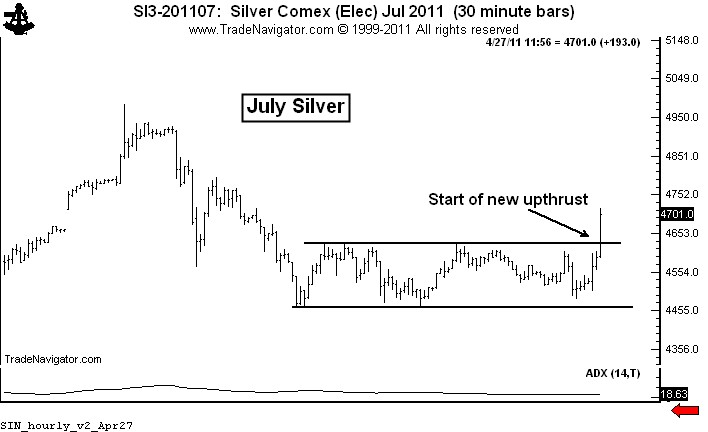

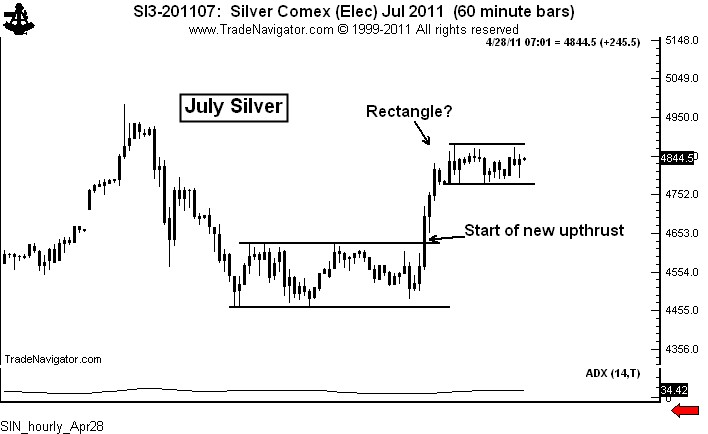

Some of my blogs have expressed opinions or perspectives on markets in which I have not had a position. I have no position in Silver nor is there any chance I will have a position within the next two or three months. I am long Gold and have been since April 5. The market came within an eyelash of my target on Monday, so I will now jam my stop.

A lot of my blog posts (perhaps the majority) reflect opinions or market commentaries or market perspectives that are disconnected from my trading operations. If you only heard from me when I took a position, you would not hear from me very often (perhaps you would rather have it this way). Similarly, I post a number of charts on Chart.ly that I find interesting, but do not even come close to qualifying for an actual trade.

But, periodically I will tout a trade I am entering – and again, a position is not an opinion and an opinion is not a position. A position, purely and simply, is a specific market set-up that provides certain risk/reward characteristics.

I have touted several of my actual, real-time trades in this blog. I laid out the specifics of a shorting strategy in Apple Computer – that trade did not work, but it provided the type of a risk/reward profile I dream about. I only get about ten or so set-ups per year like I had in AAPL.

On April 21, I posted a long strategy in the S&Ps and Nasdaq. I went long the Nasdaq on April 20 and the S&Ps on April 25. The jury is still out on these trades. Currently my stop in the Nasdaq locks in a small profit and my risk in the S&Ps is about 40 basis points.

On March 25 and April 1, I laid out a technical case for a bull move in the emerging stocks markets. I did not play this one in futures, but moved 50 percent of my IRA funds into emerging markets and China between March 23 and March 30. I pointed out this situation before I finalized my trade. The jury is still out on this trade as well.

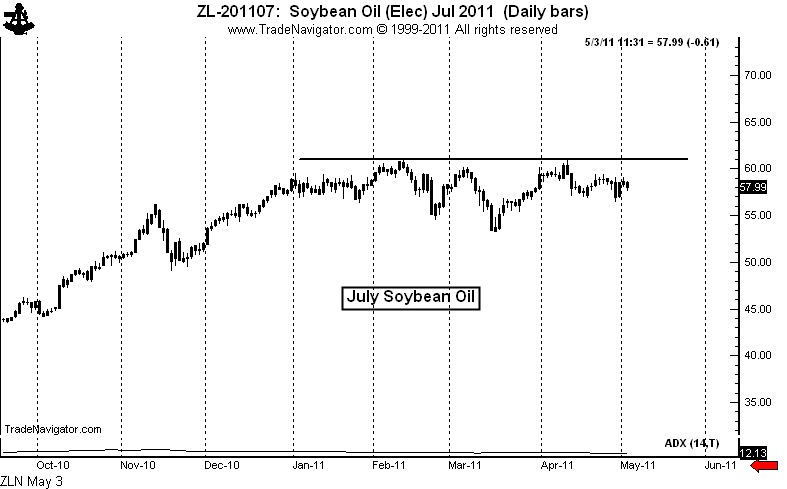

On April 13, I made the case for being long Soybeans and short Corn. I am in this trade. This is a trade that may require two or three years to fully play itself out, but it is a single trade than could return 20 to 30 percent to a portfolio. I completely understand that in the age of day trading, a trade that requires two or more years to work is not something most of you care much about. But, nevertheless, it is a trade I am carrying and will likely be carrying for a considerable period of time. BORING!

Over the years my trading horizon has gotten longer while the horizon for most traders has gotten shorter. Apparently I am out of step with the world.

So, once again, in my mind, positions are not opinions and opinions are not positions. Yet, in this blog I deal cards out of both decks. Hopefully as readers you will become aware of the deck from which I am dealing in any given blog posting, and will react to the post accordingly. If my opinion runs counter to your opinion or your position, please do not take it personally.

###