U.S. Dollar has seen its annual high or low in January in 20 of past 21 years

/by Peter BrandtHasta la vista, peso mexicano

/by Peter BrandtSoybean farmers — get ready for a $2/bushel price drop

/by Peter BrandtGap down in energy prices reminds me of my WORST trade ever

/by Peter BrandtHasta La Vista, Mexican Peso!

/by Peter BrandtChart of the Month — Japan poised for 25% advance in next six months

/by Peter BrandtCharts of the Day for November 13, 2014 — Some excitement ahead

/by Peter Brandt

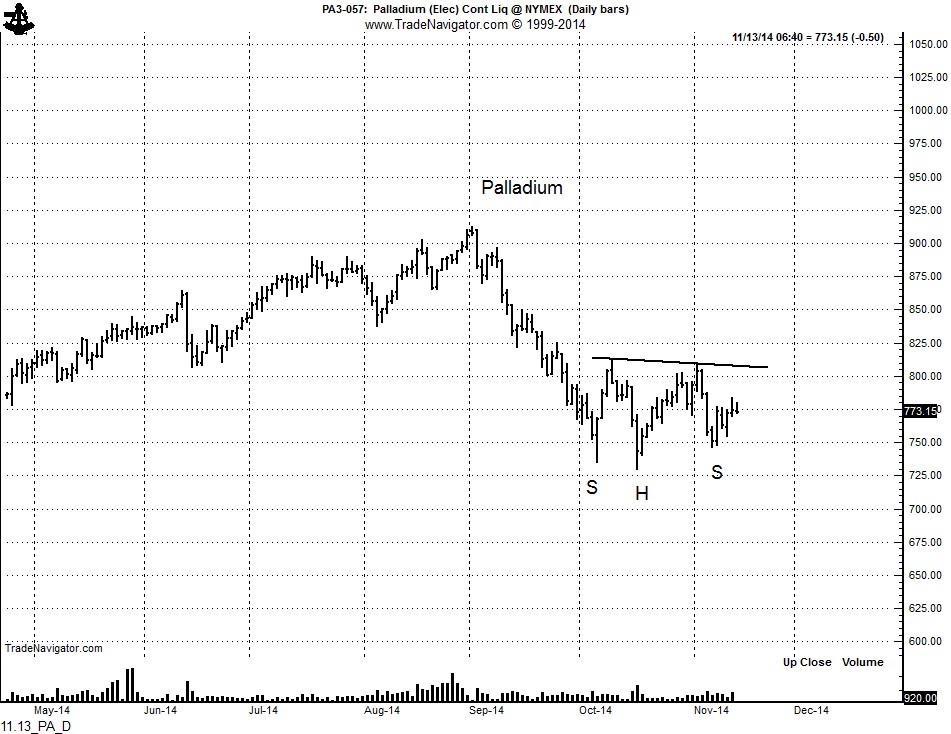

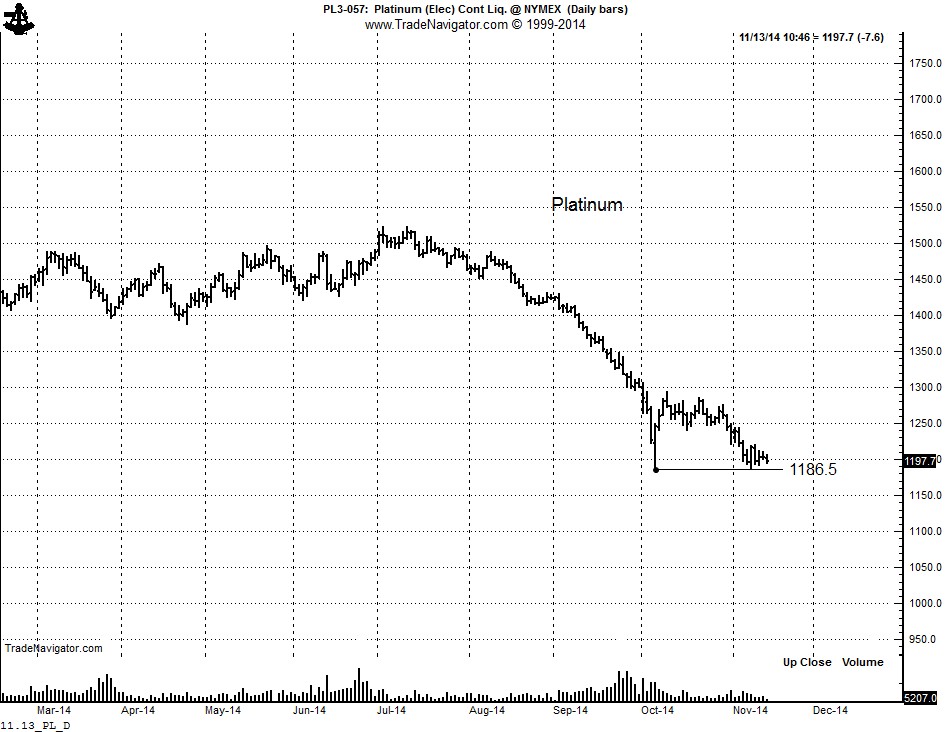

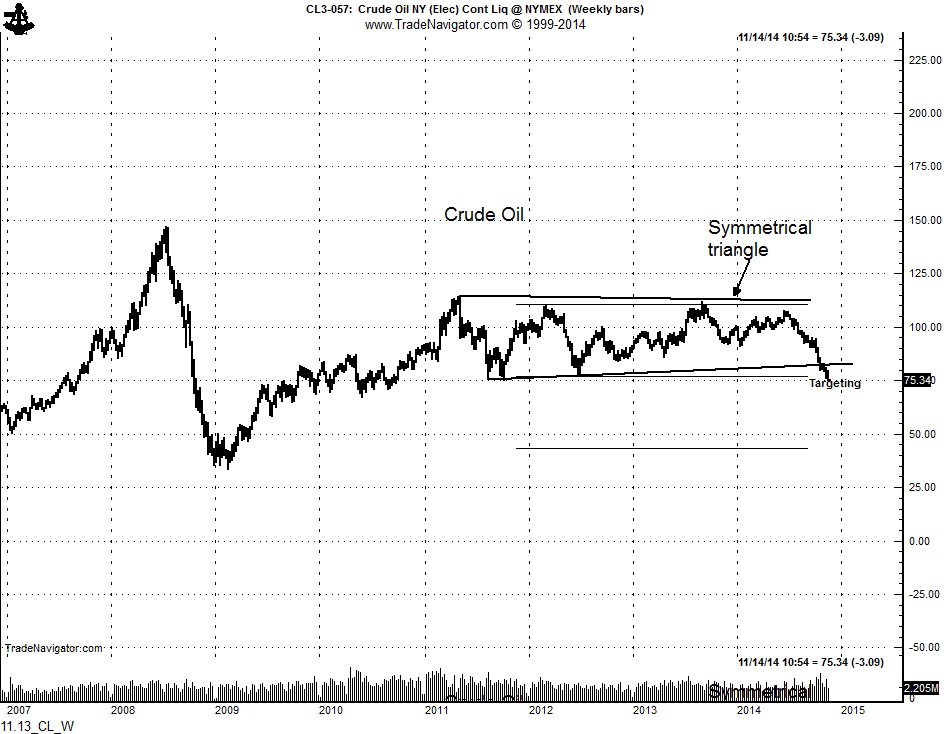

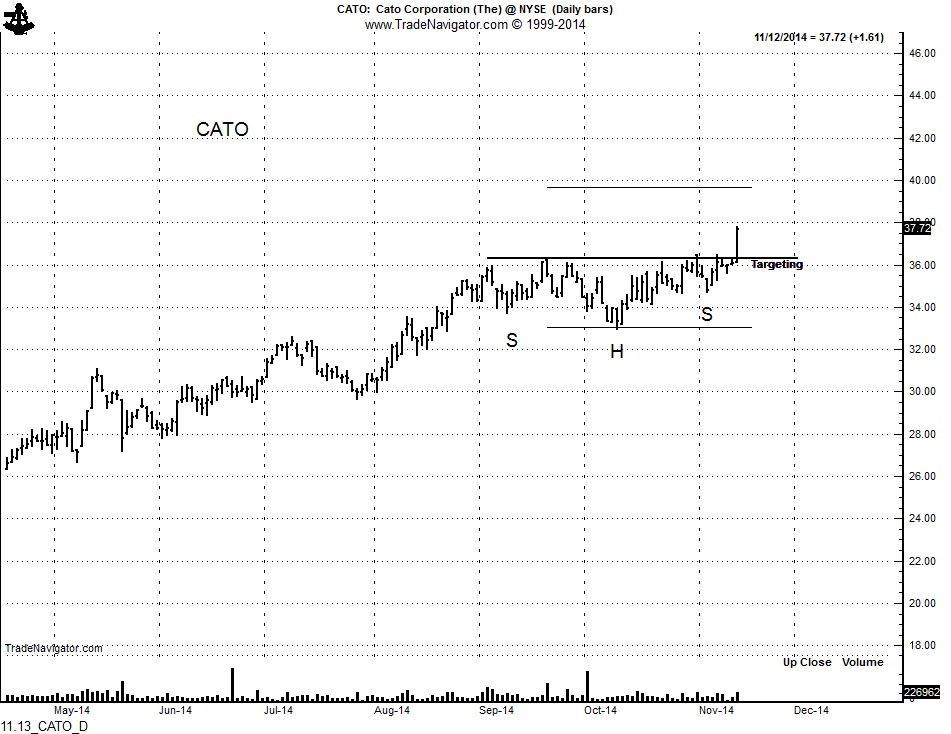

Gold, Palladium, Platinum, CATO, Crude Oil

Keep your eyes on the precious metals. Gold and Palladium could be bottoming. A decisive close by Gold above 1180 and then above 1202 would be strong indications that the 3+ year bear market has run its course.

Palladium is forming a 9-week H&S bottom pattern. The key levels to watch for the next direction are the Nov high at 809 and the Nov low at 746.25. More bearish is the Platinum chart. A new low under 1186 would not be constructive.

The weekly Crude Oil chart explains the current weakness. The 3-1/2 symmetrical triangle on the weekly chart has a target of $50. Look for real estate deals in North Dakota.

Kuddos to Factor member Paul S. for alerting me to CATO. On Tuesday he correctly interpreted the continuation H&S pattern in this stock and is profiting accordingly. Way to go, Paul.

###

Chart of the Day — Copper

/by Peter BrandtChart of the Day — Japanese stock indexes undergoing major upside breakout

/by Peter BrandtRecent Posts:

The January Effect 2026 EditionMarch 10, 2026 - 3:22 pm

The January Effect 2026 EditionMarch 10, 2026 - 3:22 pm Free ChartWizards ReportJanuary 5, 2026 - 1:17 pm

Free ChartWizards ReportJanuary 5, 2026 - 1:17 pm Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm

Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm